BB&T Bank Grows Dividend 10% Annually over Eight Years (BBT)

By: Ned Piplovic,

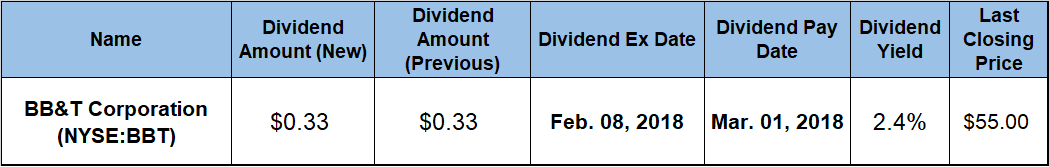

The BB&T Corporation (NYSE:BBT) has rewarded its shareholders with a double-digit-percentage growth rate for its annual dividend for nearly a decade and offers a 2.4% dividend yield.

With a long history of rising dividends and appreciating assets, the company resumed robust growth on both fronts following a brief dip during the 2008 financial crisis. In addition to the rising dividend distributions, the company offered its shareholders double-digit-percentage share price growth over the past 12 months.

The BB&T Corporation’s next ex-dividend date is set for February 8, 2018, and the company will distribute the next payout to its shareholders just three weeks later, on March 1, 2018.

BB&T Corporation (NYSE:BBT)

Based in Winston-Salem, North Carolina, and founded in 1872, the BB&T Corporation operates as a financial holding company that provides various banking and trust services for small and mid-size businesses, public agencies, local governments and individuals. The bank operates through six business segments — Community Banking, Residential Mortgage Banking, Dealer Financial Services, Specialized Lending, Insurance Services and Financial Services. As of December 2017, the bank operated approximately 2,200 locations in 15 states.

The company’s annualized dividend payout of $1.32 for 2018 is equivalent to a 2.4% forward yield, calculated using the share price as of closing on January 24, 2018. Shareholders receive this annualized amount in quarterly installments. The current quarterly payout of $0.33 is 10% higher than its was in the same period last year.

The BB&T Corporation has boosted its quarterly dividend approximately $0.03 in the second quarter each of the past six years. If the company continues this trend, the quarterly distribution amount could rise to $0.36 for the remaining quarters of 2018, starting with the June pay date. In that case, the total annual dividend for 2018 would be $1.41, which would be equivalent to a 2.6% forward yield at the current share price.

BB&T’s current 2.4% yield is 37% higher than the simple average yield of all the companies in the Mid-Atlantic Regional Banks segment. Even if we exclude from the segment all the banks that do not pay dividends, BB&T’s current yield is still more than 17% above the simple average yield of all the dividend-paying companies in the segment.

The BB&T Corporation has been distributing dividends to its shareholders since 1934 and the company failed to hike its annual payout only twice in the past two decades. The only two annual dividend reductions came after the 2008 financial crisis, when the company cut its annual distribution by more than two-thirds from $1.86 in 2008 to $0.60 in 2010.

After that two-year drop, the company reverted to boosting its annual dividends every year. Since 2011, the company has boosted its annual payout at an average growth rate of 10.4% per year. The current $1.32 annualized dividend is 120% higher than the total annual dividend of $0.60 that BB&T paid in 2010. Even with the significant drop in 2009 and 2010, the company still managed to maintain a 4.5% annual growth rate over the past two decades.

The share price came into the current trailing 12-month period on a strong uptrend from late 2016 and rose almost 6% between January 26, 2017 and March 1, 2017. However, the uptrend reversed, and the share price lost 6.5% by the end of May 2017, when it reached its 52-week low of $46.48. After bottoming out on May 31, 2017, the share price reversed course once more and gained 18.3% on its way to the $55.00 all-time high that the share price reached by closing on January 24, 2018. In addition to being 18.3% above the 52-week low from May, the closing price of $55.00 on January 24, 2018, was 17.1% higher than it was one year earlier and almost 80% higher than it was five years prior.

The combination of rising dividend payouts and asset appreciation enabled the company to reward its shareholders with a 23% total return in the last year, a 60% total return over the past three years and a total return of more than 96% over the past five years.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic