BB&T Bank Hikes Quarterly Dividend 13% (BBT)

By: Ned Piplovic,

BB&T Corporation (NYSE: BBT) – a well-known U.S. financial services holding company – has boosted its annual dividend for the past eight consecutive years and is set to increase its quarterly dividend for the upcoming payout by more than 13%.

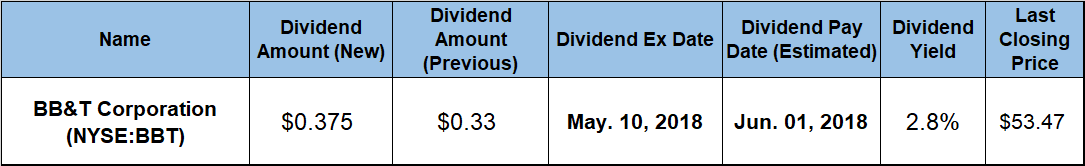

Currently paying a 2.8% yield, which outperforms the average yield of the Mid-Atlantic Regional Banks market segment by more than 50%, BB&T has increased its dividend payment 18 times in the past two decades. In addition to this impressive streak, the company also has rewarded its investors with steady, double-digit-percentage asset appreciation over the past year.

BB&T offers a solid portfolio of traditional banking products and limited exposure to risky exotic financial investments. Investors looking for a safe way to diversify their portfolio and add a company with a strong dividend payout record may want to conduct their research and assume a long position in the stock prior to the next ex-dividend date on May 10, 2018. The pay date for the dividend will be on June 1, 2018, which is a little longer than the two weeks that normally separates these two important dates.

BB&T Corporation (NYSE:BBT)

Based in Winston-Salem, North Carolina and founded in 1872, the BB&T Corporation operates as a financial holding company that provides various banking and trust services for small and mid-size businesses, public agencies, local governments and individuals. The bank operates through six business segments — Community Banking, Residential Mortgage Banking, Dealer Financial Services, Specialized Lending, Insurance Services and Financial Services. As of December 2017, the bank operated approximately 2,200 locations in 15 states.

BB&T Corporation started paying dividends to its shareholders in 1934. Prior to the 2008-2009 financial crisis, the quarterly payment had gone as high as $0.47 per share, or $1.88 every year. However, the company reduced its quarterly dividend payout 68% in the second quarter of 2009, going from the aforementioned $0.47 per share to a $0.15 distribution the following period.

Thankfully, BB&T reverted to boosting its annual dividends every year, and has done so since 2011. With the next increase coming later this month, the annual dividend will have risen 150% since its 2010 levels. Even with the significant dividend cut in 2009, the company still managed to maintain an average growth rate of 7.5% per year over the past two decades and enhance its total annual payout amount four-fold since 1998.

The upcoming dividend distribution will increase the quarterly payment 13.6% from the $0.33 per share in the previous quarter to the current $0.375 amount, which converts to a $1.50 a year. Normally, BB&T has increased its dividend in $0.03 increments over the past several years, so the current boost of $0.045 exceeds the company’s recent trend.

The upcoming dividend hike, combined with a small share price decrease over the past three months, has caused the company’s dividend yield to rise approximately 8%, from 2.6% to the current 2.8% yield. While this higher yield still lags the 3.27% average yield of the overall Financial sector by 16%, it compares favorably with the average yields of BB&T’s regional bank peers.

BB&T’s share price declined almost 5% at the onset of the trailing 12-month period, falling from $43 to a 52-week low of $41 on May 31, 2017. After bottoming out at the end of May, the share price embarked on an uptrend with some volatility along the way, advancing 34% before topping out around the 52-week high of $56 in March 2018. Since the mid-March peak, the share price experienced one significant pullback of almost 10% over just two days in late March, but the stock has recovered, albeit slowly, and closed on May 1, 2018 at $53.07. This closing price was 23% higher than one-year earlier and 28.4% above the 52-week low from the end of May 2017, as well as 70% higher than five years ago.

Combined with BB&T’s quarterly payments, investors have seen a total return of 25.7% over one year and almost 50% over three years. Long-term investors are approaching a triple-digit return should the stock continue to climb higher.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic