BCB Bancorp Offers Shareholders 3.5% Dividend Yield (BCBP)

By: Ned Piplovic,

BCB Bancorp, Inc. (NASDAQ:BCBP) currently offers its shareholders a 3.5% dividend yield and a share price growth of nearly 30% since its 52-week low in September 2017.

The bank hiked its annual dividend amount only half of the time since it started paying dividends in 2006 but avoided dividend cuts and managed an average annual dividend growth rate of more than 5% per year. Despite trending more than 15% below its own five-year average, the company’s current 3.5% yield outperformed the average yields of bank’s industry peers in several categories.

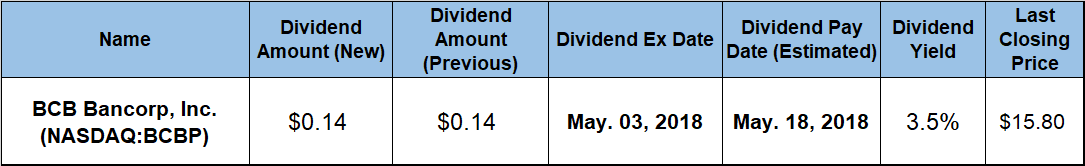

The company will distribute its next dividend on its pay date of May 17, 2018, to all its shareholders of record prior to the May 3, 2018, ex-dividend date.

BCB Bancorp, Inc.(NASDAQ:BCBP)

Based in Bayonne, New Jersey, and founded in 2000, BCB Bancorp, Inc. operates as the holding company for BCB Community Bank, which is a state chartered commercial bank that provides banking products and services to businesses and individuals. The bank offers customary deposit products, including savings and club accounts, negotiable order of withdrawal (NOW) accounts, demand accounts, money market accounts, certificates of deposit, individual retirement accounts and term certificate accounts. Additionally, the company provides real estate loans, mortgage loans, home equity loans and lines of credit, construction loans, commercial business loans and small business administration lending services. The company also offers retail and commercial banking services, such as wire transfers, money orders, safe deposit boxes, night depository services, debit cards, fraud detection services and automated teller services. As of March 31, 2018, the company operated 21 branches, two administrative offices and two loan production offices in New Jersey, as well as two additional branch locations in Staten Island, New York, and a loan production office in Manhattan.

Declining from its two-tear peak in late March 2017, the share price reached its 52-week high of $15.95 and then continued its downward trend by dropping an additional 22.2% before reaching its 52-week low of $12.30 on September 12, 2017. However, the share price reversed its trend and recovered half of its losses by the beginning of October 2017. The share price continued to grow at a more moderate pace and gained 29.7% to recover all its losses since the May 2017 peak to reach its 52-week high of $15.95 again three times in mid-March 2018. The share price pulled back less than 1% since the March peak and closed on April 24, 2018 at $15.80. This closing price was identical to the April 24, 2017, closing price one year earlier, 28.5% higher than the 52-week low from September 2017 and 53% higher than it was five years ago.

The bank’s current $0.14 quarterly dividend payout converts to a $0.56 annualized payout amount for 2018, which is the same annual amount that the company distributed each of the previous three years. The current annualized dividend distribution is equivalent to a 3.5% dividend yield, which is more than 15% less than the bank’s own five-year average of 4.2%. However, the bank’s current yield exceeds several average industry yields. BCB Bancorp’s 3.5% yield is 7.4% above the 3.3% average yield of the entire Financials sector, nearly double the 1.8% simple average yield of the Northeast Regional Banks market segment and almost 60% higher than the average yield of only the segment’s dividend-paying companies.

The company hiked its annual dividend payout in six out of the past 13 years. Even while failing to raise its annual payout more than half the time, the company did not cut its dividends and managed to maintain an average total dividend growth rate of 5.3% per year since starting to pay dividends in 2006.

Since the company experienced no share-price growth since April 24, 2017, the entire total return of 4.75% consisted of dividend distributions in the past year. However, the company’s asset appreciation over longer periods combined with its dividend income distributions to offer the company’s shareholders a total return of 42% over the past three years and an 84% total return over the past five years.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic