Boeing Boosts Quarterly Dividend 20% (BA)

By: Ned Piplovic,

The Boeing Company (NYSE:BA) hiked its quarterly dividend for the first quarter of 2018 more than 20% and doubled its share price in the past 12 months.

While the rapid share price growth suppressed the dividend yield to slightly below 2%, the company paid an annual dividend of nearly $7 per share and continued its current streak of hiking annual dividend payouts at an average rate of more than 20% per year.

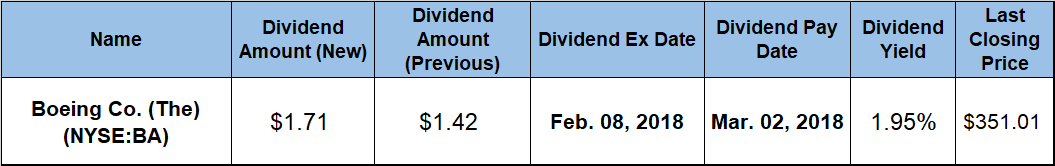

The company will distribute its next dividend payment on March 2, 2018, to all its shareholders of record as of the February 8, 2018 ex-dividend date.

The Boeing Company (NYSE:BA)

Founded in 1916 in Seattle, Washington, and currently headquartered in Chicago, Illinois, The Boeing Company designs, develops, manufactures, sells and services commercial and military aircrafts, satellites, missile defense systems, space flight vehicles and launch systems. The company operates through five business segments — Commercial Airplanes, Boeing Military Aircraft, Network & Space Systems, Global Services & Support and Boeing Capital.

The company hiked its dividend for the current quarter 20.4%, from $1.42 in the last quarter of 2017 to the current $1.71 quarterly payout. This current quarterly amount is equivalent to a $6.84 annualized payout per share and the yield is 1.95%. The relatively low yield is a result of the rapidly-appreciating share price. Using the share price from just two weeks ago, the forward yield would have been 2.3%, and the share price from 60 days ago would convert the current annualized dividend amount to a 2.6% yield.

However, even at its current level, Boeing’s current yield is 144% higher than the 0.8% average yield of all companies in the Aerospace & Defense market segment. The segment’s average yield increases from 0.8% to 1.33% if we include only dividend-paying companies. Yet, Boeing’s current yield still outperforms the average yield by more than 46%. Also, the company’s current yield is nearly 86% higher than the 1.05% average yield of the overall Industrial Goods sector.

While the company struggled to match its dividend growth to the share price growth, the rise of the annual dividend is still quite impressive and accelerating. The company has boosted its annual dividend amount at an average rate of more than 13% per year over the past 20 years and enhanced its payout 70% of the time.

Over a slightly shorter period of the past 15 years, the company grew its annual dividend distribution at 16.6% per year and hiked its annual amount 87% of the time. Lastly, the company hiked its annual dividend amount at an average rate of 22.2% per year over the past seven consecutive years and quadrupled its annual payout compared to the $1.68 amount from 2011.

As mentioned previously, the company’s share price more than doubled in the past 12 months with no signs of retreat. The share price’s path was plain and simple. It started from the 52-week low of $158.32 on January 18, 2017, and rose all the way to its new 52-week high — and all-time high — of $351.01 at closing on January 17, 2018.

The only deviations from the share price’s steady ascent were a 13.6% two-day jump that occurred in late July 2017 and the current 18.3% growth spurt over the past two weeks. Other than these two spikes, the share price rose at an average rate of 1.54% per week over the past 12 months.

The January 17, 2018, closing price of $351.01 is 121.7% higher than it was 12 months earlier and almost 368% higher than it was five years ago. The annual dividend distributions combined with the share price growth to deliver total returns of 125.3% over the past 12 months, 138% over the past three years and almost 380% over the last five years.

With the current dividend payout ratio of 47%, The Boeing Company has room to continue boosting its annual distributions to keep up with the rising share prices and keep its yield at current levels or perhaps even slightly higher.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic