Boeing’s Dividend Yield Rises to 2%, Total One-Year Return Exceeds 30% (BA)

By: Ned Piplovic,

In a competitive sector with low yields, the Boeing Company (NYSE:BA) has managed to outperform all but one peer with its 2.04% dividend yield and in the process rewarded its shareholders with a total return of more than 30% over the past 12 months.

The company has boosted its annual dividend payout amount for the past seven consecutive years, 13 times in the past 15 years and 15 times over the past two decades. Unfortunately, despite an average annual dividend growth rate of nearly 30% over the past five years, the dividend yield rose only marginally because the share price — which has more than tripled since the beginning of 2016 — suppressed the dividend yield to its current levels. Compared to the analysts’ current average target price of $415.48, the current share price could have almost 25% more on the upside to grow, once the current correction ends.

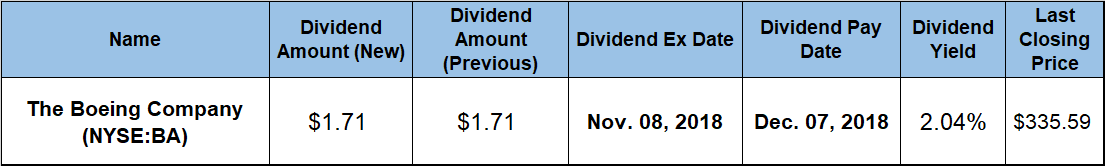

While investors seeking pure dividend income plays might pass on this company, investors seeking total returns with annual dividend income of nearly $7 per share should consider taking a position prior to the November 5, 2018, ex-dividend date. Boeing will distribute its next dividend payment to all its shareholders of record on the December 7, 2018, pay date.

The Boeing Company (NYSE:BA)

Founded in 1916 in Seattle, Washington, and currently headquartered in Chicago, Illinois, The Boeing Company designs, develops, manufactures, sells and services commercial and military aircrafts, satellites, missile defense systems, space flight vehicles and launch systems. The company operates through five business segments — Commercial Airplanes, Boeing Military Aircraft, Network & Space Systems, Global Services & Support and Boeing Capital.

The current $1.71 quarterly dividend distribution is more than 20% above the $1.42 payout from the same period last year. This current quarterly amount is equivalent to a $6.84 annualized payout and a 2.04% forward dividend yield. The current yield is approximately 11% lower than the company’s own five-year average yield of 2.3%. However, Boeing has enhanced its total annual dividend payout more than 12-fold over the past two decades, which is equivalent to a 13.3% average annual growth rate.

While many companies struggle to maintain their dividend growth rate over extended period, Boeing has managed to increase its dividend growth rate in the more recent years. During the current streak of seven consecutive annual dividend boosts, the company managed to enhance its total annual dividend payout amount more than 300%, which corresponds to an average growth rate of 22.2% per year. Over the past three years, the growth rate rose to 23.7%.

While the current 2.04% yield might seem low compared to other industries, that dividend yield rate is currently only marginally below the Raytheon Company’s (NYSE:RTN) 2.06% top dividend yield in the Major Aerospace & Defense industry segment. Furthermore, Boeing’s current dividend yield is nearly 30% higher than the 1.58% average yield of the entire Industrial Goods sector and 116% above the $0.94 simple average yield of all the companies in the Major Aerospace & Defense segment. The firm’s current 2.04% yield is also nearly 30% above the 1.57% simple average yield of the segment’s only dividend-paying companies.

Most importantly, Boeing’s current dividend payout ratio of 38% indicates that the company’s distributions are well covered by earnings and the company should be able to continue its current streak of rising annual dividends for the near term. Furthermore, the current 38% payout ratio is nearly 20% lower than the 47% ratio average over the past five years.

The company’s stellar dividend progress was only exceeded by its share price growth. The share price began the trailing 12 months from its 52-week low of $259.25. From this low, the share price advanced more than 50% before reaching its new all-time high of $392.30 on October 3, 2018.

After peaking in early October, the share price pulled back amidst the overall market correction and closed on October 29, 2018, at $335.59. While 14.5% lower than the peak price from the beginning of October, this closing price was still more than 29% higher than it was one year earlier and 150% higher than it was five years ago.

Boeing’s annual dividend distributions combined with the share price growth to reward the company’s shareholders with a 34% total returns over the past year. Over the past three years, shareholders enjoyed a total return of 140%, as well as five-year total return of 177%.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic