BP Resumes Dividend Growth with a 2.5% Quarterly Dividend Hike (BP)

By: Ned Piplovic,

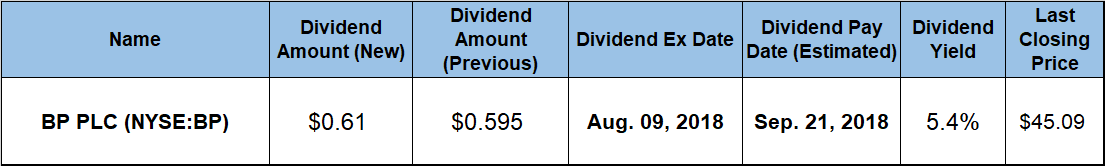

After 12 consecutive quarters of flat dividend distributions, BP plc (NYSE: BP) returned to hiking its quarterly dividend payout with a 2.5% hike for the upcoming dividend distribution in late September 2018.

The company has raised it total annual dividend amount for five consecutive years after a significant dividend reduction in 2010. However, the company did cut its quarterly dividend from $0.60 to $0.595 for the second quarter of 2015 and continued to pay the same quarterly dividend amount until the previous period.

Despite the minor dividend pullback and several years of flat dividends, the company’s dividend grew almost uninterrupted over the past two decades. Other than the 2015 dip, the company lowered its quarterly dividend on only one other occasion in 2011 when it cut the quarterly dividend in half from the previous year’s $0.84 quarterly payout amount. However, while the 2010 quarterly dividend amount was $0.84, BP distributed only one quarterly dividend that year, which made the 2010 payout the lowest annual distribution in the past 20 years.

In addition to resuming dividend growth, BP’s share price increased nearly 30% over the past 12 months to complement the company’s restored dividend growth, which currently offers a dividend yield in excess of 5%. This level of share price growth and the above-average yield could entice some interested investors to consider adding BP shares to their investment portfolio prior to the company’s August 9, 2018 ex-dividend date . This action would ensure any new investors a shareholder of record status and eligibility to receive the next round of dividend distributions on the September 21, 2018 pay date.

BP p.l.c. (NYSE:BP)

Headquartered in London, U,K. and founded in 1889, BP p.l.c. engages in the energy business worldwide. The corporation operates through three business segments: Upstream, Downstream and Rosneft. The Upstream segment comprises of oil and natural gas exploration, midstream transportation, storage and processing of liquefied natural gas (LNG) and natural gas liquids (NGLs). Additionally, this segment engages in the ownership and management of crude oil and natural gas pipelines, processing facilities, export terminals and transportation. The Downstream segment refines, manufactures, markets, transports and trades in crude oil, petroleum, petrochemical products and related services to wholesale and retail customers. Also, the segment offers gasoline, diesel, aviation fuel, lubricants and related products to the automotive, industrial, marine and energy markets under the Castrol, BP and Aral brands. Lastly, the Rosneft segment engages in the exploration and production of hydrocarbons, as well as jet fuel, bunkering, bitumen and lubricants activities. This segment also owns and operates 13 refineries in Russia, as well as approximately 3,000 retail service stations in Russia and internationally. The company also produces ethanol and solar energy, transports hydrocarbon products through time-chartered and spot-chartered vessels and holds interests in 14 onshore wind sites with a generation capacity of more than 1,400 megawatts.

The company’s upcoming quarterly dividend of $0.61 is 2.5% higher than the $0.595 distribution from the previous quarter. This new dividend amount corresponds to a $2.44 annualized payout amount and a current dividend yield of 5.4%. While the ascending share price depressed the current yield almost 10% below the company’s own 6% average yield over the past five years, the current yield still outperformed average industry yields.

BP’s current yield is almost 140% higher than the 2.27% average yield of the entire Basic Materials sector and almost 73% above the simple average yield of the Integrated Oil & Gas industry segment. As the third-highest yield within the Integrated Oil & Gas segment, BP’s current yield is more than 30% above the average yield of the segment’s only dividend paying companies.

Since skipping three out of four quarterly dividend installments in 2010, BP advanced its total annual dividend payout almost three-fold, which is equivalent to an average growth rate of 14.3% per year.

After a 3.2% drop over three weeks, the share price reached its 52-week low of $34.00 on August 21, 2017. However, the share price reversed course right away, embarked on a nine-month growth trend and gained almost 41% before peaking at $47.79 on May 21, 2018. The share price pulled back slightly and closed on July 31, 2018 at $45.09, which was 28.3% higher than it was one year earlier and 32.6% above the August 2017 low. This share-price growth contributed the largest portion of BP’s 34.8% total return over the past 12 months.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic