Camden National Corporation Boosts Quarterly Dividend 20% (CAC)

By: Ned Piplovic,

The Camden National Corporation (NASDAQ: CAC) is scheduled to increase its quarterly dividend payment by 20% starting at the end of July 2018.

This upcoming quarterly dividend hike is only the second consecutive dividend boost, but the company has been distributing quarterly dividends since 1997 and has managed to avoid any cuts since then. Over those two decades, Camden has an 80% track record of annual dividend increases.

Alongside this rising dividend income, Camden’s stock has also steadily grown over the years, save for a significant drop in the aftermath of the 2008 financial crisis. To take advantage of any future appreciation in the stock, as well as the 20% dividend increase, interested investors should do their research and take a position prior to the next ex-dividend date on July 12, 2018, which will ensure eligibility for the next round of dividend distributions on the July 31, 2018 pay date.

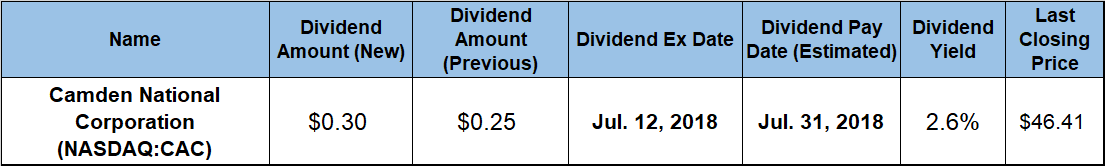

Camden National Corporation (NASDAQ:CAC)

Headquartered in Camden, Maine and founded in 1984, the Camden National Corporation operates as the holding company for the Camden National Bank. Founded in 1875, the bank has been providing banking products and services to individual consumers and commercial customers for more than 140 years. The bank offers customary money deposit products and various private and commercial loans. Additionally, the company provides brokerage and insurance services through its financial offerings consisting of college, retirement, estate planning, mutual funds and strategic asset management accounts, as well as variable and fixed annuities. The bank also offers a range of investment management, financial planning, fiduciary, asset management and wealth management services, as well as serves as trustee. As of June 2018, the bank operated a network of 60 branch locations and 74 automated-teller machines (ATMs) throughout Maine, as well as lending offices in Massachusetts and New Hampshire.

The company boosted its quarterly dividend 20% from the $0.25 payout in the previous period to the current $0.30 quarterly dividend amount. This new amount corresponds to a $1.20 annualized dividend distribution and 2.6% forward dividend yield, which is 3.4% higher than the company’s own five-year average yield.

While the company’s current yield is trailing the 3.06% average yield of the entire Financials sector, it outperforms the average yield of its industry peers. Compared to the 1.79% average dividend yield of all the companies in the Northeast Regional Banks industry segment, Camden National Corporation’s current 2.6% yield is almost 45% higher. Excluding from the yield calculation all the companies that do not distribute any dividends raises the simple average dividend yield of the segment to just 2.28% and the CAC’s current yield is still 13.4% higher.

Without any dividend cuts and just four instances of failing to boost its annual dividend amount, the company advanced its annual dividend payout 220% over the past two decades, which is equivalent to an average growth rate of 6% per year. The company failed to raise its annual dividend most recently three years ago. However, over the past two years the annual dividend amount increased 50%, which corresponds to a 22.5% average annual growth rate.

The company’s share price started the trailing 12-month period with a 14.5% pullback and reached its 52-week low of $37.33 on September 7, 2017. However, the share price reversed course and recovered all those losses before the end of September. Following increased volatility in the last three months of 2017 – which included a brief spike to $47 in late November – the share price resumed its low-volatility uptrend at the beginning of 2018. After ascending to its 52-week high of $47.43 on June 21, 2018, the share price withdrew 2.2% and closed on July 3, 2018 at $46.41. This closing price was 6.3% higher than the price level from one year earlier, 24.3% above the 52-week low from September 2017 and nearly 90% higher than it was five years ago.

The company’s shareholders enjoyed a combined total return of 8.65% over the past 12 months. However, because of a share price spike of nearly 50% in the last quarter of calendar 2016, the total return over the past three years came in at more the 90% and the five-year total return was just few basis points below 115%.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic