Carnival Corporation Boosts Quarterly Dividend 11% (CCL)

By: Ned Piplovic,

Carnival Corporation & plc (NYSE:CCL, LSE:CCL and NYSE:CUK) continues growing its annual dividend payouts with its fourth consecutive hike and the sixth dividend boost in the past eight years while offering dividend yields above industry averages.

While the company’s share price declined slightly over the past few months, influenced by the overall equity market volatility, Carnival’s share price is still more than 5% ahead of its own level from one year ago. Additionally, the share price decline increased the company’s yield nearly 20% over the past 90 days.

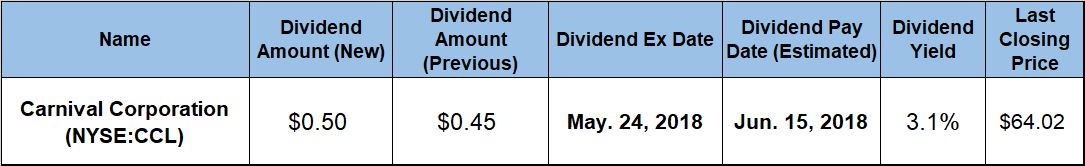

The company will distribute its next dividend payout on June 15, 2018, to all its shareholders of record before the next ex-dividend date, which will occur on May 24, 2018.

Carnival Corporation (NYSE:CCL)

Headquartered in Miami and incorporated in 1972, the Carnival Corporation — a subsidiary of Carnival Corporation & plc — operates as a leisure travel and cruise company. The company operates approximately 100 cruise ships under the Carnival Cruise Line, Holland America Line, Princess Cruises and Seabourn brands in North America; AIDA, Costa, P&O Cruises in Australia, as well as Cunard and P&O Cruises (UK) brands in Europe, Australia and Asia. Additionally, the company owns and operates Holland America Princess Alaska Tours, which is a tour company in Alaska and the Canadian Yukon that owns and operates hotels, lodges, glass-domed railcars and motor coaches. On May 10, 2018, the Carnival Corporation unveiled its new Fleet Operations Center (FOC) in Miami, which the company claims is “the largest and most advanced in the cruise industry” and will keep track of movement and operations of all 26 Carnival-branded ships.

The company boosted its quarterly dividend 11.1% from the previous period’s $0.45 payout to the current $0.50 amount. This new quarterly distribution is equivalent to a $2.00 annualized distribution and currently yields 3.1%. The current yield is 30% above the company’s own 2.4% average yield for the past five years. Additionally, Carnival’s current 3.1% yield is 52% above the 2.05% average yield of the entire Services sector and nearly triple the 1.07% simple average yield of the overall Hotel & Gaming market segment.

After cutting its dividend by 75% in 2009, which was Carnival’s only dividend reduction in the past 25 years, the company paid four years of flat $1.00 payouts and resumed hiking its annual dividend in 2015. Over the past four years of continued annual dividend hikes, the company doubled its annual amount by sustaining an average growth rate of nearly 19% per year. The company recovered from the 2009 dividend cut completely by 2017, when it paid the same $1.60 annual dividend as it did in 2008, prior to the dividend reduction.

Royal Caribbean Cruises Ltd. (NYSE:RCL) is the only other publicly-traded cruise line that currently pays dividends. However, Carnival’s 3.1% dividend yield is currently nearly 39% higher than RCL’s current 2.24% yield.

Carnival’s share price entered the trailing 12-month period riding an uptrend that started in September 2016. Continuing that trend, the share price passed through its 52-week low of $60.91 on May 15, 2017, and continued to gain another 18% before closing at $71.94 on January 29, 2018, which was its highest closing share price over the trailing 12 months.

After the late January 2018 price peak, the overall market volatility and several general pullbacks affected Carnival’s share price negatively. The share price closed on May 11, 2018, at $64.02. While that price was more than 10% below the January peak price, it was still 5.1% higher than the 52-week low from one year earlier and 83% above the price level from five years ago.

While the dividend hike offset slightly the recent share price decline, the total return on shareholder investment dropped significantly and stands currently at 6.6% for the trailing 12-month period. However, long-term investors enjoyed a total return of nearly 50% over the last three years and doubled their investment over the past five years.

Dividend increases and decreases, new announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic