Carnival Corporation Offers 2.6% Dividend Yield (CCL)

By: Ned Piplovic,

Carnival Corporation & plc (NYSE:CCL, LSE:CCL and NYSE:CUK) offered a double-digit percentage asset appreciation in the past 12 months and currently serves its shareholders a 2.6% dividend yield.

The company’s current streak of consecutive dividend hikes is only four years. However, the company has cut its dividend only once in the past 25 years. Additionally, the company announced its 2017 year-end earnings — which exceeded analysts’ expectations — and announced an aggressive outlook for 2018.

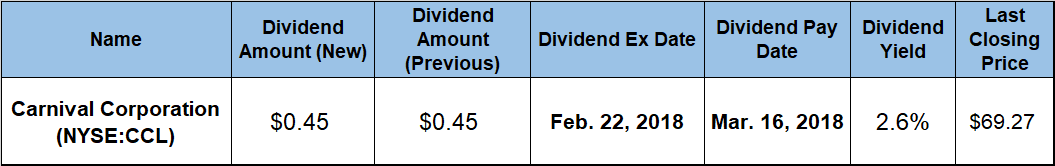

The company will distribute its next dividend payout on March 16, 2018, to all its shareholders of record before the next ex-dividend date, which will occur on February 22, 2018.

Carnival Corporation (NYSE:CCL)

Headquartered in Miami and incorporated in 1972, the Carnival Corporation — a subsidiary of Carnival Corporation & plc — operates as a leisure travel and cruise company. The company operates approximately 100 cruise ships under the Carnival Cruise Line, Holland America Line, Princess Cruises and Seabourn brands in North America; AIDA, Costa, P&O Cruises in Australia, as well as Cunard and P&O Cruises (UK) brands in Europe, Australia and Asia. Additionally, the company owns and operates Holland America Princess Alaska Tours, which is a tour company in Alaska and the Canadian Yukon that owns and operates hotels, lodges, glass-domed railcars and motor coaches.

The company carried over into the first quarter of 2018 the same $0.45 quarterly payout from the fourth quarter of 2017. However, the company hiked its quarterly dividend twice in 2017 — from $0.35 to $0.40 in the second quarter and from $0.40 to $0.45 in the fourth quarter. Therefore, the company’s current $0.45 quarterly distribution amount is 12.5% higher than the dividend amount from the third quarter of 2017 and 28.6% higher than the dividend amount from the first quarter 2017.

The current $0.45 quarterly distribution is equivalent to a $1.80 annualized amount and a 2.6% forward yield. Additionally, the current annualized dividend is 8.3% above Carnival’s own 2.4% average yield over the past five years and 32.6% higher than the current Service sector average yield of 1.96%. The company’s current annualized dividend is also almost 37% above the 1.91% yield of Royal Caribbean Cruises Ltd. (NYSE: RCL). Royal Caribbean is the only other publicly-traded cruise line that pays dividends.

The company has been paying dividends to its shareholders since 1988. Between 1993 and 2008 the company managed to avoid any dividend cuts and multiplied its annual dividend more than 11-fold by growing the annual distribution at 19% per year. The company did not pay any dividends in 2009, which marked the company’s only dividend cut in the past 25 years.

Since resuming paying dividends in 2010 with a $0.40 annual payout, the company grew its annual dividend at an average rate of nearly 22% and returned to a $1.60 annual payout by 2017, which was the same amount that the company paid out in 2008 prior to missing its dividend in 2009. Over the past four years of consecutive dividend boosts, the company raised its annual distribution at an average rate of 15.8% and enhanced its total annual payout by 80% since 2014.

Carnival’s share price was on a steady upward trajectory over the past 12 months. The share price began its trailing 12-month period from its 52-week high and rose consistently with just a minor dip in September and October. By the time the it reached its 52-week high of $71.94 on January 29, 2018, the share price had risen almost 30% from its 52-week low of $55.45 at the beginning of February 2017.

After the January 2018, the share price fell just 3.7% despite one of the largest stock market pullbacks in history in the first week of February and closed on February 6, 2018, at $69.27. That closing price was almost 25% higher than the 52-week low from one year earlier and almost 90% above its price from five years prior.

The shareholders received a 28% total return for the past 12 months through combined benefits of a 25% asset appreciation and a 2.6% yield. Over the past three years, the total return was 66%, and the total return over the past five years was 93%.

Dividend increases and decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic