Caterpillar Reaches Dividend Aristocrats Requirement Threshold (CAT)

By: Ned Piplovic,

After paying uninterrupted rising annual dividends for more than two decades, Caterpillar, Inc. (NYSE: CAT) finally reached the 25 consecutive years mark for inclusion in the elite group of companies designated as Dividend Aristocrats.

The company started paying quarterly dividends in 1933 and – adjusted for two stock splits – the upcoming quarterly 10.3% dividend hike will make it the 25th consecutive annual dividend boost. This milestone is the third major requirement for inclusion in the exclusive group of companies designated dividend aristocrats.

In addition to a minimum of 25 consecutive years of dividend hikes, a company must be a component of the S&P 500 index and must have a market capitalization of at least $3 billion to qualify as one od Dividend Aristocrats. Caterpillar met the former two requirements a while ago and it finally managed to achieve its 25th consecutive dividend boost, which opens the door to the exclusive Dividend Aristocrats designation currently earned by just 53 companies.

Caterpillar’s share price faltered a little in 2018 due to an overall market sell-off that was driven in large part on concerns about an inflation uptick and concerns about fallout from a potential trade war with China. While the North American market still generates more revenues than any other market, it is now less than half of Caterpillar’s total revenues – 46% in 2017. On a positive note, lower regulations and reduced corporate tax rates for 2018 should compensate for at least a portion of any potential revenue losses due to tariffs and other trade restrictions.

Despite the share-price pullback of more than 17% from the 52-week high in January 2018, the share price is still more than 30% higher than it was just one year earlier. Any sign of tariff conflict resolution or potential trade agreements with individual countries could send Caterpillar’s share price soaring again and some investors might try to take advantage of the current share price dip to acquire shares at discounted prices.

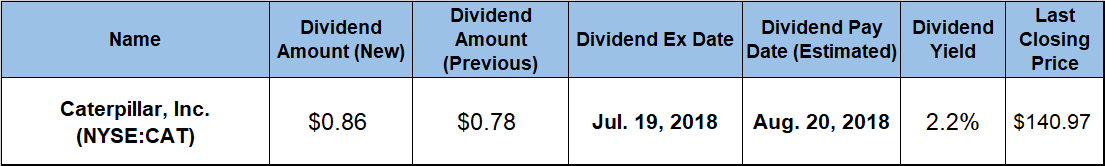

Any investor who wishes to be eligible to receive dividend distributions on the upcoming August 30 pay date must be a shareholder of record before the company’s next ex-dividend date, which is set for July 19, 2018.

Caterpillar, Inc. (NYSE: CAT)

Caterpillar Inc. manufactures and sells construction and mining equipment, diesel and natural gas engines, industrial gas turbines and diesel-electric locomotives for industrial application. The company’s Construction Industries segment offers backhoes, loaders, prep tractors, excavators, graders, asphalt pavers, etc.

CAT’s Resource Industries business segment provides electric rope and hydraulic shovels, landfill and soil compactors, track and rotary drills, hard rock vehicle and continuous mining systems, as well as mining, off-highway and articulated trucks. Additionally, the Energy & Transportation segment offers reciprocating engine-powered generators, turbines, centrifugal gas compressor, diesel-electric locomotives and other rail-related products and services. Founded as the Caterpillar Tractor Co. in 1925, the company changed its name to Caterpillar Inc. in 1986 and its headquarters are in Peoria, Illinois.

The company’s share price entered the trailing 12-month period riding an uptrend that started in January 2016. The share price then fell to an adjusted 52-week low of $104.94 on July 21, 2017, before rising more than 60% to top out at $170.89 on January 22, 2018. After peaking at the end of January, the share price gave back some of those gains and closed on July 9, 2018, at $140.97. While 17.5% below the 52-week high from January, this closing price was still more than 30% above the price level from one year earlier and 65% higher than it was five years ago.

The company’s new $0.86 quarterly dividend amount is 10.3% higher than the previous period’s $0.78 payout and equivalent to a $3.12 annualized dividend. While significantly lower than dividend yields in some high-yield sectors, Caterpillar’s current 2.2% dividend yield is the highest yield in the Farm & Construction Machinery industry segment and 70% higher than the average yield of only dividend-paying companies in the segment.

Just over the past two decades, the company managed to advance its total annual dividend payout five-fold and maintain an 8.3% average annual dividend growth rate. The growth rate over the past five years is even higher at 8.67%

Even with a little share-price stumble in 2018, the company continued to raise its dividend and became eligible for a Dividend Aristocrat moniker and rewarded its shareholders with a 33.7% total return over the past 12 months. The total returns over the past three and five years were 75% and 83.5%, respectively.

Related Articles:

5 Best Dividend Aristocrats to Buy Now

The Dividend Aristocrats Investing Strategy and Stocks List

The Best Dividend Aristocrats ETFs

Why Invest in the Dividend Aristocrats?

The S&P 500 Dividend Aristocrats — Everything You Need to Know

What are the Dividend Aristocrats?

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic