Caterpillar Rewards Shareholders with a 2.6% Dividend Yield and 25 Consecutive Annual Dividend Boosts (CAT)

By: Ned Piplovic,

Investors who anticipate the share price of Caterpillar, Inc. (NYSE:CAT) to rise as a result of any potential trade agreement between the United States and China could take a position at the currently discounted prices and collect a 2.6% dividend yield while waiting for the share price to rebound.

The company’s share price has a history of long-term growth and swift recoveries after major pullbacks. After declining more than 70% during the 2008 financial crisis and more than 40% in 2015, the share price recovered all its losses in approximately the same amount of time as the length of the decline preceding the recovery. Additionally, in both instances, the share price continued to advance after recovering to gain at least an additional 50% before the next correction.

Unlike the Caterpillar’s fluctuating share price, the company’s dividend follows a steady long-term growth trend. The company’s total annual dividend payout increased every year for the past 25 consecutive years. While the company’s current dividend payout ratio of 52% is at the upper edge of what investors consider sustainable, the current payout ratio is significantly lower than the company’s 121% five-year average. Therefore, it is reasonable to assume that the company will continue its dividend hikes streak, with an anticipated quarterly boost of 5% to 10% in the third quarter of 2019.

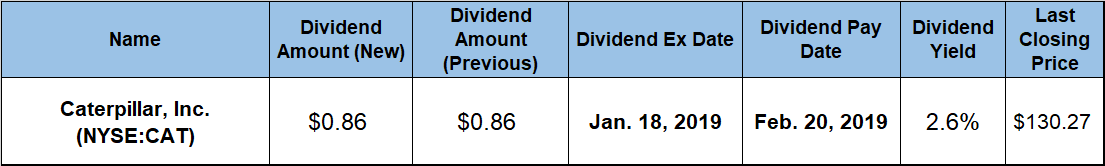

Investors who suspect that a potential resolution of the trade conflict with China is likely to occur and that a bilateral agreement might drive Caterpillar’s share price higher should confirm that the CAT stocks fits within their portfolio strategy. If the stock is a good strategy match, investors should consider taking advantage of the currently discounted prices to take a long position in the stock. Caterpillar set its next dividend pay date for February 20, 2019. On that date, the company will distribute its next round of dividend distributions to all investors who attain the shareholder of record status prior to the January 18, 2019, ex-dividend date.

Caterpillar, Inc. (NYSE:CAT)

Headquarters are in Peoria, Illinois and founded in 1925, Caterpillar, Inc. manufactures and sells construction and mining equipment, as well as engines and gas turbines for industrial application. The company’s Construction Industries segment offers backhoes, loaders, prep tractors, excavators, graders, asphalt pavers, etc. CAT’s Resource Industries business segment provides electric rope and hydraulic shovels, compactors and drills, as well as mining, off-highway and articulated trucks. Additionally, the Energy & Transportation segment offers reciprocating engine-powered generators, turbines, centrifugal gas compressor, diesel-electric locomotives and other rail-related products and services.

The company’s share price reached its 52-week high very early in the trailing 12-month period. After peaking at $170.89 on January 22, 2018, the share price reversed trend and nearly fell 35% before reaching its 52-week low of $112.34 on October 24, 2018. Despite moderate volatility that followed the unsteadiness of overall markets at the end of 2018, Caterpillar’s share price advanced to close on January 9, 2019 at $130.27. This closing price was still more than 20% lower than it was one year earlier and nearly 24% below the peak from January 2018. However, the share price advanced 16% above the 52-week low from October 2018 and is 42% higher than it was five years ago.

The company’s current $0.86 quarterly dividend is more than 10% above the $0.78 quarterly distribution from the same period last year. This current quarterly payout converts to a $3.44 annualized amount for 2018, which corresponds to a 2.6% dividend yield.

In addition to being 24% above the company’s own 2.1% dividend yield from one year ago, the current yield is more than double the 1.21% average yield of the overall Industrial Goods sector, as well as nearly 180% above the 0.95% simple average of the Farm & Construction Machinery industry segment. Furthermore, as the segment’s highest dividend yield, Caterpillar’s current yield is nearly 80% above the 1.47% simple average of the segment’s only dividend-paying companies, the sector’s only dividend yield in excess of 2% and 36% higher than Deere and Company’s (NYSE:DE) second highest yield of 1.94%.

Caterpillar enhanced its total annual dividend 450% during the past 20 years, which is equivalent to an average annual growth rate of nearly 9% per year. While the one-year share price of nearly 22% resulted in a total loss of 19% over the past 12 months, the company’s shareholders enjoyed much higher long-term benefits with a five year total return of nearly 63% and a total return of 120% over the past three years.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic