Chubb Limited Boosts Quarterly Dividend 2.8% (CB)

By: Ned Piplovic,

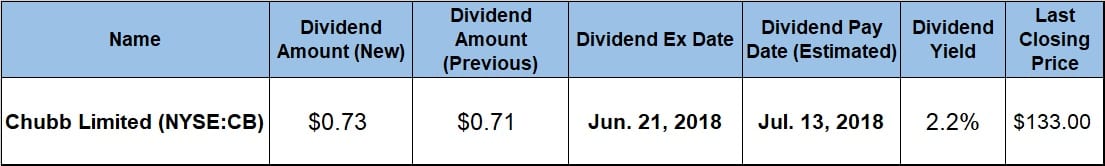

Chubb Limited (NYSE:CB) boosted its quarterly dividend 2.8% over the previous period and offers its shareholders a 2.2% dividend yield.

Chubb’s current quarterly dividend hike marks the company’s 25th consecutive year of raising its total annual dividend payout. In addition to boosting its dividend for decades, the company’s share price has also grown over that period with only a few pullbacks. During the 2008 financial crisis, the company’s share price dropped more than 50% between September 2008 and March 2009. However, the share price had been on an uninterrupted uptrend since that decline until the share price started declining again in February 2018.

The company continues to post positive financial results and boosting dividends. Therefore, the current share price pullback could be an opportunity for investors to acquire company’s shares at a discount while starting to receive quarterly dividend payouts with the upcoming distribution. The company will distribute its next round of dividend payments on the July 13, 2018, pay date to all its shareholders of record prior to the June 21, 2018, ex-dividend date.

Chubb Limited (NYSE:CB)

Chubb Limited is a provider of insurance and reinsurance products worldwide. The company’s insurance arm traces its origins to 1882, when Thomas Caldecot Chubb opened a marine underwriting business in New York City. ACE Limited acquired the Chubb Corporation in January 2016 and created the world’s largest publicly traded property and casualty insurance company. Following the merger, the company decided to operate the new entity under the established Chubb brand name. With operations in 54 countries and territories, Chubb provides commercial and personal property and casualty insurance, personal accident and supplemental health insurance, reinsurance and life insurance to a diverse group of clients. The company has almost $170 billion in assets and wrote $36 billion of gross premiums in 2017. Chubb’s United States operations accounted for 64% of those premiums in 2017. Adding Canada and Bermuda raises the North American segment’s share of total premiums to 69%. The Europe/Eurasia & Africa segments accounted for 13%, Asia for 10% and Latin America came in at 8% of premium based on 2017 figures. In addition to its global headquarters in Zurich, Switzerland, the company maintains multiple executive offices, including New York, Tokyo and London.

The company’s share price has been on a steady uptrend for nearly a decade and started its current 12-month period with a 7.2% ascend towards its 52-week high of $156.15, which it reached on January 31, 2018. After peaking at the end of January, the share price declined nearly 17% and reached its 52-week low of $129.92 on May 29, 2018. Over the two weeks after bottoming out, the share price recovered nearly 12% of those losses and closed on June 11, 2018, at $133.00. This closing price was 8.7% lower than it was 12 months earlier, but 2.7% higher than the 52-week low from a couple of weeks earlier and 54% higher than it was five years ago.

While its share price struggled in 2018, the company’s dividends continue to rise. The company boosted its quarterly dividend 2.8% from the $0.71 quarterly dividend amount in the previous period to the current $0.73 quarterly dividend payout. This new quarterly dividend amount converts to a $2.92 annualized distribution and a 2.2% forward dividend yield, which is equal to the company’s average yield over the past five years. While trailing behind the 3.06% average yield of the entire Financials sector, Chubb’s current 2.2% yield is 17% above the 1.87% simple average yield of the Property & Casualty Insurance industry segment.

With the current quarterly dividend boost, the company has raised its annual dividend every year for the past 25 consecutive years. The company has doubled its total annual dividend amount since 2010. Over the past two decades, the total annual dividend payout advanced more than 16-fold, which corresponds to an average growth rate of nearly 15% per year.

The dividend income continued to rise over the past year but was unable to overcome the 8.7% share price decline, which resulted in a 5.4% total loss over the past 12 months. However, with the current price 18% below analysts’ target price, the share price could return to its rising trend and contribute towards returning to recent total return levels, such as the 38% total return over the past three years and the 64% total return over the past five years.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic