Citigroup Raises Quarterly Dividend 40% (C)

By: Ned Piplovic,

After resuming dividend distributions in 2011, Citigroup, Inc. (NYSE:C) extended three years of dividend hikes with a 40% dividend hike to its upcoming quarterly dividend distribution.

The company started paying dividend distributions in 1986 and hiked its annual dividend for more than two decades before the 2008 financial crisis. From the $5.40 quarterly dividend paid in the last quarter of 2017, the company cut its quarterly dividend amount more than 98% prior to the $0.10 dividend distribution for the first quarter of 2009, after which Citigroup suspended dividend distributions.

The company resumed its quarterly dividend distributions in the second quarter of 2011 and has grown its dividend distributions 45-fold over the past seven years, which corresponds to an average growth rate of almost 80% per year. However, the dividend growth is even more impressive because the company paid a symbolic $0.01 quarterly dividend for 16 consecutive periods after resuming dividend payouts in the second quarter of 2011. Essentially, the company achieved the 45-fold dividend increase over the past four years.

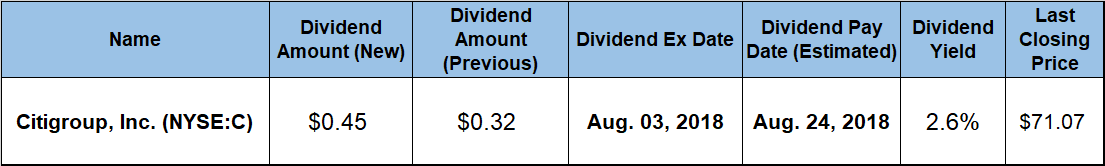

While experiencing more volatility and advancing at a slower pace in 2018 than it did in the previous two years, the company’s share price still posted a positive result over the past 12 months. The company will distribute its next dividend to all its shareholders of record before the August 3, 2018, ex-dividend date just three weeks later on its August 24, 2018, pay date.

Citigroup, Inc. (NYSE:C)

Based in New York, New York, and founded in 1912, Citigroup, Inc. is a diversified financial services holding company that provides various financial products and services for consumers, corporations, governments and institutions. The company operates through two segments, Global Consumer Banking (GCB) and Institutional Clients Group (ICG). The GCB segment offers traditional banking services to retail customers through retail banking, commercial banking, Citi-branded cards and Citi retail services. Additionally, this segment provides various banking, credit card lending and investment services through a network of local branches, offices and electronic delivery systems. The ICG segment provides wholesale banking products and services, including fixed income, equities sales and trading, foreign exchange, prime brokerage, derivative services, equity and fixed income research. In addition to these services, this segment also offers corporate lending, investment banking and advisory services, private banking, cash management, trade finance and securities services to corporate, institutional, public sector and high-net-worth clients.

By February 2009, the company’s share price had lost more than 93% of its value during the 2008 financial crisis. The share price has been recovering and has gained more than 370% since the beginning of 2009. Just during 2016 and 2017, the share price doubled its value. However, after gaining more than 21% in the first half of the trailing 12 months and peaking at $80.08 on January 26, 2018, the share price reversed its rising trend and declined 18.3% before reaching its 52-week low of $65.46 on June 26, 2018. After bottoming out in late June 2018, the share price ascended 8.6% towards its $71.07 closing price on July 24, 2018. While still 11% below the January peak, the $71.07 closing price was 7.5% higher than it was 12 months earlier and 34% higher than it was five years ago.

The company boosted its quarterly dividend amount 40.6% from $0.32 in the previous period to the current $0.45 quarterly distribution. This new quarterly dividend payout corresponds to a $1.80 annualized amount and yields 2.6%, which is significantly than the 0.7% average yield over the past five years. Citigroup increased its annual dividend 45-fold over the past four years, which is equivalent to an average growth rate of nearly 160% per year.

While slightly below the 3.04% average yield of the entire Financials sector, Citigroup’s current 2.6% dividend yield is almost 27% above the simple average yield of all the companies in the Money Center Banks industry segment, Additionally, the company’s current yield is just a fraction below the 2.7% average yield of only dividend-paying companies in the segment.

The moderate share price appreciation combined with the rising dividend income to reward the company’s shareholders with a 9% total return on investment over the past 12 months. The total return was more than 21% for the last three-year period and 38% over the past five years.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic