City Holding Company Boosts Quarterly Dividend Distributions 15% (CHCO)

By: Ned Piplovic,

City Holding Company (NASDAQ:CHCO) — a Mid-Atlantic regional bank holding company — offers its shareholders a moderate asset appreciation to complement the company’s steadily rising dividend distributions.

Following a dividend suspension in 2001, the company resumed paying rising dividenddistributions in 2002. In addition to its steady dividend distributions growth, the company also provided its shareholders with a reliable asset appreciation since the share price dropped more than 50% during the 2008 financial crisis.

While many of its peers cut their dividend distributions in the aftermath of the 2008 financial crisis, City Holding Company managed to just pause its annual dividend distribution hikes. The company paid a flat annual dividend from 2009 to 2011 and resumed dividend hikes in 2012. The bank’s solid business fundamentals allowed the company to withstand the crisis turmoil with minimal impact. For instance, while the average charge-offs for the entire industry exceeded 2.5% in 2010, City Holding Company’s charge-offs were below 0.5%. While the industry average declined to the 0.5% level by the end of 2017, City Holding Company reduced its charge-offs to less than 0.2% for the same time frame and is trending closer to 0% in 2018.

The company’s current dividend payout ratio of 46% is a little higher than optimal but still within sustainable range. This payout ratio indicates that the company’s dividend distributions are well covered by earnings. The company currently pays slightly less than half of its earnings as dividend distributions, which is nearly identical to its 47% payout ratio average over the past five years. Based on projected earnings for the remainder of 2018, the company expects to lower its dividend payout ratio to 37% by the end of the year.

Smaller regional banks, like City Holding Company, offer investors interested in the Financials sector an opportunity for exposure to the sector with lower risk than investing in major, multinational banking organizations that carry significant risk exposure from derivatives and other complex investment vehicles.

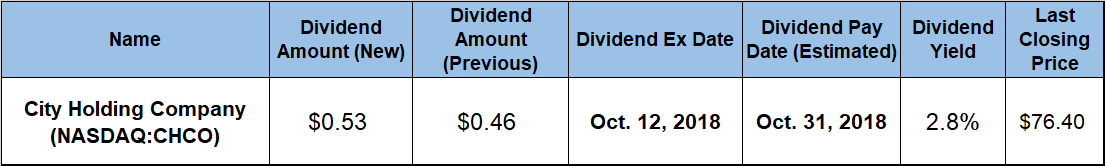

Investors interested in dividend income as well as value investing should do their research and consider taking a position in CHCO’s stock prior to the company’s ex-dividend date on October 12, 2018. Claiming shareholder of record status before this ex-dividend date will ensure eligibility for the next round of dividend distributions on the October 2018, pay date.

City Holding Company (NASDAQ:CHCO)

Headquartered in Charleston, West Virginia and founded 1957, City Holding Company operates as a holding company for City National Bank of West Virginia. The bank provides standard money deposit products, loans and investment services. As of September 2018, the company operated a network of 86 banking locations in West Virginia, Kentucky, Virginia and Ohio, as well as remote banking services through online banking, mobile banking and a network of automated teller machines (ATMs).

The company’s upcoming $0.53 dividend payout is 15.2% higher than the $0.46 amount from the previous quarter. This new payout amount corresponds to a 2.8% dividend yield. However, this yield is slightly below the company’s own five year-average yield of 3% because of the share price’s recent growth, which suppressed the current yield.

Over the past seven years of consecutive dividend hikes, the company raised its annual dividend payout 56%, which is equivalent to an average annual growth rate of 6.5%. Furthermore, even with the two missed annual dividend hikes in 2010 and 2011, the bank’s total annual dividend payout advanced more than 250% since 2012, which converts to an average growth rate of 8.2% per year over the past 16 years.

Compared to the 1.67% average yield of all the companies in the Mid-Atlantic Regional Banks industry segment, CHCO’s current yield is 66% higher. The banks current 2.8% yield even outperforms the 2.22% average yield of the segments only dividend-paying companies by 25%.

After hitting a 52-week low of $65.03 on February 5, 2018, the company’s share price advanced more than 27% before reaching a 52-week high of $82.79 on August 22, 2018. The share price closed on October 3, 2018 at $76.40, which was 6.3% higher than one year ago, 17.5% above the February low and more than 70% higher than it was five years ago.

The share-price ascent, combined with the rising dividend, result in an 8.25% total return over the past 12 months. Furthermore, Shareholders enjoyed a 70% total return over the past three years and doubled their investment over the five-year period.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic