Cohen & Steers, Inc. Offers Shareholders 3.3% Dividend Yield (CNS)

By: Ned Piplovic,

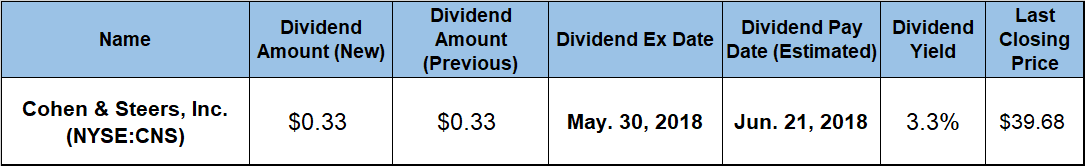

Cohen & Steers, Inc. (NYSE:CNS) has boosted its annual dividend for nearly a decade and currently offers its shareholders a 3.3% dividend yield.

While the company has been growing its dividends steadily, the share price exhibited significant volatility over the past few years. Just over the past 12 months, the share price experienced a 20% rise in the second half of 2017 and a 20% drop at the beginning of 2018.

However, the share price recovered for a slight gain for the year and combined with the company’s dividend income for a total return of nearly 8% over the past 12 months. The company’s next ex-dividend date will occur on May 30, 2018, and Cohen & Steers will distribute its next dividend payout on the June 21, 2018, pay date to all its shareholders of record prior to the ex-dividend date.

Cohen & Steers, Inc. (NYSE:CNS)

Based in New York, New York, and founded in 1986, Cohen & Steers, Inc. is a publicly owned asset management holding company. As a global investment manager, the company specializes in liquid real assets, including real estate securities, listed infrastructure, commodities and natural resource equities, as well as preferred securities and other income solutions. Through its subsidiaries, the company provides services to institutional investors, including pension funds, endowments and foundations. Additionally, the firm manages separate client-focused equity, fixed income, multi-asset and commodity portfolios through its subsidiaries. In addition to its New York City headquarters, the company has additional offices in London, Hong Kong, Tokyo and Seattle.

The share price opened its trailing 12-month period with a brief rise and then a drop to its 52-week low of $37.16 on September 5, 2017, for a total decline of 4.5% over the first four months of the trailing 12 months. After bottoming out in early September, the share price reversed direction and ascended more than 28% before reaching its 52-week high of $47.67 by December 28, 2017. However, that level was short lived as the share price reversed direction again and plummeted 20% over the following five weeks to close on February 5, 2018, just 3% above the 52-week low of $38.33 in September 2017.

Following that drop, the share price embarked on yet another uptrend and reached the price level from the beginning of the trailing 12-month — mid-May 2017 to the end of April 2018. The share price continued to rise and closed on May 16 at $39.68, which was just 2% higher than it was 12 months earlier, but nearly 7% above the 52-week low price from September 2017.

The company’s current $0.33 quarterly dividend payout is nearly 18% higher than the $0.28 distribution from the same period last year. This new quarterly distribution amount converts to $1.32 annualized for 2018 and a 3.3% forward dividend yield, which is 5% higher than the 3.17% simple average yield of all the companies in the Financials sector.

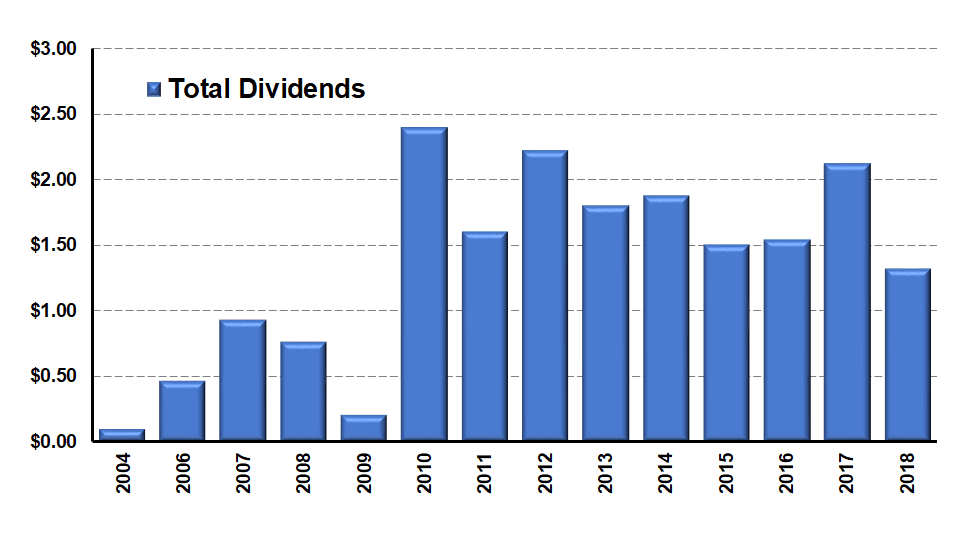

Looking at the company’s dividend payout history could be somewhat misleading and might dissuade investors from considering Cohen & Steers as a viable portfolio addition. The graph below shows the total dividend payout by year since the company started paying dividends in 2004.

The initial impression is that the company does not have a steady dividend growth policy and that its financial performance might be questionable. The graph indicates that the company might have cut its annual dividend six times over the past 13 years and never had a rising dividend streak longer than two consecutive years. Based on this information, almost all investors might skip this equity and look for dividend income elsewhere.

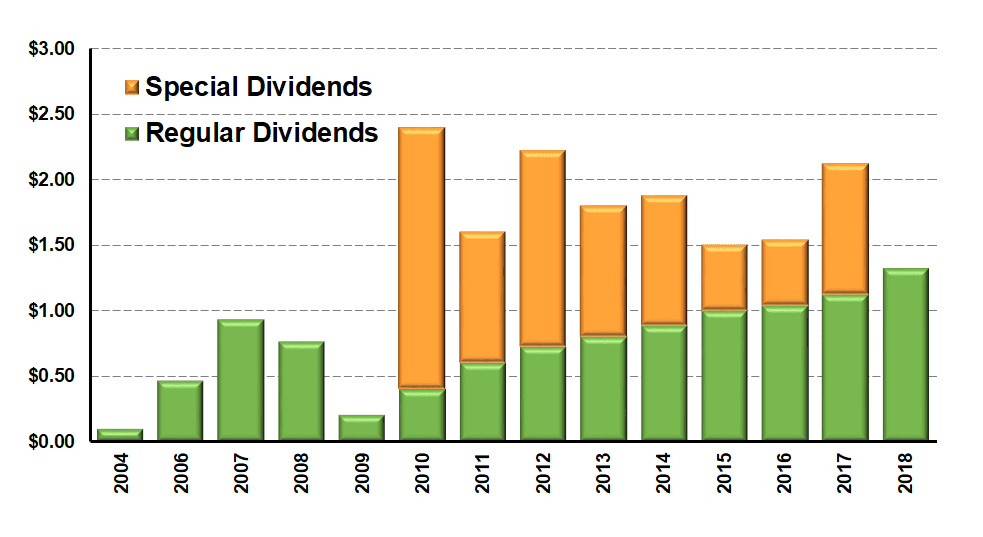

However, if we separate the company’s regular dividends from the special dividend distributions, the picture changes dramatically. The graph below shows the same information as the graph above, but the special dividends are a separate category shown on top of the company’s regular dividend payouts.

This representation of the data shows just two annual dividend cuts in 2008 and 2009. Technically, this is just one dividend cut of the quarterly payout from $0.22 to $0.05 in late 2008. Additionally, the second graph immediately above also shows a current rising dividend streak over the past nine consecutive years.

Over those nine years, the company advanced its total regular dividend payout 560% by growing its annual dividend at an average rate of 23.3% per year. The marginal share price increase and the dividend distribution over the past year combined for a total return of nearly 8%. The total return over the past three years was almost 20%.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions, dividend yield increases and other dividend yield changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic