Compass Diversified Holdings Rewards Shareholders with 8% Dividend Yield (CODI)

By: Ned Piplovic,

Featured Image Source: June 2018 Investor Presentation

Compass Diversified Holdings LLC (NYSE:CODI) offers investors a steady dividend income stream and a current dividend yield of 8%.

The share price experienced a drop of more than 17% between its peak in October 2017 and its 52-week low in April 2018. However, the share price recovered nearly all those losses and is currently trading just 2% below its peak levels.

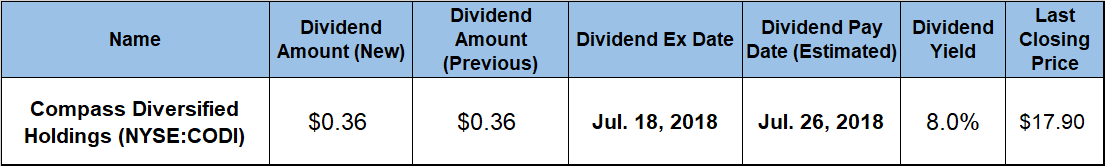

Investors seeking equities with high-dividend income, as well as potential asset appreciation, should do their due diligence take a position prior to the company’s next ex-dividend date on July 18, 2018, to ensure eligibility for the next round of dividend distributions set for July 26, 2018, pay date.

Compass Diversified Holdings LLC (NYSE:CODI)

Based in Westport, Connecticut, and founded in 2005, Compass Diversified Holdings LLC is a private equity firm specializing in acquisitions, buyouts, industry consolidation, recapitalization and middle market investments. The company seeks investments in niche industrial or branded consumer companies, manufacturing, distribution, consumer products and business services sectors. Compass prefers investment transactions in the $75 million to $700 million range and invests in consumer companies headquartered in North America that have positive and stable annual earnings before interest, taxes, depreciation and amortization (EBITDA) of at least $10 million. Additionally, the firm looks for companies in industries with favorable long-term macroeconomic trends, with strong management teams and in highly defensible positions in their markets and with their customers, i.e. where the company’s departure from the market would create a significant market disruption. As of June 2018, the company’s investments included Sterno Products, 5.11, Crossman, Ergobaby, Liberty Safe, Manitoba Harvest, Arnold Magnetic Technologies, Advanced Circuits, Clean Earth and Foam Fabricators. In addition to its Connecticut headquarters, the company has an office in Irvine, California. Compass Group Management LLC is the external manager of the Compass Diversified Holdings LLC and manages the day-to-day business and operations of the firm.

Except for a brief jump during September and October 2017 when the price spiked to its 52-week high of $18.20 on October 17, 2017, the company’s share price traded mostly sideways during the first nine months of the trailing period and dropped to a 52-week low of $15.00 on April 26, 2018. However, after bottoming out in late April, the company ascended more than 19% and closed on July 6, 2018 at $17.90, which was less than 2% below the 52-week high from October 2017. Additionally, that closing price was a little more than 1% higher than it was 12 months earlier and almost even with its price from five years ago.

The company’s current $0.36 quarterly corresponds to a $1.44 annualized dividend payout and an 8% forward dividend yield. Because, the company has been paying this same $1.44 annual dividend amount, the current dividend yield trails the company’s average dividend yield over the past five years by approximately 4%. During the six years prior to the current seven-year streak of flat dividends, the company advanced its annual dividend nearly 120%, which corresponds to an average annual growth rate of nearly 14% per year.

The company’s current dividend yield outperformed the 3.04% average yield of the overall Financials sector by nearly 165% and the 4.62% average yield of its peers in the Diversified Investments industry segment by almost 75%. Furthermore, the company’s current 8% dividend yield is also 38% above the 5.84% average dividend yield of only dividend-paying companies in the segment.

While the dividend income provided the majority of shareholders’ returns, the small asset appreciation contributed to the 11.6% total return over the past 12 months, as well as the 33.3% total return over the last three years. Over the past five years, the total return came in at 43.7%.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic