Crestwood Equity Partners Offers Shareholders Dividend Yield of Nearly 9% (CEQP)

By: Ned Piplovic,

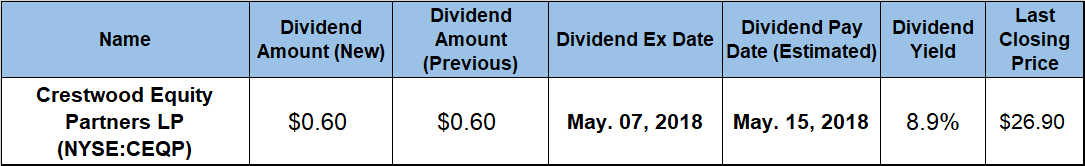

With a current yield of 8.9%, Crestwood Equity Partners LP (NYSE: CEQP) continues to sport an above-average dividend even with a rising share price for the last two years, which generally puts downward pressure on the company’s dividend yield.

While Crestwood paid a rising annual dividend for the entire first decade after its formation in late 2001, a series of mergers and acquisitions that started in 2012 interrupted the streak. Because of the significant organizational and operational changes over that period, the company’s share price dropped from more than $153 in July 2014 to approximately $8 by the end of February 2016. However, the share price has more than tripled since then and the company has paid a steady dividend — technically a ‘distribution’ — over the past nine consecutive quarters. Crestwood provides a stable flow of distributions income and the share price continues its slow, but steady, growth regardless of overall market volatility.

Investors interested in adding shares — or units, as this is a partnership — to their portfolio should complete their own due diligence and take action prior to the company’s upcoming ex-dividend date, which will occur for this period on May 7, 2018. The company will distribute the next dividend payments on May 15, 2018.

Crestwood Equity Partners LP (NYSE: CEQP)

Headquartered in Houston, Texas, and founded in 2001, Crestwood Equity Partners LP provides infrastructure solutions to liquids-rich natural gas and crude oil shale plays in the United States. The company operates through three business segments. The Gathering and Processing (G&P) segment offers gathering and transportation services for natural gas, crude oil and produced water, as well as processing, treating and compression services. Furthermore, the Storage and Transportation (S&T) segment provides crude oil and natural gas storage and transportation services. Lastly, the company’s Marketing, Supply and Logistics (MS&L) segment provides natural gas liquid (NGL) and crude oil storage, as well as marketing and transportation services. The partnership’s assets are primarily in the Marcellus Shale, Bakken Shale, Delaware Permian Basin, Powder River Basin Niobrara Shale, Barnett Shale and Fayetteville Shale.

The company’s share price has been on an overall uptrend with minimal volatility since February 2016. Since then, the share price has ascended more than 230%. While the overall growth in the past 12 months is not quite as extraordinary, it continues at the same pace that generated the compounded price increase over the past few years.

At the onset of the current 12-month period, the share price initially dropped by more than 20% and reached its 52-week low of $20.00 on June 21, 2017. However, after bottoming out in June 2017, the share price reversed direction, recovered all its losses by early December 2017 and continued to rise for a total gain of 46% before peaking at $29.25 on January 26, 2018. Since the January peak, CEQP shares have fluctuated with the overall market volatility and fell to $26.90 as of the April 25, 2018 close, which was 9% lower than the peak price. However, that price was also 6% higher than it was 12 months earlier and 34% above the 52-week low from June 2017.

As mentioned earlier, a series of mergers and and acquisitions interrupted the company’s rising dividend payments, and the amount fluctuated significantly between 2012 and 2016 while the company integrated several acquired companies into its operation. However, the company performed a reverse 10:1 stock split in November 2011 and has distributed a steady $0.60 quarterly dividend yield over the past nine consecutive quarters. The $0.60 quarterly payout converts to a $2.40 annualized payout and a current yield of 8.9%.

Crestwood’s current dividend yield outperforms the 2.5% simple average yield of the entire Basic Materials sector by more than 255% and the 4.35% average yield of all the companies in the Oil & Gas Refining & Marketing segment by 105%. Additionally, Crestwood Equity Partners’ current yield is also 55% above the 5.75% average yield of only dividend-paying companies in the segment.

Unfortunately, the steep share price decline between July 2014 and February 2016 eliminated any benefits from dividend income distributions over the past three and five years. However, with the consistent share price growth over the past two years, the company rewarded its shareholders with a total return of almost 20% over the past 12 months.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic