CyrusOne Offers Shareholders Five Years of Rising Annual Dividends, 3.2% Dividend Yield (CONE)

By: Ned Piplovic,

Since initiating dividend payments in 2013, CyrusOne Inc. (NASDAQ: CONE), a real estate investment trust, has boosted its dividend distribution amount in the second quarter of every consecutive year and currently offers a 3.2% dividend yield.

CyrusOne’s current yield is higher than the company’s own five-year average and outperforms the average yields of its industry peers.

In late 2017, the company’s stock experienced its second decline of more than 15%, but a rising trend since March 2018 has erased most of the losses since the beginning of the year. As of June 14, 2018, more than half of the analysts covering CONE have a “Buy” recommendation on the stock, with another 30% of analysts giving it a “Strong Buy” recommendation. The analysts’ average target price of $64 means the stock has potentially another 10% upward space in which to run.

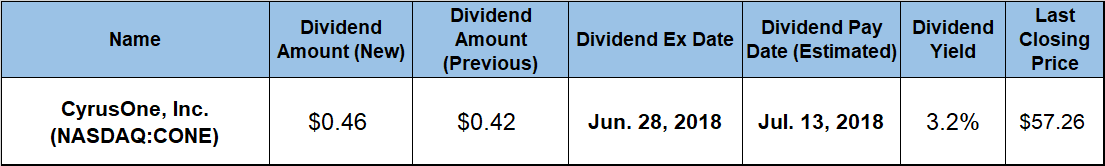

CyrusOne will distribute its next dividend on the July 13, 2018 pay date to all shareholders of record before the June 28, 2018 ex-dividend date.

CyrusOne, Inc. (NASDAQ:CONE)

Founded in 2001 and headquartered in Dallas, Texas, CyrusOne, Inc. is a REIT that specializes in enterprise-class, carrier-neutral data center properties. The company provides mission-critical data center facilities that protect and ensure the continued operation of information technology (IT) infrastructure for approximately 1,000 customers, including 200 of the Fortune 1000 companies. As of May 2018, the company operated 33 data centers in the United States, four facilities in China, one facility in Singapore and one facility in the United Kingdom.

Currently, the company’s focus is on adding additional facilities in London, with plans to establish multiple new facilities in Frankfurt, Dublin and Amsterdam. The company announced on June 5 the acquisition of nearly 70 acres of land near Phoenix for the development of five data center buildings, which will be the company’s second major data center in Arizona. CyrusOne has been trading publicly on the NASDAQ exchange since 2013.

Last year at this time, CONE paid out a $0.42 dividend distribution, so the new $0.46 per share quarterly payout is about 9.5% higher. Going forward, this amount translates to $1.84 on an annual basis, and at current prices, a forward dividend yield of 3.2%. This new dividend yield is 10% above the company’s 2.9% average dividend yield since 2013, when it started paying dividends. Over those five years, CyrusOne advanced its total annual payout nearly three-fold, which corresponds to an average growth rate of 23.5% per year.

CONE embarked on a big uptrend in November of 2016 that lasted about 10 months until September 2017. During this time, the share price climbed 65% to a high of $65.73. However, the stock lost nearly half of its recent gains by the end of February 2018, falling to 52-week low of $43.49. As a result, the 50-day moving average (MA) dropped below the 200-day MA.

While the price of CONE’s shares rallied over 30% from their low to close on June 19, 2018 at $57.26, the 50-day MA is still flying below its counterpart, though it obviously is now on a rising trend thanks to the share price jump.

CONE’s latest closing price puts the stock about 12% below the 52-week high from September 2017. Over a one-year period, the stock price is marginally lower than this time last year, but including dividend payments actually makes it positive for the year.

If dividend income over the last year is counted, CONE’s total return on shareholder investment over the last 52 weeks was 1.6%. However, taking a slightly longer look at the level of return can give us a better idea of what shareholders might expect if the stock’s uptrend continues: roughly 100% total return over three years and triple the initial investment over the past five years.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic