Delta Airlines Hikes Quarterly Dividend Nearly 15% (DAL)

By: Ned Piplovic,

Delta Air Lines, Inc. (NYSE:DAL) continued its current five-year streak of annual dividendboosts with a quarterly dividend hike of nearly 15%.

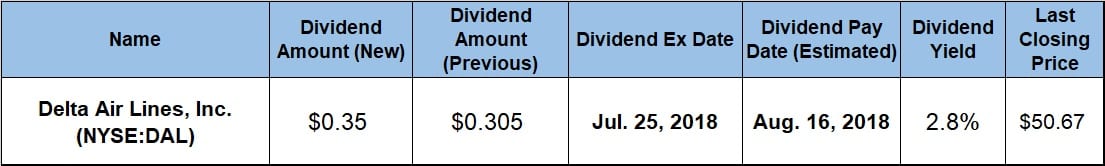

The company’s share price experienced some volatility and declined along with the overall market pullback since January 2018. However, the share price has been gaining again in July and the current price level could be an opportunity for investors to take a long position at discounted share prices and enjoy a 2.8% dividend yield.

Investors convinced that the share price will continue its current short-term rising trend, should conduct their research and take a position before the company’s next ex-dividend date on July 25, 2018, to ensure eligibility for the next round of dividend distributions on the August 16, 2018, pay date.

Delta Air Lines, Inc. (NYSE:DAL)

Headquartered in Atlanta, Georgia, and founded in 1924, Delta Air Lines, Inc. provides scheduled air transportation for passengers and cargo internationally. Delta Air Lines serves more than 180 million customers each year. Through its global network, Delta and the Delta Connection carriers offered service to 324 destinations in 57 countries and operated a fleet of more than 800 aircraft as of March 31, 2018. The airline is a founding member of the SkyTeam global alliance and participates in the industry’s leading transatlantic joint venture with Air France-KLM and Alitalia, as well as a joint venture with Virgin Atlantic. Including its worldwide alliance partners, Delta offers customers more than 15,000 daily flights and services 661 locations in 127 countries. The company’s key hubs and markets are Amsterdam, Atlanta, Boston, Detroit, Los Angeles, Mexico City, Minneapolis/St. Paul, New York-JFK and LaGuardia, London-Heathrow, Paris-Charles de Gaulle, Salt Lake City, São Paulo, Seattle, Seoul and Tokyo-Narita. The company generated more than $3.5 billion in net income from total revenue of more than $41 billion.

The company’s share price started the trailing 12-month period with a month-long decline of more than 17% towards its 52-week low of $45.21, which it reached on August 24, 2017. After bottoming out in late August 2017, the share price reversed its trend and gained a third of its value between its 52-week low and its peak price of $60.13 on January 22, 2018.

Following the January peak, the share price reversed direction and gave back all its gains over the past 12 months to close on July 16, 2018, at $50.67, which was more than 7% below its July 2017 level and more than 15% lower than the January 2018 peak. However, the July 16, 2018, closing price was 12.1% above the 52-week low from August 2017 and 130% higher than it was five years ago. Additionally, the share price has been rallying back lately and has gained nearly 4% since the beginning of July 2018.

The company has boosted its quarterly dividend at least once every year since introducing dividend distributions in 2013. Over that period, the quarterly dividend payout amount rose almost six-fold, which is equivalent to an average growth rate of more than 42% per year.

The current $0.35 quarterly dividend amount is 14.8% higher than the previous period’s $0.305 dividend distribution. This new quarterly dividend amount corresponds to a $1.40 annualized payout and currently yields nearly 2.8%, which is more than twice the company’s 1.3% average yield over the past five years.

Additionally, Delta Air Lines has currently the second highest dividend yield among its peers. Compared to the 1.92% average yield of the entire Services sector, DAL’s current dividend yield is almost 44% higher and 115% above the 1.28% average yield of the Airlines industry segment. Disregarding the companies that do not distribute dividends raises the average yield of the segment to 1.93%. This yield is nearly identical to the Services sector’s average yield and makes the company’s current yield nearly 44% higher than the average yield of only dividend-paying companies in the segment.

The company’s rising dividend income distribution managed to offset some of the share price decline and limited the total loss over the past 12 months to less than 4%. However, if the share price extends its current short-term trend, the shareholders could enjoy again returns similar to the 24% total return over the past three years or the total return over the past five years, which exceeded 180%.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic