Dividend Aristocrat Johnson & Johnson Rewards Investors with 7.1% Quarterly Dividend Boost (JNJ)

By: Ned Piplovic,

Johnson & Johnson (NYSE:JNJ) improved its streak of annual dividend boosts to 56 consecutive years with its most recent quarterly dividend hike of 7.1%.

The dividend aristocrats moniker refers to S&P 500 companies with a minimum market capitalization of $3 billion and at least 25 years of consecutive dividend boosts. Currently, only 51 companies hold the Dividend Aristocrat distinction and, within that group, only six companies have streaks longer than Johnson & Johnson’s current record of 56 consecutive years.

In addition to the long trend of rising dividends, the company has a record of long-term asset appreciation. Therefore, a recent share-price drop could be an opportunity to add JNJ shares at a discounted price. Technical indicators still are pointing to a possible further share price decline. Therefore, interested investors should conduct their own research to evaluate the company’s fundamentals to determine whether to purchase shares.

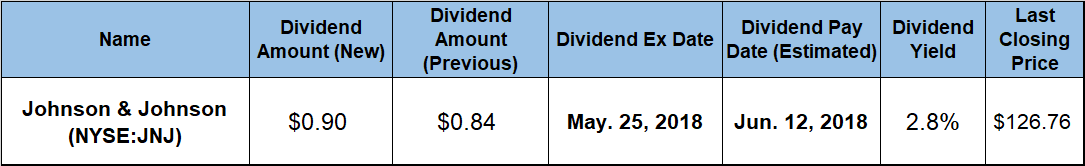

Additionally, the timing of the next dividend income distribution might be another deciding factor for some investors. The company will distribute its next quarterly dividend on June 12, 2018, to all eligible shareholders. In this case, eligible shareholders will be all shareholders of record as of May 24, 2018, which is one day before the company’s next ex-dividend date on May 25, 2018.

Johnson & Johnson (NYSE:JNJ)

Founded in 1885 and headquartered in New Brunswick, New Jersey, Johnson & Johnson researches, develops, manufactures and sells health care products worldwide. The company operates through three segments: Consumer, Pharmaceutical and Medical Devices. The Consumer segment offers baby care, oral care, women’s health products and beauty products under multiple brands, which include Johnson’s, Listerine, Clean & Clear, Stayfree, Carefree, Band-Aid, Neosporin, Neutrogena and more. Additionally, the company manufactures and distributes Tylenol, Sudafed, Benadryl, Zyrtec, Motrin IB, Pepcid and other over-the-counter medicines. Through its Pharmaceutical segment, the company offers various products in the areas of immunology, infectious diseases and vaccines, neuroscience, oncology, cardiovascular and metabolic diseases. The Medical Devices segment provides orthopedic, general surgery, sterilization and disinfection and electrophysiology products, as well as disposable contact lenses.

The company boosted its quarterly dividend payout 7.1% from the $0.84 amount in the previous period to the current $0.90 quarterly dividend distribution. This new quarterly dividend amount is equivalent to a $3.60 annualized payout for 2018 and a 2.9% forward dividend yield. Compared to JNJ’s own 2.6% average yield over the past five years, the company’s current yield is nearly 10% higher. However, JNJ’s current 2.9% yield is more than 300% above the 0.7% average yield of the overall Health Care sector and nearly 26% higher than the simple average of all the companies in the Drug Manufacturers market segment.

Over the past two decades, JNJ enhanced its annual dividend amount 860% by maintaining an average growth rate of 12% per year. The annual dividend increase rate has dropped in the more recent years and averages 66% over the past five years.

Prior to 2018, the share price has been rising steadily for nearly a decade since the 2008 financial crisis and experienced just two pullbacks of more than 10% in that period. The share price carried that momentum into the trailing 12 months (TTM). From the beginning of the TTM in mid-May 217, the share price gained nearly 17% and closed at its 52-week high of $148.14 on January 22, 2018.

However, after the overall markets started to experience some volatility on fears of rising inflation and interest rates, as well as potential tariffs on imported goods, Johnson & Johnson’s share price reversed its rising trend. The share price lost 17.2% from its January peak and closed at its 52-week low of $122.64 on May 8, 2018.

After its 52-week low in early May, the share price recovered some of its losses and closed on May 14, 2018, at $126.05, which was within 1% from the share price one year earlier. At its January peak, the share price was trending more than 70% higher over the past five years. However, the recent price drop reduced that five-year growth to 45%.

The company’s recent share price decline reduced the total return over the past year to just the 6.7% provided by the dividend income. However, over the past three years the company rewarded its shareholders with a 36.3% total return and a 67% total return over the past five years.

Related Articles:

5 Best Dividend Aristocrats to Buy Now

The Dividend Aristocrats Investing Strategy and Stocks List

The Best Dividend Aristocrats ETFs

Why Invest in the Dividend Aristocrats?

The S&P 500 Dividend Aristocrats — Everything You Need to Know

What are the Dividend Aristocrats?

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic