Dividend Aristocrat W. W. Grainger Boosts Quarterly Dividend 6% (NYSE:GWW)

By: Ned Piplovic,

Featured Image Source: Grainger 2019 FactSheet

Continuing its long streak of consecutive annual dividend hikes, W. W. Grainger Inc. (NYSE:GWW) rewarded its shareholders with another dividend income boost by raising its quarterly dividend payout nearly 6% in 2019.

Already a dividend aristocrat for more than two decades, the current dividend boost brought Grainger one step closer to another important designation — a Dividend King. In addition to meeting certain liquidity and daily trading volume minimum requirements, Dividend Aristocrats are S&P 500 components that must have a market capitalization must exceed $3 billion and must have a streak of at least 25 consecutive years of regular annual dividend hikes.

Currently, only 57 S&P 500 companies meet all requirements to qualify for the Dividend Aristocrat title. Furthermore, the Dividend Kings are even more exclusive that the Aristocrats group. To earn the Dividend King designation, companies must maintain all the Aristocrat-level requirements and hike annual dividend payouts for at least 50 consecutive years. Grainger is only three years away from qualifying for that honor. If Grainger manages to extend its current streak three more years, it will join the exclusive group that currently comprises just 13 companies.

However, in three years, the Dividend Kings group could be substantially bigger. The Sysco Corporation (NYSE:SYY) will be able to claim Dividend King status after its next dividend boost and four other companies — Becton-Dickinson & Company (NYSE:BDX), Leggett & Platt, Inc. (NYSE:LEG), PPG Industries, Inc. (NYSE:PPG) and the Target Corporation (NYSE:TGT) — have the same 47-year streak as Grainger and could become eligible for the King title in three years as well.

While W.W. Grainger continues its dividend income ascent, the company’s share price has experienced extreme fluctuations over the past few years. After surging nearly 130% between mid-2017 and mid-2018, the share price has been pulling back towards its long-term growth trend. Despite a 27% decline from its all-time high of nearly $370, the share price has advanced more than four-fold above its 10-year low that occurred in March 2009 as a consequence of the 2008 financial crisis.

W. W. Grainger Inc. (NYSE:GWW)

Based in Lake Forest, Illinois, and founded in 1927, W.W. Grainger, Inc. distributes maintenance, repair and operating (MRO) products and services in the United States, Canada and some international markets. The company provides material handling equipment, safety and security supplies, lighting and electrical products, power and hand tools, pumps and plumbing supplies, cleaning and maintenance supplies, and metalworking tools, as well as gloves, ladders, motors and janitorial supplies. W.W. Grainger also offers inventory management and technical support services. In addition to traditional channels, the company has been pushing for the efficiency and cost effectiveness of e-commerce ordering. In 2018, more than 70% of all orders in the U.S. originated through the company’s digital channels in 2018.

The United States represents more than half of Grainger’s operation in almost every aspect, including total revenues, market share and number of customers, as well as number of branches and distribution facilities. Grainger’s total U.S. operation comprises of several brands and subsidiaries — Grainger Industrial Supply, E&R Industrial, Zoro U.S. and Imperial Supplies. Japan is Grainger’s second largest market. In addition to the United States, the company’s Western hemisphere operations extend to Canada, Mexico and Puerto Rico. Furthermore, the largest European presence is in the United Kingdom and Germany. Lastly, the Fabory subsidiary brand covers the additional European markets in Belgium, Czech Republic, France, Hungary, The Netherlands, Poland, Portugal, Romania, Slovakia and Spain.

Share Price

As part of fluctuations over the past five years, the share price entered the trailing 12-month period riding an uptrend that began in August 2017. At the tail end of that uptrend, the share price gained nearly 21% before peaking at its all-time high of $369.15 on August 21, 2018. However, the steep rise over the previous year drove the price to unsustainable levels. The uptrend reversed course and the stock began its downtrend towards more-sustainable levels.

By May 24, 2019, the share price had given back 30% of its value from the all-time high in August 2018 and closed at $258.56. After bottoming out in late May, the share price showed signed of mild recovery and advance a few percentage points to close at the end of trading on July 9, 2018, at $266.69. While still nearly 28% below the all-time high and 12.6% lower than one year earlier, the July 9 closing price was 3.1% higher than the 52-week low from late May, as well as 11% higher than it was five years ago.

Dividends

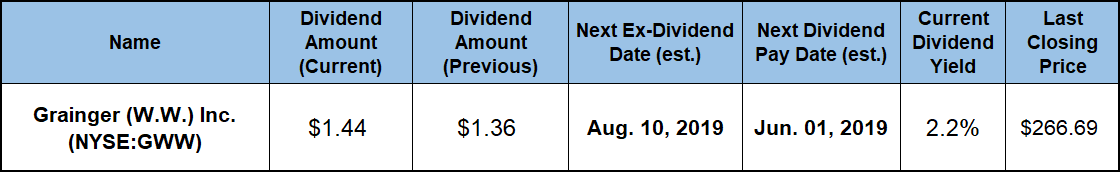

The most recent boost lifted the dividend distribution amount 5.9% from $1.36 in the previous period to the current $1.44 quarterly payout. This new payout corresponds to a $5.76 annualized distribution and a 2.2% forward dividend yield, which is 3.3% higher than the company’s own 2.09% five-year yield average. Furthermore, Grainer’s current yield is nearly 2% higher than the 2.12% average yield of the overall Services sector.

Grainger initiated dividend distributions in 1965 and started its current consecutive dividends streak shortly after, in 1972. Just over the past two decades, Grainger has enhanced its total annual dividend payout nine-fold. This advancement pace is equivalent to an 11.6% average annual growth rate. Even over the past five years, the company still maintained an average dividend growth rate of 7.4%.

The rising dividend income distributions offset some of the share price decline to limit the total loss below 11% over the past 12 months. The five-year total returns were slightly positive at nearly 17% and the shareholders received a 22.5% total return over the past three years.

However, instead of looking at past performances, investors might consider the Grainger stock because of access to a rising dividend distribution and discounted price. Grainger will distribute its next round of dividends on the September 1, 2019, pay date to all shareholders of record prior to the ex-dividend date, which should occur on or around August 10, 2019.

Related Articles:

5 Best Dividend Aristocrats to Buy Now

The Dividend Aristocrats Investing Strategy and Stocks List

The Best Dividend Aristocrats ETFs

Why Invest in the Dividend Aristocrats?

The S&P 500 Dividend Aristocrats — Everything You Need to Know

What are the Dividend Aristocrats?

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic