Dividend Definitions – What is Dividend Record Date?

By: Ned Piplovic,

While most income investors keep close track of a stock’s Ex-Dividend and Pay dates for potentially timing the buying and selling of shares for maximum gains, the Dividend Record Date often gets overlooked.

The dividend record date is crucial for determining ownership of shares, which consequently determines eligibility for receiving any subsequent dividend distribution payouts. However, unlike the ex-dividend date which is a milestone in the dividend ownership process, the dividend record date serves a more administrative function within the dividend timeline.

Most investors will consider an equity’s long-term potential of asset appreciation or prolonged dividend income payouts before deciding to take a long position. Under those circumstances, the dividend dates – such as the dividend record date – are completely irrelevant as they have very little impact over the long-term time horizon.

However, for investors who schedule the buying and selling of securities to maximize their dividend income, mistiming a transaction could result in a missed dividend distribution. Missing a few dividend payouts would mean that the investors would have to wait for the subsequent distribution, which would make the dividend-capture strategy fall short of its optimal goal.

Dividend income investors dedicate considerable resources and time to research and identify the best investments for their individual investment portfolio. Therefore, it is very important to execute trading transactions on a specific schedule to maximize returns.

Understanding dividend dates is more important for investors employing the dividend capture strategy. However, all investors interested in dividend distributions should be familiar with the implications of dividend dates. The long-term investors might not factor the dividend dates into their primary equity selection decision. However, once an investor chooses a specific equity, adjusting the timing of the stock transaction by a day or two could result in an additional dividend distribution.

Key Dates

The four key dates in the dividend distribution timeline are: Declaration Date, Ex-Dividend Date, Record Date and Pay Date.

Before a detailed examination of the dividend record date, here is a basic overview of all four dates.

Declaration Date is the date when the company announces to the public its decision about the upcoming dividend distributions. The dividend declaration announcement generally contains the dividend amount, the remaining three dividend dates and any other pertinent information. The timing of the declaration date is completely arbitrary. While most companies declare dividends for each distribution periods, some companies will make a single declaration for all upcoming dividend distributions over the entire upcoming year. Generally, securities with monthly dividend distributions are more likely to declare all their dividend distributions for the whole year at once. Furthermore, the declaration dates have no timing requirement and can occur a year in advance of the pay date or just a few days prior to the pay date.

Ex-Dividend Date, also known as the ex-date, is the date that determines which investor owns the equity’s shares. All investors who own or purchase shares before the ex-dividend date claim share ownership and eligibility to receive the next round of dividend distribution payouts. For any share sold or bought on the ex-dividend date, the seller is considered the shareowner and will receive the next dividend distribution.

Record Date or Date of Record is the date by which the company paying the dividend must compile a list of all eligible shareholders for the upcoming round of dividend distributions. The record date and the ex-dividend date are the only two of the key dividend dates for which the U.S. Securities and Exchange Commission (SEC) has specific timing requirements. The SEC requirement states that the ex-dividend date occurs two days before the record date.

Pay Date, or Date of Payment, is the date when the company makes the actual dividend distribution payments to the shareholders. On this date, the equity initiates the direct funds transfers to the shareholders’ brokerage accounts or mails out the dividend checks. While the SEC has no specific requirement on the timing for the dividend pay date, most equities set their pay dates between two and four weeks after the dividend record date. The interval between the record date and the pay date affords the company the necessary time to set up the electronic transfer of funds and print the paper checks for mailing to the shareholders who prefer that method of distribution.

Record Date

The record date is the deadline date by which the company must compile the list of all shareholders which are eligible for the next round of dividend distributions. The dividend-eligible shareholders are designated as “shareholders of record.” Effectively, shareholders of record are all shareholders who own shares of the equity before the equity’s ex-dividend date. Because of the SEC’s specific relationship between the record date and the ex-dividend date, the shareholders of record are all shareholders who own shares two days before the record date.

The Settlement Period

United States financial markets currently operate under the T+2 settlement system. The “T” in this expression represent the date on which the trade occurs. Therefore, this current system requires that all trading transactions must be processed and completed in no more than two business days after the trade date.

The speed of transaction processing has improved greatly since the early days of securities trading. While some early trading of debt instruments can be traced to 12th century France and trading of government securities to 13th century Venice, more formalized stock markets did not come into existence in Europe until the 17th and 18th. Because paper transaction records traveled by horse and carriage between exchanges in those times, the settlement intervals were from a couple weeks to more than a month, depending on the distance between the exchange locations. Manual recordkeeping and processing added additional time delays to the settlement period.

However, the settlement interval decreased as the methods of recordkeeping and channels of communication advanced. Once electronic and computerized tracking became reality, the settlement interval decreased significantly to just a few days. The exchanges and brokerages continue to innovate, and the most recent settlement period reduction occurred just a little more than one year ago. In September 2017, the SEC reduced the settlement period by one day from T+3 to the current T+2 interval. To accommodate this new settlement requirement, NASDAQ revised its ex-dividend procedure and redefined the ex-dividend date as “the first business day before the record date.”

Settlement Period Calendar

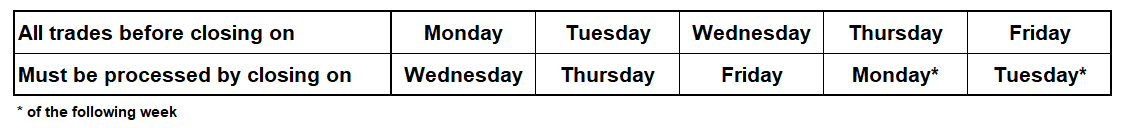

What does the T+2 settlement mean for trading? The trade day plus two days settlement requires that brokers, traders and all other institutions involved in securities trading must process all transaction that occur before closing on Monday no later than the close of trading on Wednesday. Tuesday’s transactions must be processed no later than end of trading on Thursday and Wednesday’s trading most be settled no later than end of trading on Friday.

Thursday’s and Friday’s trades must be settled no later than closing on Monday and Tuesday of the following week, respectively. Saturday and Sunday are not considered “business days.” The same exception applies to bank holidays when they occur on weekdays, which extends the settlement deadline to the next business day. The table below provides an easy summary reference of the regular settlement timing schedule.

The timing of the dividend record date will rarely be a major decision factor in determining an investment strategy. However, investors can adjust their share purchase occasionally by a few days based on the timing of the record date and capture an additional dividend distribution payout. While one or two additional dividend distributions might appear insignificant, compounding even a small amount of additional funds can yield large returns over very long time horizons.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic