Dominion Energy Offers 4.7% Yield, 15 Consecutive Annual Dividend Hikes (D)

By: Ned Piplovic,

Dominion Energy, Inc. (NYSE:D) has been distributing dividends for more than nine decades and has rewarded its shareholders with its current streak of 15 consecutive annual dividend hikes.

Prior to the beginning of the current 15-year streak of annual dividend hikes in 2004, the company paid the same $1.29 annual dividend amount for nearly a decade. The flat dividend payouts started in 1995, when the company switched from distributing its dividends monthly to the current quarterly distribution schedule.

During the first half of 2018, the company’s share price suffered its third-highest percentage decline in the past five decades. The 26% drop between December 2017 and June 2018 trails only share price drops of approximately 36% each in 2002 and 2008. However, while the current share price still has not recovered all its losses from early 2018, it has gained more than 15% since early June 2018 and technical indicators could soon confirm a that the current uptrend could extend through the rest of the year.

The share price decline dropped the combined total returns into the loss territory for the past 12 months. However, a continuation of the current uptrend and a mere 6.3% share price increase would be sufficient to return to the break-even point.

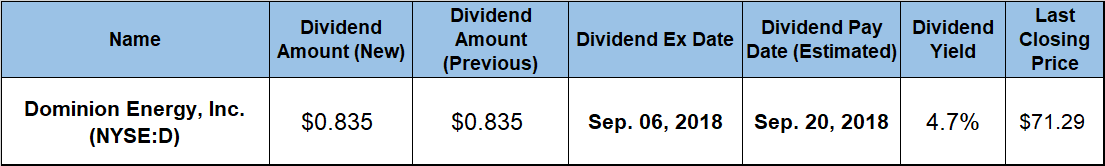

Investors convinced that the recent dip is a buying opportunity and that the share price could continue rising should consider taking a position in Dominion Energy stock before the company’s next ex-dividend date on September 6, 2018. Shareholders of record prior to that ex-dividend date will ensure eligibility to receive the next round of dividend distributions on the September 20, 2018, pay date.

Dominion Energy, Inc. (NYSE:D)

Headquartered in Richmond, Virginia, and founded in 1909, Dominion Energy, Inc. operates as an energy producer and distributor in the United States. The company’s Power Generation segment generates electricity from conventional fuels and renewable resources, Additionally, the company’s Power Delivery segment provides regulated electric transmission and distribution operations to residential, commercial, industrial and government customers. Lastly, the company’s Gas Infrastructure segment offers gathering, processing, storage, pipeline transmission and regulated distribution of gas and liquefied natural gas (LNG). As of August 2018, the company served nearly six million customers in 19 states. Dominion Energy’s assets portfolio included more than 25,000 megawatts of generating capacity and nearly 70,000 miles of electric transmission and distribution lines. The company also owned and operated underground storage systems with approximately 1 trillion cubic feet of natural gas storage capacity and more than 65,000 miles of combined natural gas transmission and distribution pipelines. Formerly known as Dominion Resources, Inc., the company changed its name to Dominion Energy, Inc. in May 2017.

The share price entered the trailing 12-month period on a rising uptrend and continued its upward trajectory to gain 7.5% before reaching the 52-week high of $84.91 on December 15, 2018. After peaking in mid-December 2017, the share price reversed trend and headed downward. Before bottoming out at its 52-week low of $61.75 on June 6, 2018, the share price declined 27.3%.

After the June low, the share price regained more than 40% of its losses from the December peak and closed on August 22, 2018, at $71.29. While that closing price was 9.7% lower than one year earlier and still 16% short of the December 2017 peak, the price was 15.4% above the June low and 22% higher than it was five years earlier.

The current $0.835 quarterly dividend payout is a result of a 9.6% dividend hike over the $0.755 payout from the same period last year. This new quarterly payout’s annualized value of $3.34 yields 4.7%, which is almost 27% higher than the company’s own 3.7% average dividend yield over the past five years. Furthermore, the company’s current 4.7% yield is approximately 85% higher than the 2.5% average yields of the overall Utilities sector and the Electric Utilities industry segment.

Additionally, Dominion Energy’s current yield also outperformed the 2.6% average yield of the Electric Utilities segment’s only dividend-paying companies. Over the past 15 years of consecutive dividend hikes, the company maintained an average annual growth rate of 6.5% and advanced its total annual payout amount nearly 130% over that period.

While short-term investors have to contend with a total loss of nearly 4% over the trailing 12 months, the three-year total return was slightly positive at nearly 7%. However, investors that held a long position over the past five years enjoyed a total return of more than 50%.

Dividend hikes and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic