Edison International Offers Investors 3.6% Yield, 14 Consecutive Annual Dividend Hikes (EIX)

By: Ned Piplovic,

Edison International (NYSE: EIX) — one of the largest investor-owned utilities in the country — has been providing its shareholders with consecutive annual dividend hikes for the past 14 years.

In addition to nearly a decade-and-a-half of annual dividendhikes, the company also enhanced its share price more than three-fold over that period. The dividend hikes and the asset appreciation ensured strong total returns for the company’s shareholders despite occasional pullbacks and three-year dividend suspension from 2001 to 2003.

In the last 10 years, EIX has seen two major dips. During the financial crisis, EIX shares lost more than half their value. The second major dip was in a four-month period between November 2017 and February 2018, where prices dropped almost 30% of their market value

However, after languishing below the 200-day moving average (MA) since early December 2017, the 50-day moving average broke back above it in a bullish manner on Aug. 22. EIX’s share price has continued its uptrend since then and has established a position above both moving averages over the past two weeks.

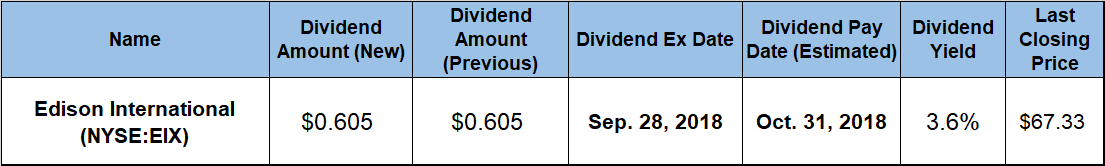

To participate in the next round of dividend distributions, interested investors should take a position prior to the ex-dividend date on September 28, 2018. Doing so will ensure eligibility for the upcoming dividend, which will be paid into shareholder accounts on Oct. 31.

Edison International (NYSE:EIX)

Based in Rosemead, California and founded in 1886, Edison International generates, transmits and distributes electric power, with its operations being based through two divisions. Southern California Edison (SCE) is one of the nation’s largest investor-owned utilities, and the company’s service area includes approximately 430 cities and more than 50,000 square miles in central, coastal and southern California. Through more than five million residential and commercial accounts, the company provides electric power to approximately 15 million people, more than the entire population of Pennsylvania — the fifth most populous state in the U.S. The other division, Edison Energy, is based out of Irvine, California and is an independent advisory and services company for commercial and industrial energy users. Edison Energy helps companies reduce energy costs, improve environmental performance, ensure energy resiliency and manage exposure to energy price risk.

The most recent in the series of EIX’s consecutive dividend hikes increased the quarterly dividend amount 11.4% from the $0.543 quarterly payout during 2017, the $0.605 quarterly distribution for 2018. Based on the historical record of company’s dividend hikes since resuming dividend distributions in 2004, EIX will likely offer another quarterly payout amount bump in December, which will be paid in late January 2019.

A quarterly payout of $0.605 corresponds to a $2.42 annualized payout and a 3.6% forward dividend yield, which is a third higher than the company’s 2.7% average over the past five years. Additionally, the 3.6% yield outperformed the average yield of the overall Utilities sector by about 40%, and the Electric Utilities industry segment yield of 2.61% by a similar amount.

After 14 consecutive annual dividend hikes, the company’s total annual dividend payout amount advanced three-fold, which corresponds to an average growth rate of 8.2% per year. However, that growth rate increased to 12.1% per year over the past five years and 13.6% per year over the past three years.

After dropping almost 30% between its respective 52-week high ($82.64 – Nov. 14) and low ($58.07 – Feb. 8), the share price resumed its long-term uptrend trajectory. In the past seven months, EIX shares have recovered almost 40% of earlier losses, have moved nearly 16% above the 52-week low and closed on September 19, 2018 at $67.33. While still 15% short of the level from one year ago, this closing price is nearly 50% higher than it was five years ago.

The share price decline — which resulted in a total loss of nearly 12% over the past year — is not good news for existing shareholders. However, the pullback might be an opportunity for new investors to enter a long position. Total returns in the past have reached 20.5% and 67% over the three and five years, respectively, so investors who take a longer-term position now may soon see similar gains.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic