Eight Reasons for Income Investors to Use a Trading Room

By: Paul Dykewicz,

Eight reasons for income investors to use a trading room could prove compelling, said stock sherpa Hugh Grossman, who recommended the one he offers with a fellow seasoned trader.

For income investors open to day-trading, Grossman shared eight reasons why he and seasoned trader Ahren Stephens try to distinguish their DayTradeSPY Trading Room from the rest. Since they take different approaches to trading options, they have two ways of verifying whatever trend that one identifies also is a proverbial friend to the other.

“When our indicators unite, our trades ignite,” Grossman told me.

The verification of a trend is “paramount” to achieving a very high degree of success in trading, Grossman said. When both he and Stephens concur on market direction and strength, the wise traders who follow their guidance generally enjoy successful execution, Grossman added.

Eight Reasons for Income Investors to Use a Trading Room: Gain Leverage

Imagine that you need to produce $200 a day from a starting capital base of $20,000. A standard dividend payout every month, quarter or year would not produce the needed daily income.

“Using our methodology, you should be able to generate your daily gains quite effortlessly, actually,” Grossman said.

First, options provide huge leverage, Grossman said. An investor does not need much of a move on the underlying asset to see a change in the option price, he added.

“This benefit alone enables even the most humble of traders, beginners and those who may not have overreaching wealth, to enter the foray of the market,” Grossman said. “Each option controls 100 underlying shares. ‘At the money’ options generally have a delta of 50, meaning that for every dollar the stock moves, the option moves $ .50. If the stock costs $500 per share, the option expiring a few days out might cost only $2. Therefore, it would cost you $200 — $2 x 100 underlying shares that it controls — to buy a single ‘call’ option, if you expect the market to rise.”

Eight Reasons for Income Investors to Use a Trading Room: Two Sherpas

“Our daily Trading Room is unique in a number of ways,” Grossman told me.

Most notably, Grossman said he has a set of indicators that he has used successfully for years. Exponential moving averages (EMAs), support and resistance, chart patterns and trends are among key factors that determine high probability trades, he added.

“Short-term gains can be had by following tight technical entries using the 10 and 20 EMAs,” Grossman told me. “This technique is both profitable and fun as you are actively trading, beating the market at its own game.”

It also helps if the EMAs are climbing on the five-minute chart to support the trade, Grossman said.

“That’s almost a sure profit for short-term gains, Grossman told me.

Hugh Grossman leads DayTradeSpy’s Trading Room and Pick of the Day.

Eight Reasons for Income Investors to Use a Trading Room: Partnership

The Trading Room advisory service that Grossman founded has catapulted to a new level of expertise with the addition of Ahren Stephens, who brings his own set of indicators like Fibonacci retracements and Andrews’ Pitchfork. By collaborating, they identify trades that have a high probability of success, Grossman continued.

Ahren Stephens co-heads of Pick of the Day and the Trading Room.

Combined, their joint analysis offers extra brainpower for their subscribers who want to tap the guidance they offer to the subscribers of their Trading Room advisory service, Grossman said.

“Our Trading Room is an event that traders look forward to, earn while you learn and absorb all you can from two outstanding mentors,” Grossman told me.

Eight Reasons for Income Investors to Use a Trading Room: Track Record

A second reason to consider the DayTradeSpy Trading Room is its 14-year track record, Grossman said.

“The DayTradeSPY Trading Room is the longest running trading room that we know of… now in its 14th year,” Grossman said. “We know what works and what doesn’t in both trading and training.”

The partners also spoke favorably about the interactive chat aspect to their Trading Room, allowing real-time feedback with their subscribers.

Eight Reasons for Income Investors to Use a Trading Room: Subscriber Friendly

Grossman told me that their Trading Room is “fun” and typically profitable for their subscribers. The intent is to help subscribers trade profitably and enjoy doing so, he added.

These are not “watch Hugh and Ahren” trade sessions to guide subscribers in doing so profitably, Grossman said. The focus is on the subscribers and meeting their needs, he added.

Another plus is the limited time commitment that is required each day, Grossman added. Subscribers are expected to join them virtually at 9:20 a.m. ET and usually wrap up about 10:30 a.m. ET, he added.

Eight Reasons for Income Investors to Use a Trading Room: Interactive Sessions

Another distinction between the DayTradeSPY Trading Room and its competitors is the interactive aspect, Grossman said. Subscribers are welcome and encouraged to communicate directly with the two hosts, privately, during these live sessions, he continued.

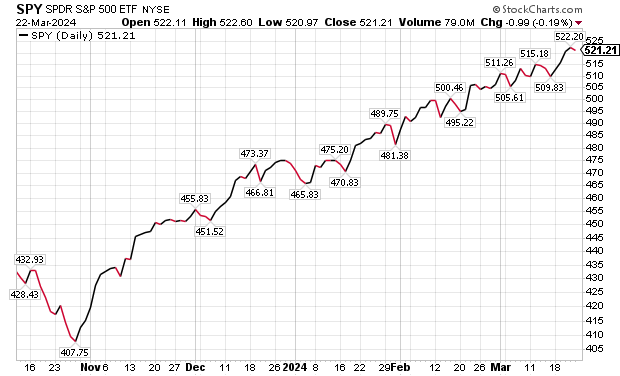

Almost all the trades involve options of the SPDR S&P 500 ETF Trust (NYSE ARCA: SPY).

“Get immediate answers, relevant answers and answers you need to hear,” Grossman said.

Chart courtesy of www.stockcharts.com

Eight Reasons for Income Investors to Use a Trading Room: Thin Time Commitment

The goal is to help subscribers profit in a short amount of time that ideally is less than an hour a day, Grossman said.

“Our events are respectful of your time,” Grossman told me. “We do not monopolize your day but try to teach you first thing in the morning from 9:20 a.m. to 10:30 am, ET, so you can carry on with the rest of your day.”

For less than an hour a day, the potential to profit is unbeatable, Grossman continued.

Eight Reasons for Income Investors to Use a Trading Room: Complementary Skills

With two seasoned traders, subscribers have double the expertise to tap, Grossman said Each is “knowledgeable” in his respective areas, he added.

Together, they have a combined 40-plus years of market participation,” Grossman told me.

“Nobody else provides such comprehensive, focused training at such an affordable price.”

Eight Reasons for Income Investors to Use a Trading Room: Entertainment Value

The last reason to use the DayTradeSPY Trading Room is that the sessions are designed to be entertaining and fun, Grossman said.

“Our members are amused by our humor and lightheartedness during the ‘off times,’” Grossman told me. “When trades are ‘on,’ they are exciting, motivating, inspiring and confidence building.”

The result typically is profits for subscribers, as well as a good time for all, Grossman said.

“It is little wonder those in our Trading Room are trading well. They know how to combine Andrews’ Pitchfork, Fibonacci, support and resistance, Exponential Moving Averages and other technicals to all but guarantee winning trades,” Grossman told me.

Trading Room Alternatives

For those not ready to give the Trading Room a try, they can consider the DayTradeSPY Pick of the Day.

The Pick of the Day is “ideal” for traders who may not have the time to watch the market or stare at charts,” Grossman said. The Pick of the Day is sent to the inbox of each subscriber daily at about 9 am ET.

Subscribers are provided with an overview of the exact trades that Grossman and Stephens are looking at before each market opens.

Ultimate Trading Workshop Preps Participants for Potential Profits

Grossman and Stephens also offer their Ultimate Training Workshop to help people day trade profitably. They created videos based on a live event held a few months ago, teaching everything they thought would help day traders.

“No stone is left unturned,” Grossman said. “If you have never traded options before, this is what you need. Even if you are a seasoned trader, the nuances, tips, tricks and traps you will pick up from this series of 11 sessions, each roughly an hour and a half in length, will benefit you immensely.”

The two investment gurus share their “deep in the trenches” experience with concepts that cannot be found anywhere else, Grossman said. Key topics include setting up Schwab (formerly TD Ameritrade) Think or Swim charts to visualize patterns, identifying key indicators and strategies, “repairing trades,” money management and more, he added.

Stephens provides a deep-dive analysis that can answer many questions in the Q&A section of the Ultimate Training Workshop, Grossman said.

“It’s all there,” Grossman advised. “Of course, there may be other updated information only available through our trading room sessions, but the Ultimate Training Workshop will provide you the launch pad you need to get started day trading SPY options.”

The videos are available for at least six months, and can be viewed as often as desired during that period, Grossman said.

“Fast forward, pause and rewind,” Grossman continued. “We recommend going through them at least once completely, even if you are an experienced trader. It’s the little subtleties that can make all the difference in your trading. Take advantage of 40+ combined years of Hugh and Ahren’s market participation… master the Ultimate Training Workshop.”

Geopolitical Risk Keeps Rising

Russia suffered an attack reportedly by ISIS that killed 40 people and injured at least 100 others at a symphony in Moscow on Friday, March 22. It is the latest major incident that shows mounting geopolitical risk in the world.

Russia’s President Vladimir Putin cautioned on March 18 that the NATO’s unwillingness to allow his efforts to proceed with his “special military operation” in Ukraine could start World War III. He won re-election to a fifth six-year term just weeks after the mysterious death of political opponent the Alexei Navalny, one of Putin’s most ardent critics in Russia. Navalny seemed fine to observers when he appeared in a courtroom the day before he died.

Navalny’s burial on Friday, March 1, drew thousands of mourners. With Navalny dead, Putin had no genuine opposition to his re-election to a new six-year term as Russia’s president during the country’s March 15-17 election.

Navalny’s family claims their loved one was fatally poisoned at the arctic prison with a nerve agent on Putin’s orders.

President Putin’s surprise attack of Ukraine with Russian forces more than two years ago has caused him to send continuing waves of soldiers into battle as human sacrifices to gain land that is within the sovereign borders of its neighboring nation. The invasion shows no signs of waning.

Middle East Fallout from Oct. 7 Mayhem

The Middle East diplomacy efforts have not borne fruit as Israel seeks the return of hostages taken from their country by Hamas militants during a murderous raid on Oct. 7, as well as bring the perpetrators to justice. The Israel Defense Forces (IDF) entered neighboring Gaza, but the death toll there has been high, reaching nearly 31,900 at press time, according to the latest media reports.

The war started on Oct. 7 when Hamas fighters invaded southern Israel in a precedented assault by Hamas that reportedly killed 1,163. Other barbarous acts included rapes, torture and the abduction of at least 250 others.

A week-long truce in late November led to Hamas freeing more than 100 Israeli and foreign hostages in exchange for Israel releasing about 240 Palestinian prisoners. However, talks aimed at securing the release of additional hostages have not produced results.

President Biden approved and initiated a humanitarian air drop and food distribution for beleaguered Palestinian civilians in Gaza. Roughly 130 hostages abducted on Oct. 7 by Hamas remain trapped in Gaza. But Israeli officials say about a quarter of them are dead.

Income investors worried about geopolitical risk may want to consider day trading to limit the potential impact of military conflicts due to the quick nature of such trades.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, Guru Focus and other publications and websites. Paul, who can be followed on Twitter @PaulDykewicz, is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Easter Season Sale! Paul is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The uplifting book is great gift and is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others. Call 202-677-4457 for reduced pricing on multiple-book purchases.

Connect with Paul Dykewicz

Connect with Paul Dykewicz