Enbridge Offers Shareholders Two Decades of Annual Dividend Hikes (ENB)

By: Ned Piplovic,

Enbridge, Inc. (NYSE: ENB) — a Canadian crude oil and natural gas transportation company — has rewarded its shareholders with annual dividend hikes for nearly two decades.

Over the past 19 years of consecutive hikes, the company managed to maintain an average annual dividend growth rate of nearly 12%. Additionally, three and five-year growth rates show that Enbridge has advanced its annual dividend hikes at a higher rate over the last several years, with the average growth rate increasing to more than 16%.

Enbridge’s share price history tells a different tale though. Unlike the steady dividend growth of the past few years, ENB shares experienced a loss of almost 45% of their value from April to December 2015, and were at about the same level close to two and a half years later. However, the share price has been riding an uptrend over the past 90 days, and half of Wall Street analysts covering the stock have a “Buy” of “Strong Buy” recommendation.

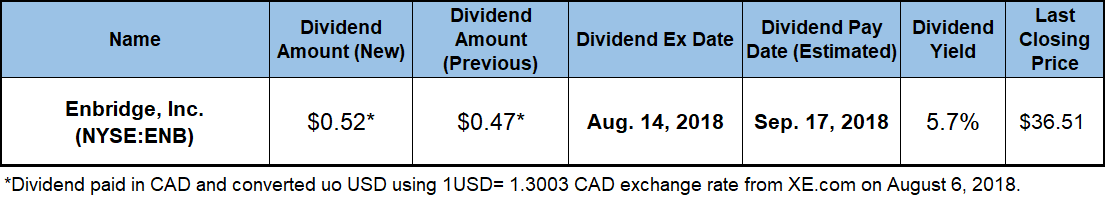

With an average target price of $45.03, Enbridge has plenty of room for further growth, as the current share price target is close to 25% below this threshold. Investors interested in the possibility of double-digit growth, an upcoming dividend hike, and a two decade track record of successive dividend hikes may want to take a position prior to the upcoming August 14, 2018 ex-dividend date. Enbridge will distribute its next quarterly payout on September 17, 2018 to all shareholders of record.

Enbridge, Inc. (NYSE:ENB)

Headquartered in Calgary, Canada and founded in 1949 as the Interprovincial Pipeline Company, Enbridge Inc. operates as an energy infrastructure company in Canada and the United States. The company manages and has an 84.6% economic interest in the Enbridge Income Fund (NYSE: ENF), a 34.9% economic interest in Enbridge Energy Partners L.P. (NYSE: EEP) and a 75.0% equity interest in Spectra Energy Partners, LP (NYSE: SEP). Enbridge is Canada’s largest natural gas distribution provider, with about 3.7 million retail customers in Ontario, Quebec, New Brunswick and New York State. Additionally, Enbridge operates the world’s longest crude oil and liquids transportation system, with more than 17,000 miles of active pipe and an average delivery quota almost 3 million barrels of crude oil each day.

Also, Enbridge transports 28% of the crude oil produced in North America. It owns and operates almost 66,000 miles of gathering lines, more than 25,500 miles of transmission lines, and more than 100,000 miles of distribution lines of natural gas and natural gas liquids (NGL) pipelines across North America and the Gulf of Mexico. These totals include the DCP Midstream (NYSE: DCP) pipeline network, which is an equal partnership joint venture between Enbridge Inc. and Phillips 66 (NYSE: PSX) and moves approximately 22% of natural gas consumed in the U.S. Additionally, Enbridge has NGL production capacity of more than 300 thousand barrels per day and 438 billion cubic feet (Bcf) of net natural gas storage capacity. Enbridge operates in five segments: Liquids Pipelines, Gas Transmission and Midstream, Transmission and Energy Services, Gas Distribution and Green Power.

Amid moderate volatility, Enbridge reached its 52-week high of $41.97 on October 3, 2017 before continuing the downtrend of the last few years. By April 25, 2018, the share price reached its 52-week low of $29.27. However, the share price reversed direction and closed on Aug. 4 at $36.51, which was 13% below the October 2017 peak, 12% lower than it was one year earlier but almost 25% above the 52-week low from late April 2018.

The upcoming quarterly dividend payment of $0.52 (CAD 0.671) will be 10% higher than the $0.47 (CAD 0.61) payout from the same quarter last year, and will result in an annualized payout of $2.064 (CAD 2.684), or a 5.7% dividend yield at current levels — 13% higher than the company’s 5% yield from 12 months ago. Enbridge’s current 5.7% yield outperforms the 2.3% average yield of the entire Basic Materials sector by almost 150%, and exceeds the 4.73% simple average yield of all the companies in the Oil & Gas Pipelines industry segment by more than 20%.

After almost two decades of consecutive annual dividend hikes, Enbridge has seen its total annual dividend amount grow more than nine-fold, which is equivalent to an average growth rate of 11.8% per year. However, the more recent annual dividend hikes are even higher, with average annual growth rates of 16.3% and 16.6% over the past three and five years, respectively.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic