Ennis, Inc Offers 4% Yield, 30% One-Year Total Return (EBF)

By: Ned Piplovic,

Ennis, Inc. (NYSE:EBS) has been offering businesses printed products for more than a century and offers its current shareholders a 4% dividend yield that combined with asset appreciation for a total return on investment of more than 30% over the past year.

The company has distributed dividends for nearly three decades without a dividend cut and has raised its annual dividend amount in the past three consecutive years. In addition to the recent consecutive annual dividend hikes, the company paid a special dividend in two out of the past three years.

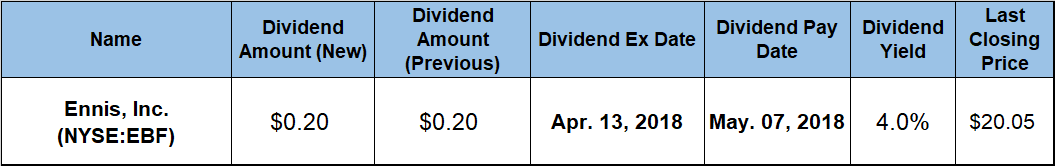

While not a large company, as it has a market capitalization of approximately $500 million, Ennis, Inc. posted steady capital growth over the past year that complemented the company’s steady dividend income distribution. Ennis, Inc. set its next pay date for May 7, 2017, when the company will distribute its dividend to all its shareholders of record prior to the April 13, 2018, ex-dividend date.

Ennis, Inc. (NYSE:EBS)

Founded in 1909 as Ennis Printing & Publishing and headquartered in Midlothian, Texas, Ennis, Inc. designs, manufactures and sells business forms and other business products. Through its 32 subsidiaries, the company offers snap sets, continuous forms, laser cut sheets, tags, labels, envelopes, integrated products, jumbo rolls and pressure sensitive products under multiple brand names. Additionally, the company provides point of purchase advertising for large franchise and fast food chains, as well as kitting and fulfillment under the Adams McClure brand name. The company’s portfolio also includes presentation folders and document folders, custom printed labels, custom and stock tags products, as well as custom and imprinted envelopes, and financial and security documents. As of the end of 2017, the company had more than 2,300 employees distributed across its network of 55 facilities in 21 states.

The company has distributed dividends since 1990 and its current $0.20 quarterly amount is 14.3% higher than the $0.175 payout from the same period last year. Additionally, the current quarterly distribution is equivalent to an $0.80 annualized amount for 2018, which yields 4%. This current yield exceeds the 1.87% average yield of the Consumer Goods sector by more than 110% and the 3.12% average yield of the Office Supplies market segment by nearly 28%.

The company paid a flat $0.62 annual dividend for 14 years between 1998 and 2011. The company boosted its annual dividend to $0.68 in 2012. Over the past three consecutive years, the company enhanced its annual dividend amount 33% from $0.70 in 2016 to the current $0.80 annualized amount for 2018 by boosting the annual payout at an average rate of 10.1% per year. Additionally, the company distributed two special dividends in the past two years. The company paid a $0.10 special dividend in the first quarter of 2018, which is equivalent to 12.5% of the $0.80 annual dividend amount, and a $1.50 special dividend in the third quarter of 2016, which was more than double that year’s $0.70 annual dividend payout.

The company’s share price dropped more than 28% in the first half of 2016 and has been rising since that drop. Entering the trailing 12-month period on that uptrend, the share price hit its 52-week low of $15.50 on March 27, 2017, and continued to rise with moderate volatility for the remainder of 2017. Over that nine-month period, the share price advanced almost 37% and reached its new 52-week high of $21.20 on January 2, 2018, the first trading day of the new year.

After a 7% pullback during the overall market selloff at the beginning of February, the share price recovered two-thirds of those losses and closed on March 26, 2018, at $20.05, which was just slightly more than 5% below the peak price from the beginning of January 2018. However. The March 26, 2018, closing price is 29.4% higher than its 52-week low from one year earlier and 38% higher than it was five years prior.

The company’s robust asset appreciation and the above-average dividend income combined for a 30.5% total return on shareholders’ investment over the past 12 months. Over the past three years, the company rewarded its investors with a total return of nearly 62%.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic