First Horizon National Hikes Quarterly Dividend 33% (FHN)

By: Ned Piplovic,

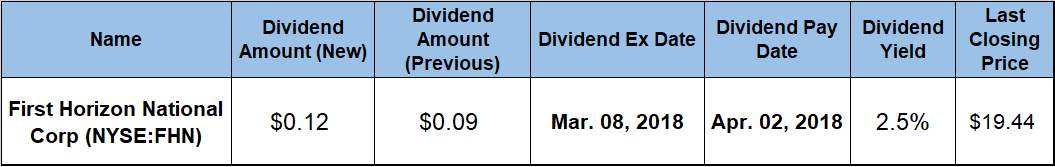

To rebuild income distribution to its shareholders after eliminating its dividend payout following the 2008-2009 financial crisis, First Horizon National Corporation (NYSE:FHN) boosted its quarterly dividend payout 33% and currently offers a 2.5% yield.

While the company’s current yield is less than half the average yield of the entire Financials sector, it outperformed the average yield of the Southeast Regional Banks segment by a significant margin. While the current share price still trails its own level from one year ago, the price has risen more than 20% since its 52-week low in September 2017 and continues to rise after the recent market pullback.

The company’s next dividend date will occur on March 8, 2018, and the pay date follows three weeks later, on April 2, 2018.

First Horizon National Corporation (NYSE:FHN)

Founded in 1864 and headquartered in Memphis, Tennessee, the First Horizon National Corporation offers regional banking, wealth management and capital market services through four business segments — First Tennessee Bank, Capital Bank, FTB Advisors and FTN Financial. The bank operates 153 of its 169 branch locations in Tennessee, with the remaining branches and offices located in Georgia, Mississippi, North Carolina, Virginia, South Carolina, Florida and Texas.

The company’s newly announced $0.12 quarterly dividend payout in the second quarter of 2018 is 33.3% higher than the $0.09 amount distributed in the previous quarter. This new quarterly amount converts to a $0.48 annualized amount and yields 2.5%, which is 45.2% higher than the company’s own 1.7% average yield over the past five years.

The Financial sector overall tends to have yields higher than other industries. However, while First Horizon’s 2.5% current yield lags behind the average yield of the entire financial sector by more than 50%, it is 46% higher than the simple average yield of all the companies in the Southeast Regional Banks segment. Excluding the companies that do not pay any dividends, the average yield increases to 2.24%. Yet, First Horizon’s current yield is still more than 10% higher compared to the average yield of its dividend-paying peers in the Southeast Regional Banks segment.

The company has been distributing dividends to its shareholders since 1895 and had a remarkable dividend growth record leading up to the 2008 crisis. In less than a decade, the company boosted its annual dividend amount more than threefold from $0.485 in 1998 to $1.80 in 2007 by growing its annual payout at an average rate of 15.4% per year. At the end of 2007, the company’s dividend yield was more than 10%. However, during the financial crisis the company cut its annual dividend more than 52% for 2008, and it eliminated the payout for 2009 and 2010.

The company started rebuilding its dividend income distributions in 2011 with a $0.01 quarterly payout in the second quarter. Since resuming dividend distributions, the company averages a 48.6% compounded annual growth rate over the past seven years, which resulted in a 16-fold enhancement of the total annual amount since 2012.

The share price jumped more than 30% during November 2016 and continued to trade around the $20 level until the end of February 2017. This price spike was uncharacteristically above the growth trend over the last decade. Therefore, the price started correcting after February 2017 and declined almost 30% between its 52-week high on March 1, 2017, and its 52-week low of $16.05 on September 7, 2017. After bottoming out in early September, the share price embarked on its long-term growth trend and rose more than 25% and came to within 0.7% of the 52-week high before the most recent market selloff.

Since the selloff, the share price rose the entire second week of February and closed on February 20, 2018, at $19.44, which is still 3.6% short of the share price level from 12 months ago and 6.4% below the 52-week high from March 2017. However, the current share price is 21% higher than the 52-week low from September 2017 and 82% above the share price from five years earlier. Because the share price still has not fully recovered all its losses compared to its price from 12 months ago, the company delivered to its shareholders a 1% total loss over the past year despite the rising dividend. However, over the last three and five years the company provided its investors with total returns of 42% and 96%, respectively.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic