Five Dividend-paying Semiconductor Investments to Purchase for AI Initiatives

By: Paul Dykewicz,

Five dividend-paying semiconductor investments to purchase as artificial intelligence (AI) initiatives fulfill the potential that is raising the value of their share prices.

The five dividend-paying semiconductor investments to purchase are poised to ride the emerging artificial intelligence technology trend that is expected to help fuel the industry’s resurgence this year after a 30% drop in 2022. The first half of 2023 has shown renewed enthusiasm about technology’s potential to catalyze progress in business and society, according to a new report by McKinsey & Co.

“Generative AI deserves much of the credit for ushering in this revival, but it stands as just one of many advances on the horizon that could drive sustainable, inclusive growth and solve complex global challenges,” according to McKinsey & Co.

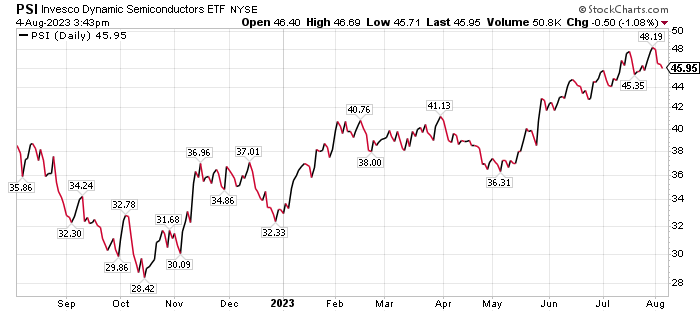

Five Dividend-paying Semiconductor Investments to Purchase: Invesco Dynamic Semiconductors (PSI)

For investors seeking to play the AI field rather than buy individual stocks, the “best” exchange-traded fund (ETF) available is Invesco Dynamic Semiconductors (PSI), said Bob Carlson, a pension fund chairman who heads the Retirement Watch investment newsletter. The fund tracks the Dynamic Semiconductor Intellidex Index, aiming for price momentum, earnings momentum, quality, management action and value.

Paul Dykewicz interviews Bob Carlson, head of Retirement Watch.

The turnover ratio of the fund is more than 100% a year, Carlson said. The ETF typically holds 30 stocks and adjusts the allocation among them based on the factors previously listed. Recently, 47% of PSI was in its 10 largest positions.

The top holdings in the fund recently are NVIDIA (NASDAQ: NVDA), Broadcom (NASDAQ: AVGO), Lam Research (NASDAQ: LRCX), Applied Materials (NASDAQ: AMAT) and Micron Technology Inc. (NASDAQ: MU). As far as the fund’s performance, PSI is up 1.43% in the last month, 25.83% in three months, 39.64% for the year to date and 20.31% over 12 months.

Chart courtesy of www.stockcharts.com

Five Dividend-paying Semiconductor Investments to Purchase: AI Spur Growth

Initial results of second-quarter 2023 cloud capital expenditures (capex) are showing investments in AI seem to be offset by slowing traditional computer spending, according to BofA Global Research. For example, Microsoft’s (NASDAQ: MSFT) capex outperformance of $8.9 billion topped a forecast of $7.8 billion, while Google, a key business of Alphabet (NASDAQ: GOOGL), attained a capex of $6.9 billion, but fell short of an expected $8.0 billion. Meta Platform Inc.’s (NASDAQ: META) $6.2 billion capex dipped below a projected $7.9 billion.

“All three hyperscalers highlighted material portions of capex supporting AI projects,” BofA technology analyst Vivek Arya wrote in a recent research note. Meta/Google reported capex cuts from delays of data center construction projects, moderation in build-out of office facilities (Google) and cost savings centered on non-AI servers (Meta), he added.

“We continue to see benefits for semis as AI investment ramps,” Arya wrote.

However, it will be prudent for “hyperscalers” to show profitability from AI projects, potentially leading to cautious data center capex spending patterns, Arya wrote in his note.

AI server central processing unit (CPU) demand is offset by slowing non-AI spending on CPUs already included in all non-AI servers, according to Arya’s research note. Rising investment in graphics processing unit-based cloud service providers should help quicken generative AI adoption, showcasing the value of having an end-to-end AI platform, rather than just a cheaper graphics processing unit (GPU), further raising AI barriers for typical CPU vendors, he added.

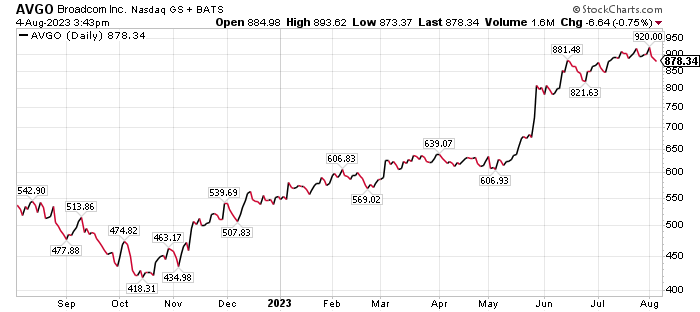

Five Dividend-paying Semiconductor Investments to Purchase: Broadcom Inc. (AVGO)

Another of the five dividend-paying semiconductor investments to purchase is San Jose, California-based Broadcom, with a $1,050 price objective that falls within the stock’s long-term 10x-30x range, given double-digit-percentage earnings per share (EPS) growth and best-in-semis profitability, free cash flow (FCF) generation and returns. Free cash flow represents money a company has left over after paying its operating expenses and capital expenditures.

Risks to Broadcom achieving the price objective include sensitivity to U.S./China trade relations, high exposure to Apple (NASDAQ: AAPL), networking, smartphone, storage and enterprise software market challenges, and a recent strategy of moving into non-core software businesses that could have execution issues.

Chart courtesy of www.stockcharts.com

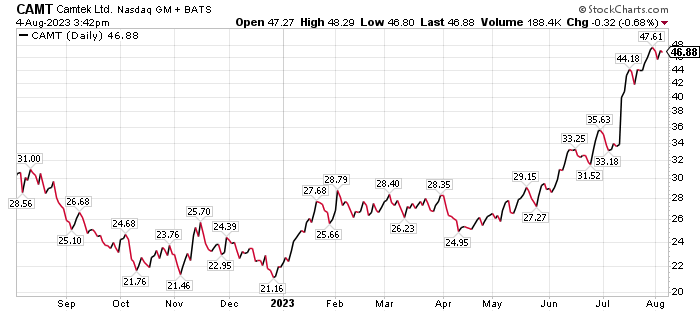

Five Dividend-paying Semiconductor Investments to Purchase: Camtek (CAMT)

Israel-based Camtek (NASDAQ: CAMT) received a $50 price objective from BofA, coming within the company’s long-term 8x-40x range. Prospects for outperforming BofA’s price objective could be aided by accelerated share gains vs. key competitor Onto Innovations, stronger-than-expected electronics demand that may tighten semiconductor capacity further to drive increased semiconductor equipment sales and the potential industry consolidation that may turn it into an acquisition target.

Risks to Camtek fulfilling its price target include a weaker-than-expected capital spending cycle, heightened competition with large competitors like KLA Corp. and the historically cyclical nature of semiconductor capital spending, particularly on packaging equipment.

Chart courtesy of www.stockcharts.com

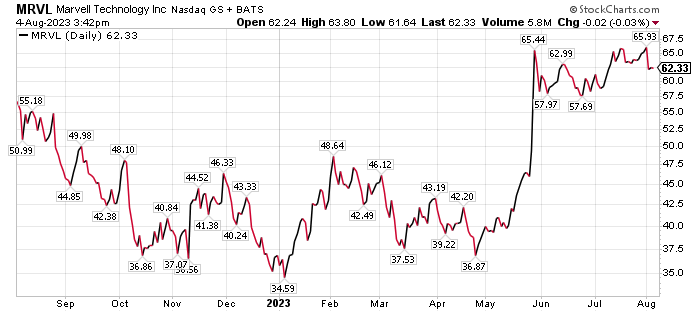

Five Dividend-paying Semiconductor Investments to Purchase: Marvell Technology Group Ltd. (MRVL)

Marvell Technology Group Ltd. (NASDAQ: MRVL), of Santa Clara, California, received an $80 price objective from BofA. The valuation is “well-supported” by Marvell’s 15-20% longer-term compounded annual earnings per share (EPS) growth potential, within the normal 1x-2x range for high-growth semiconductor peers.

Risks to Marvell reaching that price target include integration of businesses from its recent deals, financial hurdles related to going to net debt from net cash position, as well as achieving expected cost synergies in a timely manner. Additional risks include its cyclical industry, possible slowdown in legacy hard disk drive, infrastructure spending and storage assets, along with competition from larger, well-resourced rivals, BofA added.

Chart courtesy of www.stockcharts.com

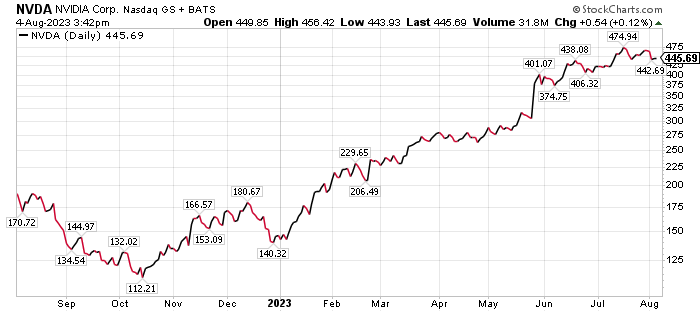

Five Dividend-paying Semiconductor Investments to Purchase: NVIDIA Corporation (NVDA)

Santa Clara, California-based NVIDIA’s $550 price objective set by BofA is within the semiconductor company’s historical 26x-69x forward year price-to-earnings range, the investment firm wrote. The valuation is justified, given stronger growth opportunities ahead as gaming cycle troughs and data center demand potentially face strong, long-term demand dynamics, BofA wrote.

Risks to NVIDIA meeting the price objective set by BofA are weakness in the consumer-driven gaming market, competition with Intel (NASDAQ: INTC), AMD, Broadcom and Marvell, internal cloud projects and other companies in accelerated computing markets, and potential restrictions from the U.S. government on shipments of advanced AI technologies to overseas customers. Other risks include lumpy and unpredictable sales in new enterprise, data center and auto markets, potential for decelerating capital returns, possible automobile sale slowdowns until advanced driver-assist systems become more meaningful and elevated operational expense growth.

Chart courtesy of www.stockcharts.com

Political Risk Increases from Russia’s Escalating Attacks Against Ukraine

Political risk is growing amid drone strikes hitting targets in both Ukraine and Russia this week by each side. Russian forces struck residential areas and a hospital in Kharkiv, Ukraine, reportedly killing a doctor and injuring five medical workers. In turn, a government ministry building in Moscow was damaged from a drone attack likely to have come from those sympathetic to Ukraine’s plight.

Ukrainian sea drones attacked a major naval base in Russia on Friday, damaging a Russian warship in the Black Sea and causing it to list to the side. The drone strike occurred hundreds of miles from Ukrainian-held territory.

Social media videos showed the amphibious Russian landing ship tilting and sitting low in the water. The vessel needed to be towed near the base at Novorossiysk, Russia’s largest port.

The strike came amid growing tensions in the Black Sea, with Ukrainian President Volodymr Zelensky recently vowing to bring the war to Russian territory. Despite heavy losses of soldiers on both sides since Russia invaded Ukraine in February 2022, a peaceful resolution seems unlikely anytime soon.

With Russia disrupting grain exports from Ukraine in July 2023, endangering the food supply to countries in Africa and elsewhere, the fallout from the protracted war is immense. Political risk for investors is rising further amid an intensifying conflict as Ukrainian forces attempt a counteroffensive aimed at pushing Russian forces back to their own land.

The five dividend-paying semiconductor investments to purchase are positioned to benefit from increased demand for artificial intelligence advances. Despite heightening political risk amid Russia’s unrelentingly war that brazenly has targeted civilians in residential neighborhoods of Ukraine, investors can still profit from an important technology trend.

Paul Dykewicz, www.pauldykewicz.com, is an award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Crain Communications, Seeking Alpha, Guru Focus and other publications and websites. Paul can be followed on Twitter @PaulDykewicz, and is the editor and a columnist at StockInvestor.com and DividendInvestor.com. He also serves as editorial director of Eagle Financial Publications in Washington, D.C. In that role, he edits monthly investment newsletters, time-sensitive trading alerts, free weekly e-letters and other reports. Previously, Paul served as business editor and a columnist at Baltimore’s Daily Record newspaper and as a reporter at the Baltimore Business Journal. Plus, Paul is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The uplifting book is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many other sports figures. To buy signed and specially dedicated copies, call 202-677-4457.

Connect with Paul Dykewicz

Connect with Paul Dykewicz