Getty Realty Corporation Offers 4.45% Yield, Six Consecutive Annual Dividend Hikes (GTY)

By: Ned Piplovic,

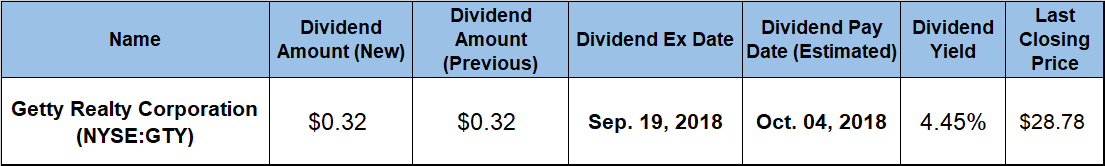

Complementing six consecutive annual dividend hikes, the Getty Realty Corporation’s (NYSE:GTY) share price continues rising after an early 2018 pullback and the company currently offers a 4.45% dividend yield.

The company’s share price reversed its uptrend in early October 2017 and started a slow decline that lasted until the end of the overall market’s pullback in early February 2018. However, that price drop turned out to be an excellent buying opportunity as the share price fully recovered by early September 2018 and might have a little more steam left for investors interested to jump in at this point.

The current share price is still more than 10% below Wall Street analysts’ average target price. Therefore, the share price might still have double-digit-percentage upside potential. The share price’s 50-day moving average (MA) crossed above the 200-day MA in early July 2018 and continues to ascend. The share price has been trading above both moving averages since mid-June. In the last 10 days, the share price closed marginally below the 50-day MA three times. However, that could be just a result of moderate price volatility as the longer-term trend still appears to point upwards, at least for the near term.

The company will distribute its next dividend payments on the October 4, 2018, pay date to all shareholders of record prior to the September 19, 2018, ex-dividend date.

Getty Realty Corporation (NYSE:GTY)

Headquartered in Jericho, New York, and founded in 1971, the Getty Realty Corporation is a publicly traded real estate investment trust (REIT) that specializes in the ownership, leasing and financing of gasoline station and convenience store properties. As of June 30, 2018, Getty Realty’s portfolio consisted of 932 properties located in 28 states across the United States and Washington, D.C. These locations operate under multiple brand names, including 76, Aloha, BP, Citgo, Conoco, Exxon, Getty, Mobil, Shell and Valero. Getty owns 854 of the total stores and leases the remaining 78 stores to third-party operators. After operating as a publicly traded company for its first 30 years, Getty Realty elected to be treated as a real estate investment trust (REIT) under federal income tax laws and changed its status as of January 1, 2001.

The company’s current $0.32 quarterly dividend is 14.3% above the $0.28 payout from the same period last year. This current quarterly payout amount is equivalent to a $1.28 annualized distribution and currently yields 4.45%. The rapid share price growth since February 2018 has suppressed this current yield to nearly 10% below Getty’s own 4.9% five-year average. However, GTY’s current yield still outperforms the 3.87% simple average yield of all the companies in the Retail Industry REIT segment by almost 15% and is nearly 50% above the 3% average yield of the overall Financial sector.

Over the past six years of consecutive annual dividend hikes, GTY advanced its total annualized dividend amount more than 150%, which corresponds to an average growth rate of 17% per year. With just one annual dividend cut, the company also enhanced its total annual payout five-fold since introducing dividend distributions in 1998. This pace of annual dividend hikes corresponds to a 6.3% average annual growth rate over the past two decades.

After nearly doubling during a two-year uptrend, the share price reached its 52-week high of $29.81 on October 18, 2017. Following a trend reversal, the share price lost nearly 24% before reaching its 52-week low of $22.69 on February 8, 2018.

However, the share price resumed its uptrend, recovered all those losses by early July 2018 and continues to rise. The share price rose to within 3.5% of the October 2017 peak and closed at $28.78 on September 12, 2018. This closing price was 1.5% higher than one year earlier, nearly 27% above the February low and 46% higher than it was five years ago.

The company’s recent share price growth complemented the streak of annual dividend hikes to reward the company’s shareholders with a total return of 86% over the past five years. The three-year total return was even higher at 111%. Most importantly, the share price growth in 2018 converted a 1.3% one-year loss from three quarters ago into a 7.25% total return over the past 12 months.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic