Gilead Sciences Lifts Quarterly Dividend Payout 10% (GILD)

By: Ned Piplovic,

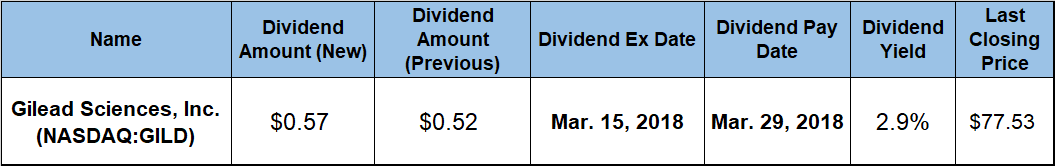

Investors who are looking for dividend-paying companies in the biotech segment should go no further than Gilead Sciences, Inc. (NASDAQ:GILD), which just boosted its quarterly dividend amount almost 10% and offers its shareholders a 2.9% yield.

The company provided a significant dividend income to its investors over the past few years and its share price rose by a double-digit percentage over the past year. However, some analysts looking at technical indicators are concerned about the share price’s recent short-term decline and are waiting to see whether the price support at $73 will hold.

If it does not, the share price could drop another 10% to 15% into the $60 to $65 range. Alternatively, if the support holds, the share price could be on the way towards its late January 2018 levels above $85.

Investors convinced that the share price might bounce back should do their research and take a position prior to the company’s next ex-dividend date on March 15, 2018, and make sure to be eligible for the next round of dividend distributions on the March 29, 2018, pay date.

Gilead Sciences, Inc. (NYSE:GILD)

Headquartered in Foster City, California, and founded in 1987, Gilead Sciences is a research-based biopharmaceutical company that discovers, develops and commercializes medicines and medical treatments. The company’s portfolio of current products and products in its development pipeline includes treatments for HIV/AIDS, liver diseases, cancer, inflammatory and respiratory diseases and cardiovascular conditions.

The company has many innovations to its credit, including several category firsts, such as complete treatment regimens for HIV infection available in a once-daily single pill and the first oral antiretroviral pill available to reduce the risk of acquiring HIV infection in certain high-risk adults. As of January 2018, Gilead Sciences had approximately 9,000 employees spread across the company’s 47 locations on six continents.

The company announced its next quarterly dividend of $0.57 on February 6, 2018. This new amount is 9.6% higher than the company’s $0.52 quarterly payout from the prior period. The annualized dividend of $2.08 for 2018 converts to a 2.9% yield, which is almost 26% higher than the 2.3% yield from the same period last year.

The 2.9% yield is lower than average yields in many other sectors. However, within the Health Care sector or the Biotechnology segment, Gilead’s current yield is among the highest. The company’s current 2.9% yield is almost 320% higher than the 0.69% average yield of the overall Health Care sector and more than 1,200% above the 0.22% simple average of all the companies in the Biotechnology segment.

The reason for such a massive disparity in the Biotechnology market segment is that most companies in the segment do not pay dividends. However, Gilead’s current yield is still more than 28% higher than the simple 2.26% average yield of the dividend-paying companies.

Out of approximately three dozen major biotech companies that are publicly traded, only three companies, Gilead, Amgen, Inc. (NASDAQ:AMGN) and Bio-Techne Corporation (NASDAQ:TECH), currently pay dividends. While Amgen pays a dividend with a similar yield of approximately 2.9%, it is few tenths lower than Gilead’s 2.94% yield. Bio-Techne’s current 0.92% yield is significantly lower.

Gilead began distributing dividends in the second quarter of 2015 with an annualized $1.72 payout amount. The company has raised its annual dividend amount every year since and has enhanced its total annual dividend distribution 33%. This level of dividend growth came from an average growth rate of 9.9% per year over the past three years.

While the company rewarded its shareholders with a hefty dividend payout bump, the share followed suit and rose more than 25% by the end of January 2018. The share price gave back most of its gains during February 2018 but still held on to a double-digit percentage rise over the past 12-months. At the onset of the trailing 12 months (TTM), the share price dropped 8.6% between March 1, 2017, and its 52-week low of $64.12 on June 8, 2017.

After bottoming out at the beginning of June, the share price ascended 38.5% to reach its 52-week high of $88.80 on January 29, 2018. Since the January peak, the share price fell more than 12% because of the overall market sell-off and the reduced earnings outlook for the next three years. The share price closed on March 1, 2018, at $77.53, which was 12.7% lower than the January peak, 10.5% higher than its was one year prior and almost 21% higher than the 52-week low from June 2017.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic