Hershey Offers Shareholders 2.7% Dividend Yield, 19 Annual Dividend Hikes Over Past Two Decades (HSY)

By: Ned Piplovic,

The Hershey Company (NYSE:HSY) has managed to boost its annual dividend every year but one since 1998 and currently offers its shareholders a dividend yield of 2.7%.

While many companies were forced to reduce or eliminate their dividend distributions during the 2008 financial crisis, the Hershey company managed to avoid dividend cuts, paid a flat annual dividend in 2009 and resumed rising dividends in 2010. Since skipping the boost in 2009, the company has increased its annual dividend payout for the past eight consecutive years.

The company’s share price fought against moderate volatility over the past few years and is currently trading within 2% of the price level from one year ago. After a decline in the first half of the trailing 12 months, the share price has recovered its losses and technical indicators suggest that the current uptrend might have a little more room on the upside.

The 50-day moving average (MA) has been rising steadily since June 2018 and broke above the 200-day MA in late September. The 50-day MA continues to rise and is currently almost 7% above the 200-day MA. Furthermore, the share price has remained above both moving averages since the beginning of September, with the exception of just two trading sessions when the price dipped marginally below the 50-day MA in late October 2018.

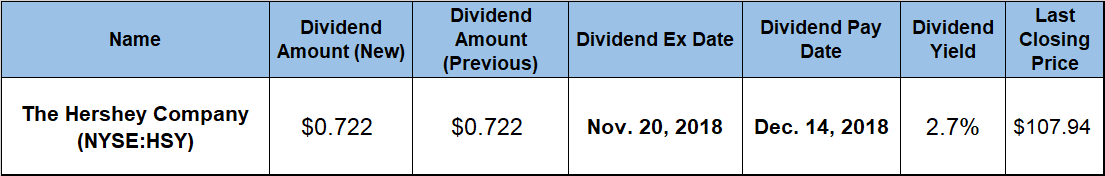

Investors convinced that the share price might continue its current uptrend should consider acting prior to the company’s next ex-dividend date on November 20, 2018, to ensure eligibility for the next round of dividend distributions on the December 14, 2018, pay date.

The Hershey Company (NYSE:HSY)

Founded in 1894 in Hershey, Pennsylvania, The Hershey Company manufactures and sells confectionery products. The company operates through two segments, North America and International and Other. Among the company’s product offerings are chocolate and non-chocolate confectionery products, gum and mint refreshment products that include chewing gums, bubble gums, hard and soft fruit candy, lollipops and flavored soda. Additionally, the company manufactures pantry and snack items, including toppings, beverages, sundae syrups, spreads, meat snacks, bars and snack bites. The company provides its products primarily under the Hershey’s, Reese’s, Kisses, Jolly Rancher, Almond Joy, Brookside, Cadbury, Good & Plenty, Kit Kat, Payday, Rolo, Twizzlers, Whoppers, York, Ice Breakers, Breathsavers, Bubble Yum and Heath brands.

After a short 5% spurt at the beginning of the trailing 12 months, the share price peaked on December 19, 2017 at $115.45. However, the immediate direction change sent the price down 22.4% towards its 52-week low of $89.54 by May 2, 2018. Fortunately, the low did not last too long. The price embarked on an uptrend and gained 20.5% above the May low to close on November 14, 2018, at $17.94, which was 6.5% short of the peak from December 2017, 1.7% lower than it was last year and 12% higher than it was five years ago.

The company’s current $0.722 quarterly dividend distribution is 10% higher than the $0.656 payout from the same period last year. This new distribution amount is equivalent to a $2.888 annualized payout and converts to a 2.7% forward dividend yield. This current yield is approximately 11% higher than the company’s own 2.4% average dividend yield over the past five years.

Furthermore, Hershey’s current 2.7% dividend yield outperformed average yields of Hershey’s industry peers. The current 2.8% dividend yield is 27% above the 2.1% yield average of the overall Consumer Goods sector. Additionally, Hershey’s current yield is also 2% higher than the 2.62% simple average yield of the Confectioners industry segment.

Over the past two decades, the Hershey company failed to boost its annual dividend payout only once. Even with the missed dividend hike in 2009, the company has enhanced its total annual payout six-fold since 1998, which is equivalent to an average growth rate of 9.4% per year.

Additionally, the current streak of eight consecutive annual dividend boosts advanced the annual distribution amount more than 140%. This advancement corresponds to a 10.4% average annual growth rate.

Because the share price still has not fully recovered from the mid-year decline, the total return for the past 12 months was limited to 3%. While the Hershey Company provided a steadily rising dividend income distributions, the share price encountered moderate volatility over the past several years. Therefore the five-year total return of 24% is lower than the total return of 40% over the past three years.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic