Host Hotels & Resorts Offers 3.8% Dividend Yield (HST)

By: Ned Piplovic,

Featured Images Source: Company Website

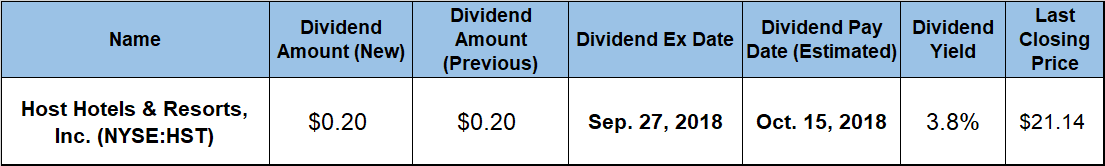

Host Hotels & Resorts, Inc. (NYSE:HST) rewarded its shareholders with a 3.8% dividend yield and – aided by a double-digit-percentage share price growth – a total return of more than 20% over the past 12 months.

The company cut its quarterly dividend only twice since 1999, with the most recent cut in early 2009 during the financial crisis. However, after that most recent quarterly dividend cut, the company managed to avoid dividend cuts and even distributed special dividends in three out of the last four years.

Host Hotels & Resorts is the only lodging REIT included in the Standard & Poor’s 500 Index (S&P 500) and the Fortune 500 list. Additionally, HST’s current $15.8 billion market capitalization is more than three times higher than the $4.5 billion average capitalization of its market peers. Furthermore, the REIT’s current capitalization is more than double the $6.75 billion market capitalization of HST’s closest peer – Park Hotels & Resorts Inc. (NYSE:PK).

The company’s share price lost more than 85% of its value over just two years during the 2008 financial crisis. However, since its trend reversal in February 2009, the share price advanced nearly six-fold, with just two significant pullbacks – one in 2011 and the other in 2014. In just over the past two years, the share price gained 40%.

Despite moderate volatility, the share price continued to advance over the past 12 month and technical indicators suggest that there might be a little more room on the upside. The company will distribute its next dividend on the company’s October 15, 2018, pay date to all its shareholders of record prior to the September 27, 2018, ex-dividend date.

Host Hotels & Resorts, Inc. (NYSE:HST)

Based in Bethesda, Maryland and tracing its roots to the 1920s, Host Hotels & Resorts, Inc. is a real estate investment trust (REIT) and one of the largest owners of luxury and upscale hotels. The current legal entity came into existence in 1993 when the Marriott Corporation split into two separate and distinct companies – the Host Marriott Corporation and Marriott International, Inc. Host Marriott retained Marriott’s lodging real estate and airport/toll road concessions business, while Marriott International took over management of the lodging and contract service businesses. In January 1999, the Host Marriott Corporation started operating as a REIT and in 2002 became the only lodging REIT on the Fortune 500 list. By 2007, the company also gained inclusion in the S&P 500 Index. As of June 2018, the company owned 88 properties in the United States and six properties internationally, with a total of more than 52,400 rooms. The properties operate under established lodging brands, including Marriott, Ritz-Carlton, Westin, Sheraton, St. Regis, Le Méridien, Hyatt and Novotel, as well as under independent brands in over 50 major markets. Among the REIT’s iconic properties are the Marriott Marquis hotels in New York’s Time Square, San Diego Marina and San Francisco; the Ritz-Carlton properties in Amelia Island and Marina Del Rey, as well as the Grand Hyatt hotel in Washington D.C.

The current $0.20 quarterly dividend is equivalent to an $0.80 annualized payout and a 3.8% dividend yield. Despite its dividend growth, the current dividend yield is 12% below the 4.3% average dividend yield over the past five years because the share price advanced at a faster rate than the dividend distributions.

Additionally, the current 3.8% dividend yield is nearly 25% higher than the 3.04% average yield of the overall Financials sector, as well as 7.8% above the 3.51% simple average of all the companies in the Hotel Motel REIT industry segment. Since 2011, when the company resumed hiking its dividends again after the financial crisis, the total annual dividend amount advanced eight-fold, which corresponds to an average growth rate of 34.6% per year.

After some volatility in the first half of the trailing 12 months, the share price reached its 52-week low of $17.98 on March 23, 2018. However, a reversal in trend brought the share price up nearly 24% towards its 52-week high of $22.25 by June 6, 2018. On September 19, the share price closed at $21.14, which was 15.5% above the price from one year earlier and 17.6% higher than the March low. The combined benefit of the rising share price and steady dividend income rewarded shareholders with a 23.1% total return over the past 12 months. The total return over the three years was double that at 46.3%.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic