HP, Inc. Boosts Quarterly Dividend Payout 15% (HPQ)

By: Ned Piplovic,

HP, Inc. (NYSE:HPQ) – the computer hardware and peripherals manufacturer formerly known as the Hewlett-Packard Company – will reward its shareholders by boosting its upcoming quarterly dividend payout 15%.

Following a 35% annual dividend cut in 2016, HP, Inc. has enhanced its total annualized dividend payout nearly 30% for the three subsequent years. This level of growth converts to an average annual growth rate of nearly 9% per year. The company’s only other dividend cut in the past two decades occurred in 2011. After nearly tripling its total annual dividend payout between 1992 and 1998, the company distributed a flat $0.32 dividend through 2009 before beginning to raise its annual dividend payout again – excluding the aforementioned cuts in 2011 and 2016.

Including the inherited history of Hewlett-Packard, the company’s share price had several major selloffs but has moved up with relative consistency and with only one significant pullback since 2012. HP’s share price quadrupled since late 2012 and grew nearly 150% over the past two years.

While the rising share price suppressed the dividend yield growth, the combined benefit of rising dividend payouts and reliable asset appreciation nearly doubled the shareholders investment over the past three years and delivered a double-digit percentage total return over the past 12 months.

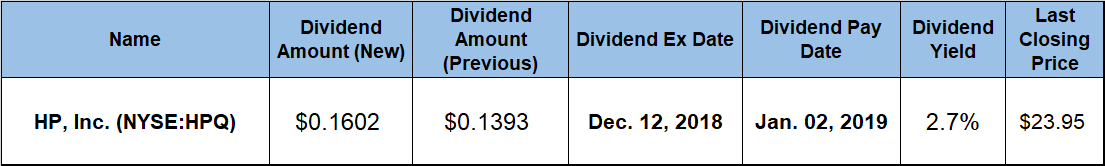

HP, Inc. will distribute its next dividend on company’s January 2, 2019, pay date to all its shareholders of record prior to the December 12, 2018 ex-dividend date.

HP, Inc.(NYSE:HPQ)

Headquartered in Palo Alto, California and founded in 1939 as the Hewlett-Packard Company, HP, Inc. provides consumer and business products, technologies, software and services. HP, Inc. was the legal entity that retained the old company’s personal computer and printer businesses during a split in 2015. The Hewlett Packard Enterprise Company (NYSE:HPE) retained the technology and rights to the enterprise information segment, which comprises enterprise networking, storage and server solutions. HP Inc. operates through two business segments – Personal Systems and Printing. The Personal Systems segment offers commercial personal computers (PCs), consumer PCs, workstations, thin clients, commercial tablets and mobility devices, retail point-of-sale systems, displays and other related accessories. Additionally, this segment offers software, support and services for the commercial and consumer markets. The Printing segment provides consumer and commercial printer hardware, supplies, media, solutions and services. This segment also offers printing and scanning devices, including 3D printing solutions.

The company will boost its quarterly dividend payout 15% from $0.1393 per share in the previous period to the current quarterly dividend distribution of $0.1602. this new dividend distribution amount corresponds to a $0.6408 annualized payout and currently yields 2.7%. The current yield is nearly 150% higher than the 1.09% average yield of the overall Technology sector. Additionally, the company’s 2.7% yield is also nearly 40% above the 1.92% simple average yield of all the HP’s peers in the Diversified Computer Systems industry segment.

In addition to a 9% dividend payout growth rate over the past three years, the company doubled the total annual dividend amount over the past decade, which still is equivalent to a 7.2% growth rate since 2009 despite two dividend cuts.

The share price started the trailing 12 months with a 15% gain but lost all those gains and more during the overall market pullback in early 2018 – during the last week of January and first week of February. After dipping to its 52-week low of $19.92 on February 8, 2018, the share price recovered those losses over the subsequent 30 days and continued to rise while battling some volatility. Just before the beginning of another market selloff in early October, the share price reached its 52-week high of $26.42 on October 4, 2018. After the early-October peak, the share price pulled back slightly along with the overall market and closed on December 3, 2018 at $23.95. This closing price was almost 10% below the peak from early October. However, that closing price was also 13.6% higher than it was one year earlier, more than 20% above the February low and nearly double the price from five years ago.

As already indicated, the capital gains and the dividend payouts income distributions combined for a double-digit percentage total return of 16.3% over the past year. While the 50% price pullback in 2015 limited the five-year total return to just 103.4%, the shareholders nearly doubled their return on investment over the past three years with a total return of 96%.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic