Hubbell Incorporated Boosted Annual Dividend Distribution 10 Consecutive Years (HUBB)

By: Ned Piplovic,

Featured Image Source: Company Website

Hubbell Incorporated (NYSE:HUBB) boosted its annual dividend every year over the past decade and the company’s current 2.55% dividend yield outperformed industry averages by significant margins.

In addition to the current streak of 10 consecutive annual dividend hikes, the company cut its annual dividend amount only one time in the past 18 consecutive years. That dividend cut occurred during the financial crisis in 2008. However, the company resumed its annual dividend hikes immediately and increased the total annual dividend amount above the 2007 level within two years.

Similarly, the share price lost almost 55% of its value between mid-2007 and February 2009. After reversing trend in early 2009, the share price embarked on a rising trend and ascended more than 350% over the past decade. The share price experienced a decline of more than 25% in early 2018. However, the January peak resulted from a share price spike in late 2017, Therefore, after recovering nearly half of those losses, the share price currently trades within its five-year trend range.

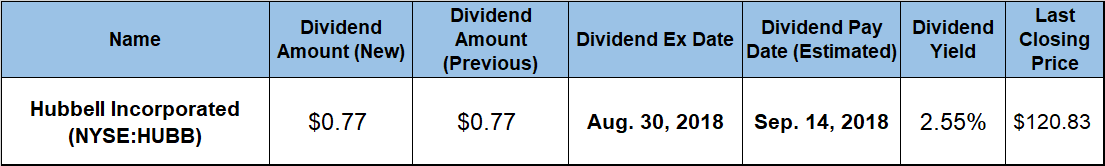

Investors interested in the rising annual dividend income and convinced that the share price could continue its current 90-day uptrend, should act quickly. The company’s next ex-dividend date will occur on August 30, 2018. The company will distribute its next quarterly dividend distribution on the September 14, 2018, pay date to all its shareholders of record prior to the August 30, 2018, ex-dividend date.

Hubbell Incorporated(NYSE:HUBB)

Based in Shelton, Connecticut and founded in 1888, Hubbell Incorporated designs, manufactures and sells electrical and electronic products. The company operates through two business segments. The Electrical segment offers standard and special application wiring device products, connector and grounding products, lighting fixtures and controls. Additionally, this segment offers other electrical equipment for use in industrial, commercial and institutional facilities, as well as components and assemblies for the natural gas distribution market. Furthermore, this segment also designs and manufactures various high voltage test and measurement equipment, industrial controls and communication systems for industrial markets, as well as the oil, gas and mining industries. The Power segment designs, manufactures and sells distribution, transmission, substation and telecommunications products. Over the past 130 years, the company evolved from a family owned business to a global player with 2017 revenues of $3.7 billion. As of May 2018, Hubbell Incorporated’s portfolio included 82 brands, with a third of those brands acquired in the last five years. The company spent nearly $900 million for these acquisitions and in the process increased its earnings before interest, taxes, depreciation and amortization (EBITDA) nine-fold.

The company’s share price spiked at the beginning of the trailing 12-month period and rose more than 22% over the first five months. After reaching its 52-week high of $139.21 on January 26, 2018, the share price gave back all those gains and continued to decline. The share price fell 26.4% below the January peak by the time the price reached its 52-week low of $102.51 on May 1, 2018.

However, the share price reverse direction again and resumed its growth trend. The share price ascended almost 18% to close at $120.83 on August 15, 2018. This closing price was 6% higher than one year earlier and 15% higher than it was five years ago.

The current $0.77 upcoming quarterly payout is 10% above the $0.70 dividend distribution from the same period last year. The new quarterly payout amount converts to a $3.08 annualized dividend and corresponds to a 2.55% forward yield. This current yield is 12.3% higher than the company’s 2.27% average yield over the past five years.

Furthermore, the company’s current yield performed even better compared to the average yields of its industry peers. The current 2.55% yield outperformed the 1.8% average yield of only dividend-paying companies in the Diversified Electronics industry segment by more than 40% and the 1.07% average of all the segment’s companies by almost 140%. Additionally, Hubbell’s current yield is also more than 125% above the 1.13% average yield of the entire Technology sector.

Over the past decade since the most recent dividend cut in 2008, the company advanced its total annual dividend payout amount three-fold from $1.03 to the current $3.08. This level of dividend growth corresponds to an average annual growth rate of 11.6%.

Despite the share price drop of more than 25% in early 2018, the shareholders received a total return of more than 8% over the last 12 months. The more stable share price growth over the past three years contributed significantly to the 25.4% total return over the past three years.

Dividend distribution increases and dividend distribution decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic