IBM Offers Shareholders 4.4% Forward Dividend Yield (NYSE:IBM)

By: Ned Piplovic,

After more than a century of dividend distributions and more than two decades of consecutive annual dividend hikes, the International Business Machines Corporation (NYSE:IBM) continues to be a draw for dividend-seeking investors and currently offers an above-average forward Dividend Yield of 4.4%.

Adjusting for stock splits, IBM has rewarded its shareholders with at least one quarterly dividend boost per year over the past 22 consecutive years. Since the onset of the current consecutive annual dividend hike streak in 1997, IBM has enhanced its total annual dividend distribution amount more than 15-fold.

In addition to offering its shareholders a steady supply of rising-dividend income, IBM was one of the most reliable asset appreciation stocks for decades. Unfortunately for long-term shareholders, IBM’s share price has experienced increased volatility since reaching its all-time high in 2013. Before peaking at nearly $216 in mid-March 2013, the share price had risen nearly seven-fold from the beginning of the current dividend hikes streak in 1997. However, the share price has lost more than 30% of its value since peaking in early 2013.

Since then, IBM’s been restructuring away from computer hardware manufacturing and is working towards assuming a leading role in the development and application of new technologies. IBM current focus is on delivering cloud storage solutions, data analytics, Artificial Intelligence (AI), digital solutions for farming, blockchain technology and other solutions.

Even the steady stream of dividend income payouts and annual dividend hikes were unable to compensate for the 30%-plus share price decline over the past few years and IBM’s existing long-term shareholders suffered total losses of more than 8% over the past five years. However, the share price pullback might be an opportunity for new investors to take a long position at currently discounted prices.

If the share price rebounds (even if the recovery takes a little longer than anticipated), the new investors will be able to collect a dividend income through the above-average dividend yield while waiting for the share price recovery.

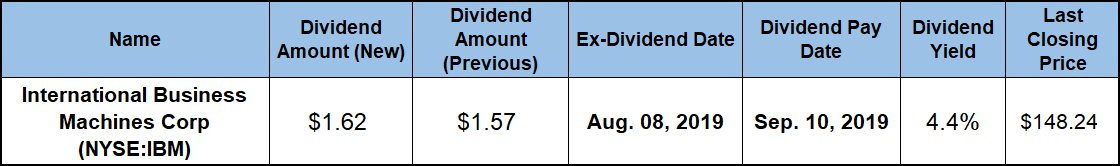

IBM’s most recent quarterly dividend hike was in the previous quarter. Since then, it has set its next distribution for September 10, 2019. On that pay date, IBM will distribute its next round of dividend payouts to all eligible investors who claim stock ownership before the August 8, 2019, ex-dividend date.

International Business Machines Corporation (NYSE:IBM)

Headquartered in Armonk, New York, and formed in 1911 as the Computing-Tabulating-Recording Company, the International Business Machines Corporation assumed its current name in 1924 and operates as an integrated technology and services company worldwide. The company’s Cognitive Solutions segment offers Watson — a cognitive computing platform that interacts in natural language, processes big data and learns from interactions with people and computers. In addition to Watson, this segment also offers data analytics solutions and transaction processing software that runs mission-critical systems in banking, airline and retail industries. The company’s Global Business Services segment offers business consulting services, application management services for packaged software applications, as well as finance, procurement, talent engagement and industry-specific business process outsourcing services.

Additionally, the Technology Services & Cloud Platforms segment provides cloud and outsourcing services, as well as technical support and integration software solutions. The company’s Systems segment offers servers, data storage products and the z/OS enterprise operating system. IBM’s Global Financing segment provides lease, installment payment plans, loan financing services and short-term working capital financing to suppliers, distributors and resellers, as well as remanufacturing and remarketing services.

Dividends

After the most recent dividend boost in the previous period, IBM’s $1.62 upcoming dividend payout amount is 3.2% higher than the $1.57 distribution from the same period last year. This new quarterly payout corresponds to a $6.48 total annual dividend distribution and a 4.4% forward dividend yield. The rising dividend distribution, as well as the share price pullback, have pushed the current dividend yield to a position that is 18% above IBM’s own 3.7% yield average over the past five years.

In addition to outperforming its own five-year average, IBM’s current dividend yield outperformed the 0.97% simple average yield of the overall Technology sector by more than 350%. This level of difference is not out of the ordinary for this particular sector as most companies in the Technology sector do not distribute dividends as they funnel most of their earnings into research and development. Therefore, the sector’s average yield is traditionally very low. However, since older and well-established companies like IBM can afford to distribute dividends to shareholders, their dividend yield will easily outperform the sectors yield average by significant margins.

Additionally, IBM also has the highest dividend yield in the Diversified Computer Systems industry segment. As such, IBM’s current 4.4% dividend yield is 140% higher than the 1.82% average yield of all the companies in the sector. Furthermore, IBM’s current yield has also outperformed the 3.71% yield average of the sector’s only dividends-paying companies by nearly 18%.

Since its most recent stock split in 1999, IBM has boosted its annual dividend payout every year. Over the past two decades, the total annual distribution has advanced nearly 14-fold. This level of advancement corresponds to an average growth rate of nearly 14% over the last 20 years.

Even as growth rates decline with annual payout amount appreciation, IBM has managed to maintain double-digit percentage growth rates. Over the past decade, IBM has enhanced its annual dividend amount three-fold for an average annual growth rate of 11.7%. Additionally, IBM has also managed a 10% average growth rate for its annual dividend over the last five years.

While unable to compensate fully for the 21% share price decline, the dividend income distributions have reduced the total losses to just 8% over the past five years. The combined benefit of share price movement and dividend distributions over the past three years managed to end up in positive territory with a 5.5% total return during that period. However, the share price delivered a gain over the trailing 12 months. While this was only a small gain, this asset appreciation added to the robust dividend yield for a total return of 8.4% over the last year.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic