Intel Corporation Offers Investors 2.3% Dividend Yield, 40%-Plus One-Year Total Return (INTC)

By: Ned Piplovic,

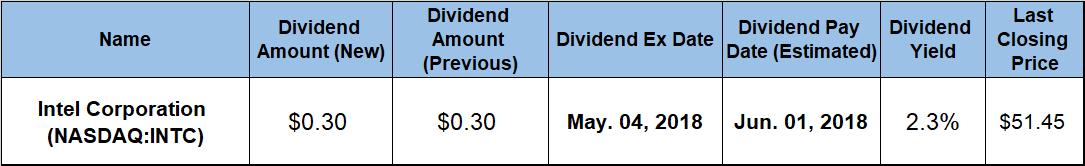

Intel Corporation (NASDAQ:INTC) offers a 2.3% dividend yield and continues to reward its shareholders with rising dividends, which the company has boosted 85% of the time in the past two decades.

While Intel Corporation’s current streak of consecutive annual dividend hikes is only four years, the company failed to raise its annual payout only three times in the past 20 years. In addition to the steadily increasing dividend payout and a moderate dividend yield, the company continues to reward its shareholders with stable asset appreciation that combined with the dividend income distribution for a total return on shareholder’s investment of more than 40% over the past 12 months.

Every investor should consider including a stock such as the Intel Corporation as a long-term foundation of any capital-growth portfolio. After analyzing the company’s financials and near-future outlook, investors interested in taking advantage of the upcoming dividend distributions must take a long position in the Intel stock prior to the May 4, 2018, ex-dividend date. All shareholders of record prior to that ex-dividend date will receive dividend payouts on the company’s next pay date, which will occur on June 1, 2018.

Intel Corporation (NASDAQ:INTC)

Intel Corporation (INTC) designs and manufactures microprocessors that process system data and controls, along with other devices in the system, chipsets that send data between the microprocessor and various peripherals and accessories, as well as computer, networking and communications platforms worldwide. Intel also develops and produces flash memory products primarily for use in solid-state drives, security software products, programmable semiconductors and related products for communications, data center, industrial, military and automotive market segments.

The company’s current $0.30 quarterly dividend payout is 10.1% higher than the $0.275 payout from the same quarter last year. This new quarterly amount is equivalent to a $1.20 annualized dividend payout for 2018 and a 2.3% forward dividend yield. The 72% share price growth over the past two years exceeded dividend growth over the same period by a wide margin, which suppressed the current dividend yield nearly 20% below the company’s own 2.9% average yield during the past five years.

However, the annual dividends still grew at a steady rate. The company missed a dividend hike in 2013. Since then, the company enhanced its total annual dividend amount 33% by boosting its annual payouts at an average rate of 7.5% per year. The company’s extended record of dividend hikes is even more impressive. Prior to 2013, the last time that the company failed to boost its total annual dividend was 2004. Over the 15 years since 2004, Intel advanced its annual dividend amount 15-fold by maintaining an average growth rate of 19.8% per year. Even with two additional missed dividend hikes over the past two decades, the company managed to maintain the same 19.8% average annual growth rate and increased its total annual dividend payout nearly 37-fold since 1998.

Most new companies in the Technology sector focus on reinvesting their earnings into research, development and growth. Therefore, only the minority of technology companies pay dividends and, most of the time, these are established technology companies, such as Intel. Therefore, it is no surprise that Intel’s current yield of 2.3% is 118% higher than the 1.07% average yield of the overall Technology sector and 26% above the 1.85% simple average yield of all the companies in the Broad Line Semiconductors market segment.

While Intel’s steady dividend income growth is attractive to investors, the company’s share-price growth makes an even more compelling case for ownership of Intel shares. The share price declined slightly more than 9% between the beginning of the current 12-month period and reached its 52-week low of $33.46 by July 3, 2017. After bottoming out in July 2017, the share price reversed its trend and has been rising since then. Despite several pullbacks of approximately 10%, the share price regained its losses quickly after every drop and continued to rise. The share price rose more than 60% between its 52-week low in July 2017 and its 52-week high of $53.61 on April 18, 2018. Since the recent peak, the share price pulled back 4% and closed on April 24, 2018, at $51.45, which was nearly 40% higher than it was 12 months earlier, 54% above the 52-week low from July 2017 and 115% higher than it was five years earlier.

The strong share-price growth and the rising dividend income combined to reward the company’s shareholders with a 44.6% total return over the last year, a 68.6% total return over the past three years and a total return of more than 140% over the past five years.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic