Intel Corporation Rewards Shareholders with 5% Quarterly Dividend Boost (INTC)

By: Ned Piplovic,

The Intel Corporation’s (NASDAQ:INTC) current 5% quarterly dividend boost is just the most recent step in the company’s long streak of rewarding the company’s shareholders with a steady source of rising dividend income.

The current streak of annual dividend hikes stretches back only five consecutive years. However, the reason for such a short consecutive streak is that Intel skipped a dividend boost in 2014 and just paid the same annual dividend amount as it did in the previous year. However, the 2014 missed dividend boost is the only such occurrence in the past 15 years. Actually, Intel failed to offer its investors an annual dividend boost only three times since initiating dividend distributions in the last quarter of 1992.

In addition to offering an annual dividend boost nearly 90% of the time, Intel also offers a steady dividend growth rate. During the current dividend boost streak over the past five years, the company enhanced its total annual dividend amount 40%. This enhancement corresponds to an average annual growth rate of 7%.

Over the past 15 years – which includes the missed dividend boost in 2014 – Intel advanced its total annual dividend amount nearly eight-fold – an average rate of 14.7% per year. Overall, the company managed an average annual dividend growth rate of nearly 20% by increasing its annual dividend payout 134-fold since its first dividend distribution in 1992.

While dividend growth rates continue to decline as the total payout amount increases, Intel’s current financials indicate that investors should not be overly concerned about dividend hikes. The company, current 37% dividend payout ratio indicated that the company is distributing just a little more than one-third of its earnings towards dividends. Therefore, the payout ratio is well within the sustainable range and Intel should be able to support continued dividend distributions and its current dividend boost streak for the foreseeable future. Additionally, the Intel’s current payout ratio is even lower than the company 44% five-year ratio average. The ratio reduction indicates that the company is even better positioned for continued dividend growth than it was a couple of years ago.

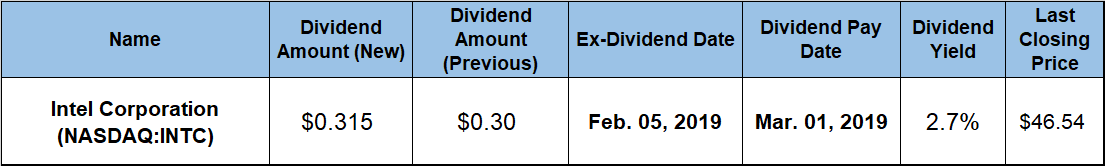

The Intel Corporation will distribute its next round of dividends on the company’s next pay date, which is set for March 1, 2019. On that pay date, the company will distribute quarterly dividend payouts to all investors who attained a shareholder of record status prior to the company’s February 5, 2019, ex-dividend date.

Intel Corporation (NASDAQ:INTC)

Intel Corporation (INTC) designs and manufactures microprocessors that process system data and controls, along with other devices in the system, chipsets that send data between the microprocessor and various peripherals and accessories, as well as computer, networking and communications platforms worldwide. Intel also develops and produces flash memory products primarily for use in solid-state drives, security software products, programmable semiconductors and related products for communications, data center, industrial, military and automotive market segments.

The company’s current 5% dividend boost advanced the quarterly payout amount from $0.30 in the previous period to the current $0.315 quarterly distribution for 2019. This new quarterly payout is equivalent to a $1.26 annualized dividend payout for 2019 and yields 2.7%, which is marginally above Intel’s own 2.68% average yield over the past five years.

Generally, only mature and established technology companies like the Intel Corporation distribute dividends. Most new companies in the sector focus on reinvesting their earnings into research, development and growth. Therefore, it is understandable that Intel’s current 2.7% dividend yield outperformed the 1.2% simple average yield of the overall Technology sector by more than 125%. Even compared to the 1.52% simple average of all the companies in the Broad Line Semiconductors industry segment, Intel’s current yield is 80% higher. Excluding companies that do not distribute dividends from the average yield calculation raises the segment’s average yield to 2.65%. While the margin might be only 2%, Intel’s current yield is still slightly higher than the average yield of the segment’s only dividend-paying companies.

Unfortunately for Intel’s current shareholders, the company’s share price declined enough to erase all gains from dividend distributions over the past 12 months. The offsetting share price decline and dividend distributions netted a marginal loss of 0.1%. However, over the past three years, the share price worked in unison with the rising dividends to reward Intel’s shareholders with a 64% total return. Furthermore, the shareholders more-than doubled their investment with a total return in excess of 113% over the past five years.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic