J.M. Smucker Company Hikes Quarterly Dividend 9% (SJM)

By: Ned Piplovic,

The J.M. Smucker Company (NYSE: SJM) is set to boost its quarterly dividend payout 9% in the upcoming distribution, which will also be the company’s 21st consecutive annual dividend hike.

In addition to the quarterly dividend hike, J.M. Smucker also offers a 3.1% current dividend yield, which outperforms the company’s own five-year average, as well as the average yields of industry peers.

After the 2008 financial crisis, SJM’s share price advanced nearly 350% and reached its all-time high in excess of $155 by July 2016. However, since that peak, the share price has pulled back on moderate volatility. While SJM is still recovering from a 23% drop over a 90-day period, the share price has gained more than 10% in the last 60 days and appears to be primed for additional gains.

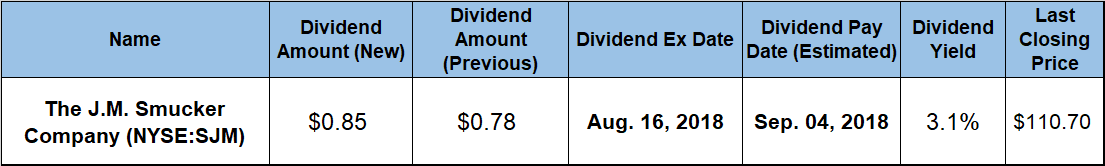

Because the recent uptrend means that now could be a good time to acquire shares at discounted prices, interested investors should observe the price movement over the next few weeks and act accordingly. Alternatively, long-term investors who are confident that the share price will rise along its established long-term trend can consider taking a position before the Aug. 16 ex-dividend date. Doing so will ensure shareholders receive the upcoming distribution on the September 4, 2018 pay date.

The J.M. Smucker Company(NYSE: SJM)

Headquartered in Orrville, Ohio and founded in 1897, the J.M. Smucker Company manufactures and markets branded food and beverage products. The company operates through four business segments — International & Foodservice, U.S. Retail Coffee, U.S. Retail Consumer Foods and U.S. Retail Pet Foods. Among the company’s almost 50 brands are Folgers, Dunkin’ Donuts, Jif, Smucker’s, Crisco, Pillsbury, Meow Mix, Milk-Bone, Natural Balance, Carnation and Hungry Jack.

After dropping 23% from the onset of the trailing 12-months to a 52-week low of $99.99 on November 6, 2017, SJM’s share price reversed direction and gained more than 30% towards its 52-week high of $131.53 on March 13, 2018. After peaking in mid-March, the share price gave back all those gains and fell to just one cent above its November low by early June 2018. However, the share price reversed trend one more time and closed on August 9, 2018 at $110.70, which was just 9% lower than one year earlier, nearly 11% above the 52-week low and even with its level from five years ago.

The upcoming quarterly dividend payout will increase from $0.78 in the previous period to $0.85 per share, a difference of about 9%. Annualized, an $0.85 payout results in a $3.40 yearly distribution amount and a 3.1% forward dividend yield, which is 33.5% higher than the company’s own 2.3% average yield over the past five years.

Additionally, the current yield of 3.1% outperforms the simple average yield of the entire Consumer Goods sector by more than 66% and is currently almost 80% higher than the average yield of all the company’s peers in the Processed & Packaged Goods industry segment.

J.M. Smucker has been distributing dividends since 1949 and has boosted its annual dividend for more than two decades. Over the past twenty years, SJM has advanced its annual dividend payout amount almost six-fold. The average annual growth rate of 9.2% over that period is in line with the company’s current quarterly dividend hike rate as well.

Unfortunately, the recent share price decline of more than 23% dropped the overall returns into a single-digit-percentage loss of almost 7%. However, over the longer-term of the last three and five years, the company rewarded its shareholders with total returns of 9% and 10%, respectively. While these total returns seem small, the company’s dividend offers steady, above-average dividend income. Plus, just a small gain in the share price as it progresses along its current uptrend could bring total returns well into the double-digit percentage territory again.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic