Kellogg Company Hikes Quarterly Dividend Distribution Amount 3.7% (K)

By: Ned Piplovic,

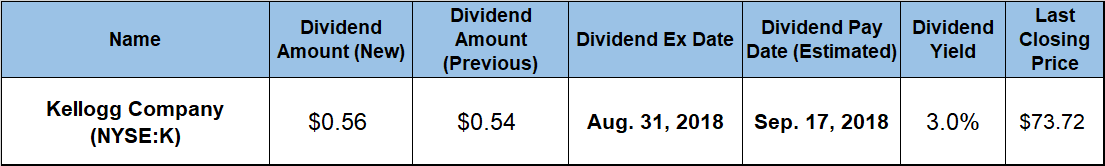

The Kellogg Company (NYSE:K) hiked its upcoming quarterly dividend distribution 3.7% over the previous period’s payout amount and extended the company’s streak of annual dividend hikes to 14 consecutive years.

In addition to 14 consecutive annual dividend distribution hikes, the Kellogg Company has boosted its annual payout 17 times over the past two decades — 85% of the time — with no dividend cuts. Unlike the previous quarter, when the dividend income had to offset some of the share price losses over the preceding 12 months, the current share price has been rising steadily over the past 90 days and has been trading above its level from one year earlier since the beginning of August 2018. Therefore, the small asset appreciation and the moderate dividend income combined over the past 12 months for total returns of nearly 9%.

The recent trend reversal appears to put the share price back in line with the company’s long-term trend of general growth with occasional volatility. Every share price pullback during the past three decades turned out to be an opportunity for investors to buy shares at a discount and take advantage of the next price increase.

Another reason to consider taking position in the Kellogg’s stock is the company’s positive hear-term outlook and operational initiatives aimed at cost-reducing to strengthen profit margins. The largest of the current initiatives is the company’s decision to abandon its direct-store delivery (DSD) program and switch to a centralized warehouse delivery model. While the DSD program has cost and delivery speed advantages, the program yields these advantages only for supply chains with a low variety of products shipped in large volumes from a manufacturing facility directly to the store. However, Kellogg’s current portfolio comprises more than 20 brands and hundreds of product variants produced in more than two dozen manufacturing facilities just in the United States. Therefore, a centralized warehouse distribution model is operationally and financially a better fit for the company going forward.

The next ex-dividend date will occur on August 31, 2018. Approximately three weeks later — on the September 17, 2018, pay date — the Kellogg Company will distribute its next round to all shareholders of record before the ex-dividend date.

Kellogg Company (NYSE:K)

Headquartered in Battle Creek, Michigan, and founded in 1906, the Kellogg Company manufactures and markets ready-to-eat cereal and convenience foods. The company operates through U.S. Morning Foods, U.S. Snacks, U.S. Specialty, North America Other, Europe, Latin America and Asia-Pacific segments. The Kellogg Company’s main products include cookies, crackers, savory snacks, toaster pastries, cereal bars, granola bars and bites, fruit-flavored snacks and ready-to-eat cereals. The company also offers a line of frozen breakfast foods, including waffles, pancakes and French toast. In addition to the Kellogg brand, the company offers its products under the Kashi, Bear Naked, Eggo, Morningstar Farms, Keebler, Cheez-It, Pringles, Famous Amos and several other brands. In addition to 25 manufacturing facilities in the United States, the Kellogg Company operated an additional 31 plants to support the distribution and sales of its products in approximately 180 countries around the world.

The company’s share price entered the trailing 12 months on a declining trend and passed through its 52-week high of $73.49 on June 16, 2017. The share price reversed trend in November 2017 and rose to within 4% of its 52-week high by mid-March 2018. However, that recovery was only temporary as the share price plunged nearly 20% to its 52-week low of $56.65 by May 2, 2018. Since bottoming out at the beginning of May, the share price regained 8.6% and closed on May 22, 2018 at $61.52.

Juxtaposed with the company’s share price troubles is the company’s dividend performance. The company has been paying dividends for nearly a century. It has not cut its dividend distribution in the past two decades and has boosted its annual dividend distribution amount for the past 14 consecutive years. The company’s current $0.54 quarterly distribution is 3.8% higher than it was in the same period last year. Additionally, the company’s current quarterly distribution is equivalent to a $2.16 annualized amount and a 3.5% dividend yield, which is 17% higher than its 3% average yield over the past five years.

In addition to outperforming its own average yield, the Kellogg Company’s current 3.5% yield is 81% higher than the 1.94% average yield of the entire Consumer Goods sector and 68% higher than the 2.1% average yield of all the companies in the Processed & Packaged Goods market segment. Furthermore, as the fifth-highest current yield in the Processed & Packaged Goods segment, Kellogg’s yield is also 9.4% higher than the 3.2% average yield of the segment’s dividend-paying companies.

Over the most recent 12-month period, shareholders’ total return was 8.92%. Returns were 15.56^ and 33.80% over the last three and five years, respectively.

Dividend distribution increases and dividend distribution decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic