Kellogg Company Offers Shareholders 3.5% Dividend Yield, Boosts Annual Payout 15 Consecutive Years (NYSE:K)

By: Ned Piplovic,

After boosting its annual dividend distribution for 15 consecutive years, the Kellogg Company (NYSE:K) continues to provide shareholders with dividend income at above-average dividend yield levels.

In addition to the current streak of 15 consecutive annual dividend boosts, the Kellogg Company also enhanced its annual payout 17 times in the past 20 years, or 85% of the time. Furthermore, three years of flat dividend payouts from 2002-04 are the only three years when the Kellogg Company failed to boost its annual distribution amount in the past six decades — a 95% success rate.

Over the previous couple of years, a declining share price erased all dividend income gains to deliver total losses on shareholders’ investment. However, a steady uptrend over the past six months, pushed the share price higher and turned overall losses into a double-digit-percentage total return over the trailing one-year period.

While riding a solid uptrend, the share price is still slightly below the company’s long-term average trend. Because of the long-term uptrend, every share price decline over the past several decades was an opportunity for investors to take a long position and benefit from the subsequent share price recovery and additional advancement.

Furthermore, the Kellogg Company continues revising its operational framework to adjust to the changing market demands. One of the most significant changes it’s the company’s choice to change its old direct-store delivery (DSD) distribution setup and switch to a centralized warehouse delivery model. Despite cost and delivery speed advantages, the DSD offers those advantages only for distribution networks with a low product variety and high volumes sufficient to deliver full-truck loads directly from the production facility to the stores.

However, Kellogg Company’s current mix of nearly 20 brands and thousands of individual product varieties does not generate sufficient volumes for direct factory-to-store shipments. Instead, the company aggregates products from various production facilities in dozens of centrally located and strategically positioned distribution centers to build full-truck loads for individual store deliveries.

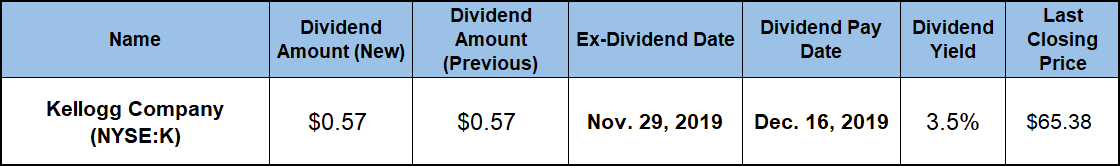

As with every decision, interested investors must conduct their own analysis and due diligence to evaluate and confirm the stock’s advancement potential and compatibility with their own investment portfolio strategy. Those investors that deem the Kellogg stock worthy of inclusion in their portfolio should act before the upcoming ex-dividend date on November 29, 2019, to ensure eligibility for the next round of dividend distributions. Kellogg will distribute its last quarterly dividend of 2019 to all its shareholders of record on the Dec. 16 pay date.

Kellogg Company (NYSE:K)

Founded in 1906 as the Battle Creek Toasted Corn Flake Company and currently headquartered in Battle Creek, Michigan, the Kellogg Company manufactures and markets ready-to-eat cereal and convenience foods. The company operates through U.S. Morning Foods, U.S. Snacks, U.S. Specialty, North America Other, Europe, Latin America and Asia-Pacific segments. The Kellogg Company’s main products include cookies, crackers, savory snacks, toaster pastries, cereal bars, granola bars and bites, fruit-flavored snacks and ready-to-eat cereals. The company also offers a line of frozen breakfast foods, including waffles, pancakes and French toast. In addition to the Kellogg brand, the company offers its products under the Kashi, Bear Naked, Eggo, Morningstar Farms, Cheez-It, Pringles and several other brands. In addition to 25 manufacturing facilities in the United States, the Kellogg Company operated an additional 31 plants to support the distribution and sales of its products in approximately 180 countries around the world. In the first half of 2019 the company divested a portion of its business to focus on its core cereals and snacks businesses. In the first half of 2019, a $1.3 billion transaction transferred all assets and intellectual property of Kellogg’s cookies business — including the Keebler, Mother’s, Famous Amos, Murray’s, and Murray’s Sugar Free brands — to the Italian manufacturer of chocolate and confectionary products, Ferrero SpA.

Unlike the share price, which fluctuated and experienced moderate volatility over the past several years, the Kellogg Company’s dividend payout has continued to rise almost continuously over the last six decades. Just over the last two decades, the annual dividend distribution amount rose nearly 130%. This level of advancement corresponds to an average dividend growth rate of 5.6% per year.

For its most recent quarterly payout in September 2019, the Kellogg Company enhanced its quarterly payout 1.7% from $0.56 to the current $0.57 payout amount. This new quarterly distribution amount is equivalent to a $2.28 annualized distribution and a 3.5% forward dividend yield. The current forward yield outperformed Kellogg’s own 3.18% five-year average dividend yield by more than 10%.

In addition to outperforming its own average yield, the Kellogg Company’s current 3.5% yield outperformed by almost 75% the 2.01% average yield of the entire Consumer Goods sector. Furthermore, the current 3.5% dividend yield is also 25% higher than the 2.78% simple average yield of the Kellogg Company’s peers in the Processed & Packaged Goods industry segment. Moreover, as the fourth-highest current dividend yield in the Processed & Packaged Goods segment, Kellogg’s yield is also 2% higher than the 3.42% dividend yield average of the segment’s only dividend-paying companies.

A share price decline of nearly 40% offset all dividend payouts over the last three years and resulted in a 1% total loss over that period. The same share price pullback limited the total returns over the last five years to just slightly above 15%. However, a share price recovery of nearly 25% since the five-year low in late-May 2019 delivered a gain of nearly 6% and contributed almost two-thirds of the 9.3% total return over the trailing 12-month period.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic