KeyCorp Raises Quarterly Dividend 14.3% (KEY)

By: Ned Piplovic,

Featured Image Source: www.key.com/about/company-information/key-company-overview.jsp

Since nearly eliminating its dividend payment in the aftermath of the financial crisis, KeyCorp (NYSE: KEY) has continued to rebuild its dividend distributions and is now in its eighth consecutive year of annual increases.

While the company still has a long way to go before hitting its pre-crisis payment levels again, the upcoming 14.3% quarterly dividend boost is certainly a move in the right direction. Since resuming dividend hikes in 2011, KeyCorp has enhanced its total annual dividend payout more than 10-fold. However, since KeyCorp’s dividend payout ratio is still low, it helps instill confidence that the company will be able to continue raising its dividends for the foreseeable future.

In addition to the rising dividend payments, Keycorp’s share price has risen more than three-fold since the financial markets declined in 2008. Combine these two increasing amounts and KEY offers an attractive long-term total return on shareholder investment.

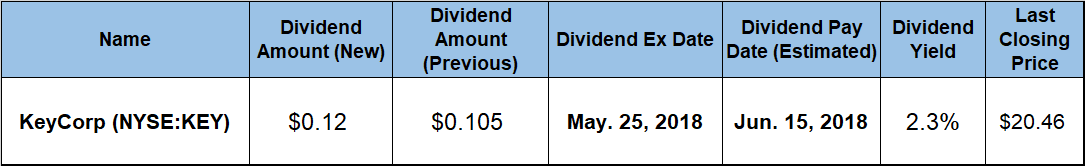

After conducting thorough due diligence, investors who are interested in adding KeyCorp’s shares to their portfolio may want to do so before the company’s May 25, 2018 ex-dividend date. Doing so will ensure eligibility for the next round of dividend distributions on the June 15, 2018 pay date.

KeyCorp (NYSE:KEY)

Headquartered in Cleveland, Ohio and founded in 1849, KeyCorp operates as the holding company for KeyBank National Association that provides various retail and commercial banking services in the United States. The company’s Key Community Bank segment offers various deposit and investment products, including residential mortgages, home equity loans, credit cards, personal property insurance and casualty insurance. Additionally, the bank purchases retail auto sales contracts through a network of auto dealerships, offers financial planning, asset management and trust services. The Key Corporate Bank segment offers a suite of banking and capital market products, such as commercial payments, equipment finance, commercial mortgage banking, derivatives, foreign exchange, financial advisory and various types of corporate loans. As of December 31, 2017, the company offered its products and services through nearly 1,200 retail banking branches and more than 1,500 automated teller machines.

After raising the quarterly dividend to $0.105 per share in August 2017, the upcoming quarterly payment will increase to $0.12 per share, a 14.3% boost from the previous level. This new quarterly payout equals a $0.48 annualized distribution for 2018 and a 2.3% forward dividend yield. While the company’s share price has nearly doubled over the past five years, the dividend growth rate has outpaced the share price increases. Additionally, the current 2.3% yield is more than 17% above company’s own five-year average of 2%.

Over just four quarters, starting in mid-2008, KeyCorp nearly eliminated its dividend distribution entirely. The dividend fell from a robust $0.375 per share quarterly payout (more than a 7% yield at current prices) to $0.1875 to $0.0625 to the symbolic $0.01 amount by the second quarter of 2009. KeyCorp continued paying that $0.01 quarterly dividend for eight subsequent periods before resuming dividend boosts in the second quarter of 2011. Since the $0.04 annual dividend amount in 2010, the company has augmented its total annual dividend 12-fold, which converts to an average growth rate of 36.4% per year over the past eight years.

In addition to the above-average dividend growth rate, KeyCorp also has seen robust asset appreciation since the company lost 87% of its value in the aftermath of the 2008-2009 recession. This share price growth paused during the first half of 2017, and KEY entered the trailing 12-month period on a slight downtrend. This downtrend continued for the next four months, with KEY shares reaching a 52-week low of $16.28 on September 7, 2017.

Since that low, KEY has advanced more than 25% to close at $20.35 on May 16. With a 52-week high of $22.40 achieved in March 2018, KeyCorp’s maximum appreciation off its low is over 30%. The closing price of $20.35 represents 9.76% growth the past 12 months and is almost 100% higher than five years prior.

The combined effect of rising dividend payments and robust long-term asset appreciation gave KeyCorp’s shareholders approximately a 12% total return over the past 12 months, a 40% total return over the past three years and a 105% total return over the last five years.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic