Kinder Morgan Pays 4.5% Dividend Yield (KMI)

By: Ned Piplovic,

After starting 2016 with a 75% quarterly dividend cut and its share price 67% lower than the 2015 high, Kinder Morgan, Inc. (NYSE:KMI) resumed raising its dividend and appreciating its share price in 2018 and currently offers its shareholders a 4.5% dividend yield.

The company paid a flat $0.50 annual dividend for two years but started 2018 with a significant dividend boost. Additionally, the current dividend yield outperformed the sector average by more than 100%. The company’s share price declined for most of the past year but reversed trend in mid-March and has been advancing higher over the past four months.

While technical indicators did not give a clear signal of a continued share price uptrend, the 50-day moving average (MA) has been rising since May 29, 2018, and it advanced from nearly 10% to just 0.7% below the 200-day MA as of the July 23, 2018, closing. At this pace, the 50-day MA could breach above the 200-day MA as early as this week.

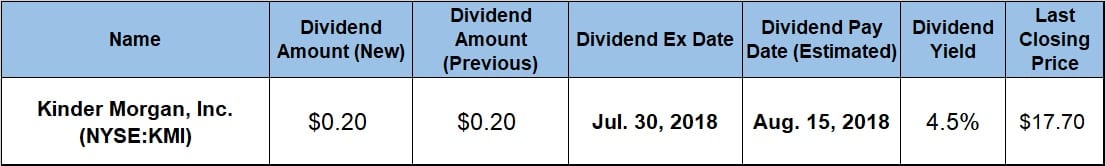

Risk-averse investors could take a chance that the technical indicators will confirm the current trend in the next week or two and take a long position now. While riskier than waiting for the actual moving average crossover, the advantage of acting now is that investors taking a position before the next ex-dividend date on July 30, 2018, will be eligible to receive the upcoming quarterly dividend on the August 15, 2018, pay date.

Kinder Morgan, Inc. (NYSE:KMI)

Headquartered in Houston, Texas, and founded in 1936, Kinder Morgan, Inc. operates as an energy infrastructure company in North America through five business segments. The Natural Gas Pipelines segment owns and operates natural gas and crude oil gathering, pipeline, storage and transportation systems. The CO2 segment produces, transports and markets carbon dioxide (CO2) for recovering crude oil from mature oil fields and operates a crude oil pipeline system in West Texas. Additionally, the Terminals segment owns and operates liquids and bulk terminals and tankers that transload, store and transport refined petroleum products, crude oil, chemicals, ethanol, coke, steel and coal. Furthermore, the Products Pipelines segment owns and operates refined petroleum products, NGL and crude oil and condensate pipelines, terminals and transmission facilities. Lastly, the Kinder Morgan Canada segment owns and operates the Jet Fuel aviation turbine fuel pipeline that serves the Vancouver International Airport and the Trans Mountain pipeline system — which transports crude oil and refined petroleum products from Alberta, Canada to marketing terminals and refineries in British Columbia, Canada and Washington state. As of June 2018, Kinder Morgan, Inc. owned or operated approximately 85,000 miles of pipelines and 152 terminals.

The company hiked its quarterly dividend 60% in the first quarter of 2018 from $0.125 in the last period of 2017 to the current $0.20 quarterly payout. This current amount corresponds to a $0.80 annualized dividend distribution and a 4.5% dividend yield, which is more than 10% above the company’s own 4.1% average yield over the past five years. Additionally, the company’s current dividend yield is more than twice the 2.19% average dividend yield of the entire Basic Materials sector and just 6.5% below the 4.84% average yield of the Oil & Gas Pipelines industry segment.

Despite the higher-than-sector-average dividend yield of 4.5%, the company’s dividend income could not overcome the share price decline over the past few years and delivered to the shareholders a total loss of more than 40% over the past three years and the last five years. However, the share price trend reversal since mid-March 2018, reduced the total loss to just slightly above 10% over the past 12 months.

The company’s share price experienced slow growth since hitting its all-time low in January 2016. Entering the trailing 12-month period on a downtrend, the share price passed through its 52-week high of $20.33 on July 24, 2017, and continued to decline more than 27% before bottoming out at its 52-week low of $14.81 on March 21, 2018.

However, since the March low, Kinder Morgan’s share price has experienced reduced volatility and closed on July 23, 2018, at $17.70. This closing price was almost 13% below its peak from July 2017 and more than 50% lower than it was five years earlier. However, the current closing price was almost 20% above the 52-week low from mid-March 2018.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic