Life Storage Offers Shareholders 4% Dividend Yield (LSI)

By: Ned Piplovic,

Life Storage, Inc. (NYSE: LSI) has boosted its annual dividend amount for the past five consecutive years and currently offers a 4% dividend yield.

Over the past two decades, LSI has an 80% track record of annual dividend boosts, the only exceptions being one dividend cut in 2009 and three years where payouts were flat. Despite some volatility in the stock price over the last five years, the company has powered upwards in the last year, giving shareholders a total return of more than 40% over the past 12 months.

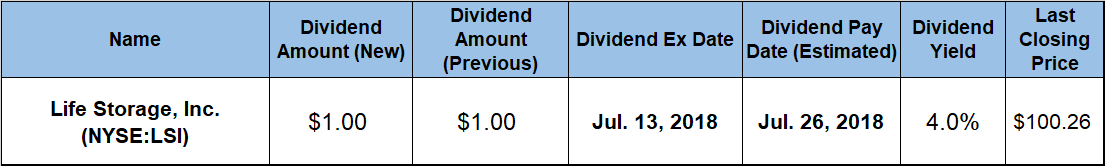

Investors who are interested in adding this equity to their portfolio and wish to be eligible for the next round of dividend payouts, scheduled for July 26, must take a position before the fast-approaching ex-dividend date on July 13, 2018.

Life Storage, Inc. (NYSE:LSI)

Headquartered in Buffalo, New York and founded in 1985, Life Storage, Inc. is a self-administered and self-managed equity REIT that acquires, operates and manages self-storage facilities. As of June 2018, the company’s portfolio comprised 711 storage facilities in 28 states, with a combined leasable space of more than 50 million square feet. The company wholly owns 566 of those facilities, operates 98 facilities through joint ventures and manages 47 facilities for other owners. With a focus on operating facilities in major markets, Life Storage has a presence in 18 of the top 25 fastest growing markets in the country, as defined by the Forbes’ 2018 Fastest Growing U.S. Cities list.

Formerly known as the Sovran Self Storage, Inc., the company changed its name to Life Storage in 2016. The company serves nearly 400,000 residential and commercial storage customers. Starting in 2010, the company placed additional focus on growing its third-party management revenue and the initiative yielded positive results. Life Storage increased its third-party management revenue 75% from 2016 to 2017, managed to maintain a 36% compounded average growth rate since 2011 and projects additional double-digit-percentage growth for 2018.

Life Storage grew its annual dividend at a steady pace between 1995 and 2008. However, the financial crisis caused the company to cut its dividend nearly 30%, going from a $0.64 quarterly amount in the second quarter of 2009 to a $0.45 quarterly distribution in the next period. Following the dividend cut in 2009, Life Storage distributed the same $0.45 amount for the next 14 quarters.

In 2013, Life Storage resumed its dividend hikes and has done so for each of the past five consecutive years. Over those five years, the total annual dividend amount rose more than 120%, which is equivalent to an average growth rate of 14.2% per year.

Currently, Life Storage pays out a $1.00 quarterly dividend, which corresponds to a $4.00 annualized payout and a 4% forward dividend yield. The 4% yield that LSI currently sports is slightly below the simple average dividend yield of the Diversified REITs industry segment and 31% higher than the 3.04% average yield of the entire Financials sector. Compared to LSI’s five-year average yield, the company’s current yield is about 5% higher.

Between March 2016 and the beginning of the trailing 12-month period that started in early July 2017, LSI’s share price saw a 40% decline. In the last 12 months, though, it has seen significant gains, going from a 52-week low of $70.59 in July to more than $91 by mid-December 2017. After a brief pullback, shares resumed the uptrend and ascended 31% to a 52-week high of $100.76 on July 5. Shares currently trade just slightly below that level, having closed at $100.26 on July 26. This closing price was 42% higher than the 52-week low from early July 2017.

While the 4% dividend yield contributed to the 46% total return over the past 12 months, the main driver of the strong performance was the share price growth. The share price decline in 2016 limited the three-year total return to just 27%. However, the total return over the past five years exceeded 75%.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic