Lowe’s Record of Consecutive Annual Dividend Hikes Nears Six Decades

By: Ned Piplovic,

Based on the timing of annual dividend hikes, investors should expect Lowe’s Companies, Inc. (NYSE:LOW) to declare its 58th consecutive annual dividend hike in late May or early June 2019.

However, the company is not relying solely on its very long record of annual dividend hikes to attract income investors. The company’s current 2% yield is on the lower end of what dividend investors seek but it is still only slightly below the 2.7% simple average dividend yield of all the companies in the Dividend Aristocrats group.

The Dividend Aristocrats consist of S&P 500 companies that have boosted their annual dividends for at least 25 consecutive years and whose individual market capitalization exceeds $3 billion. Currently, only 53 companies have met the criteria for the Aristocrat designation. The dividend yields in this group currently range between the low yield of 0.7% for Roper Technologies Inc. (NYSE:ROP) and a high of 6.5% for AT&T Inc. (NYSE:T).

Furthermore, in addition to exceeding the 25-year mark required for the Aristocrat designation, LOW’s current streak of annual dividend boosts also exceeds the 50-year minimum requirement for inclusion in the even more exclusive group of just 25 Dividend Kings. Even among the Dividend Kings, LOW’s current streak of annual dividend hikes is in the top of the group. Only eight companies have dividend hike streaks that are longer than the LOW’s current 57 years.

Additionally, Lowe’s current yield is equal to the 2% average yield of the entire Services sector and only slightly lower than the 2.15% simple average yield of the Home Improvement Stores industry segment. Compared to the current 2.3% dividend yield of its main competitor – Home Depot, Inc. (NYSE:HD) – LOW’s current yield trails only by 30%. However, Home Depot failed to boost its annual dividend in 2008 and 2009 and has a current streak of only nine consecutive annual dividend hikes.

Additionally, compared to the Lowe’s current dividend payout ratio of 40%, Home Depot distributes a larger share of its earnings as dividends – 58% – to support its current dividend payouts. Even over the past five years, Home Depot’s average payout ratio of 48% is higher than the 38% ratio paid by Lowe’s. The lower payout ratio is more sustainable and is an indication that the company is more likely to continue to distribute its rising dividends.

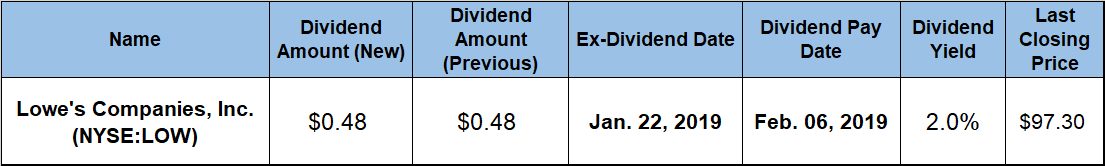

All shareholders of record prior to Lowe’s January 22, 2019, ex-dividend date will be eligible to receive the next round of dividend distributions on the company’s next pay date, which is set for February 6, 2019.

Lowe’s Companies, Inc. (NYSE:LOW)

Headquartered in Mooresville, North Carolina and founded in 1946, Lowe’s Companies, Inc. operates as a home improvement company in the United States, Canada and Mexico. The company provides home improvement products in various categories, such as lumber and building materials, tools and hardware, appliances, fashion fixtures, rough plumbing and electrical, seasonal living, lawn and garden, paint, flooring, kitchens, outdoor power equipment, and home fashions. Additionally, Lowe’s offers installation services through independent contractors in various product categories and extended protection plans, as well as warranty and non-warranty repair services. As of 2018, the company operated 2,390 home improvement and hardware stores. In addition to its stores, the company also sells its products through the Lowes.com and Lowesforpros.com websites and through mobile applications.

The company’s current $0.48 quarterly dividend is more than 17% above the $0.41 payout from the same period last year. This new quarterly distribution converts to an annual dividend of $1.92, which is equivalent to the 2% dividend yield at the current price level. Additionally, the company’s current 2% yield is 26.5% above the company’s own 1.6% yield over the past five years.

In addition to its extensive streak of annual dividend hikes, Lowe’s also manages to reward its shareholders with above-average growth rates. The company maintained an average growth rate of more than 21% over the past five years. Even over the extended time horizon, Lowe’s managed to maintain double-digit percentage growth rates. Despite slower growth in the aftermath of the 2008 financial crisis, the total annual dividend payout still advanced more than five-fold over the past decade, which corresponds to an average annual growth rate of 18.6% per year. Furthermore, the company advanced its total annual dividend payout 64-fold over the past two decades, which is equivalent to a 23.1% average annual growth rate since 1999.

Related Articles:

5 Best Dividend Aristocrats to Buy Now

The Dividend Aristocrats Investing Strategy and Stocks List

The Best Dividend Aristocrats ETFs

Why Invest in the Dividend Aristocrats?

The S&P 500 Dividend Aristocrats — Everything You Need to Know

What are the Dividend Aristocrats?

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic