Marathon Petroleum Delivers Eight Consecutive Annual Dividend Hikes, 3.8% Dividend Yield (MPC)

By: Ned Piplovic,

The second-largest petroleum refiner in the United States — the Marathon Petroleum Corporation (NYSE:MPC) — rewarded its shareholders with consecutive annual dividend hikes for the past eight years and currently offers a 3.8% dividend yield.

Driven by the integration of the recently acquired Andeavor unit into the company’s operations and the overall market correction in late 2018, Marathon’s share price declined more than 30% over the trailing 12-month period. However, the company maintained a steady annual income payout growth since introducing dividends in 2011. The enhancement of 370% over the past eight years corresponds to an average annual dividend growth rate of 21.4%. The share price pullback and the rising dividend income pushed the Marathon Petroleum Corporation’s dividend yield more than 60% above the 2.3% level from just one year earlier.

However, prior to the current pullback, the Marathon Petroleum Corporation advanced its share price at a relatively steady pace for several years. Since initiating dividend distributions in 2011, the share price encountered just one significant correction of more than 40%. After losing close to half its value in 2015, the share price resumed a relatively steep uptrend and nearly tripled before peaking at its all-time high in early October 2018.

Furthermore, the company’s current 38% dividend payout ratio is still slightly lower than the company’s own 39% five-year ratio average. The payout ratio of 38% indicates that the Marathon Petroleum Corporation currently distributes only a little more than one third of its earnings in its current dividend distributions. With its payout ratio well within the 30% to 50% sustainable range, the company has demonstrated its ability to cover its dividend distributions with ease, at least in the near term. Additionally, the current payout ratio level also indicates that the Marathon Petroleum Corporation should be able to support the continuation of its current streak of consecutive annual dividend hikes.

While the company’s dividend income history and future outlook look good, even the current share price pullback might be an advantage for some investors. Whereas long-term shareholders lost nearly one third of their investments over the past year, new investors who are looking for an equity with reliable dividend income payouts and a potential for robust capital gains could discover that the Marathon Petroleum Corporation might fit that profile.

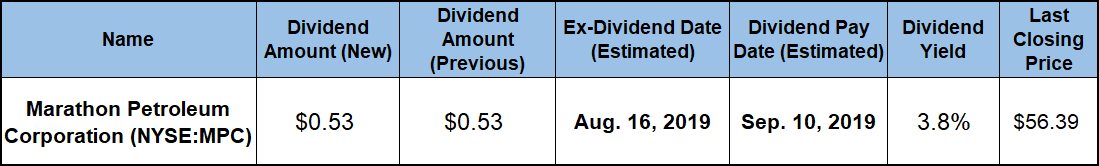

However, as with any investing decision, investors interested in the Marathon Petroleum Corporation stock must perform their own due diligence before taking any action. Investors whose analysis indicates that the Marathon Petroleum Corporation might be a good investment should act before the next ex-dividend date on August 16, 2019. Claiming stock ownership before this ex-dividend date will ensure eligibility for the next round of dividend distributions on the September 10, 2019, pay date.

Marathon Petroleum Corporation (NYSE:MPC)

Headquartered in Findlay, Ohio, and incorporated in 2009, the Marathon Petroleum Corporation engages in refining, marketing, retailing and transporting of petroleum products. The company’s three business segments — Refining, Midstream and Retail — offer a full spectrum of products and services from crude refining to distribution and the direct sale of its products to final customers. As the largest refiner in the United States, the company’s Refining sector operates 16 refineries in 13 U.S. States with a total refining capacity of more than three million barrels per day. This segment refines crude oil into gasoline, distillates, propane, heavy fuel oil and asphalt. As of July 2019, the Marathon Petroleum’s Midstream segment primarily includes the operations of MPLX LP and Andeavor Logistics LP — the company’s sponsored master limited partnerships. This segment transports, stores, distributes and markets crude oil and refined products through 120 terminals and a network of more than 13,000 miles of various product transportation and distribution pipelines. Additionally, the company’s Retail segment sells its product in 43 U.S. states and the District of Columbia through approximately 6,800 Marathon, Arco and Speedway branded retail outlets. The Marathon petroleum Corporation owns and operates more than 57% of these retail locations — 3,900 of them — and independent third-party operators run the remaining locations. The company’s Speedway LLC subsidiary owns and operates the nation’s second-largest convenience store chain, with nearly 2,800 convenience stores in 21 states.

The company’s current $0.53 quarterly payout is 15% higher than the $0.46 dividend distribution from the same period last year. Over the past three years, the quarterly payout amount has advanced nearly 50%. This current $0.46 quarterly distribution is equivalent to a $2.12 annualized payout and a 3.8% forward dividend yield. The current dividend yield is almost 30% higher than the company’s own 2.4% average yield over the past five years.

Furthermore, Marathon’s current dividend yield is nearly 70% higher than the 2.22% simple average yield of the entire Basic Materials sector. While Marathon’s current yield trails the 4.78% yield average of the Oil & Gas Refining & Marketing industry segment, that comparison is slightly misguided. Many of the top-yielding equities in the Oil & Gas Refining & Marketing segment that are driving the average yield higher are trusts and limited partnerships. As such, these equities are designed to funnel earnings to the unitholders and partners. Therefore, due to their specific setup, these equities have naturally higher yields.

However, stripping these equities from the average yield calculation makes the Marathon Petroleum Corporation’s current yield as much more competitive. Compared to the 2% adjusted segment average that excludes trusts and limited partnerships, Marathon’s current yield is 88% higher. Furthermore. Marathon’s current yield is also nearly 12% above the 3.36% adjusted average dividend yield of the segment’s only dividend-paying companies.

Despite rising at double-digit percentages, the dividend income was unable to counter the 30%-plus share price decline over the trailing 12 months. However, dividend distributions managed to reduce the total one-year loss to 27%. Longer-term analysis shows stronger results. The five-year total return has been 54%. Finally, the timing of a share price drop in late 2015 and early 2016 resulted in a three-year total return of nearly 58% that outperformed the aggregate total return over the last five years.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic