Marathon Petroleum Offers 2.8% Dividend Yield, Seven Consecutive Annual Dividend Hikes (MPC)

By: Ned Piplovic,

The Marathon Petroleum Corporation (NYSE:MPC) — the second-largest petroleum refiner in the United States — Delivered to its shareholders consecutive annual dividend hikes for the past seven years and currently offers its shareholders a 2.8% dividend yield.

The overall market selloff and the oil price decline since the beginning of October 2018 pushed the share price into a steep downtrend. However, prior to the current deterioration, the company’s share price rose at a relatively steady pace and had just one significant correction since initiating dividend distributions in 2011. Following a correction of more than 40% in 2015, the share price reversed course and nearly tripled before reaching its all-time high in early October 2018.

Despite the current share price decline, the company still managed a total return of 9% for the trailing 12 months. Regardless of the current performance, Marathon might have potential as a long-term investment option. MPC might see a boost in profits once the company fully integrates the additional revenues from the recently acquired Andeavor (NYSE: ANDV) and optimizes shared costs. This acquisition should add an additional 3,100 gas station/convenience store locations to the company’s Marathon brand.

Furthermore, the company’s current 22% dividend payout ratio is 35% lower than the company’s own 34% average payout ratio over the past five years. The payout ratio of just 22% indicates that the company’s present earnings are more than sufficient to cover current and upcoming dividend distributions, as well as support future dividend hikes.

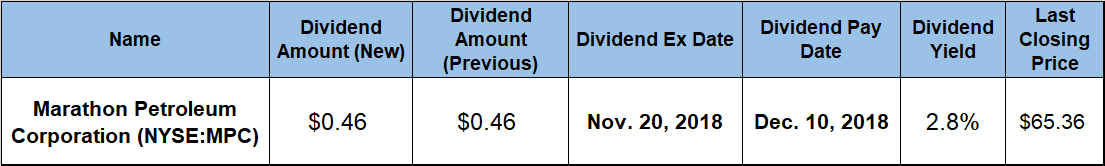

Investors convinced that the Marathon Petroleum Corporation’s share price will recover in the near term and see the current price drop as a buying opportunity, should act quickly. Taking a long position in Marathon’s stock prior to the next ex-dividend date on November 20, 2018, will ensure eligibility for the next round of dividend distributions on the December 10, 2018, pay date.

Marathon Petroleum Corporation (NYSE:MPC)

Headquartered in Findlay, Ohio, and incorporated in 2009, the Marathon Petroleum Corporation engages in refining, marketing, retailing and transporting of petroleum products. The company operates six refineries in the Gulf Coast and Midwest regions to refine crude oil into gasoline, distillates, propane, heavy fuel oil and asphalt. As of December 31, 2017, the company owned and operated 18 asphalt terminals, 61 light products terminals and more than 10,000 miles of various product transportation and distribution pipelines. Additionally, the company sells its Marathon brand gasoline through approximately 5,600 independently owned retail outlets — excluding the 3,100 additional locations pending the Andeavor acquisition — across 20 states and the District of Columbia. The company’s Speedway LLC subsidiary owns and operates the nation’s second-largest convenience store chain, with approximately 2,740 convenience stores in 21 states.

After two dividend hikes since January 2017, the company’s current $0.46 quarterly dividend distribution is 15% higher than the $0.40 payout from the same period last year and has advanced nearly 28% higher over the past two years. This $0.46 quarterly dividend converts to a $1.84 annualized payout and a 2.8% forward dividend yield.

The current yield is nearly 18% higher than the company’s own 2.4% average yield over the past five years. Furthermore, while trailing per averages in the Oil & Gas Refining & Marketing industry segment, Marathon’s current yield is 13% above the 2.5% simple average of the entire Basic Materials market sector.

Since beginning its dividend distributions in 2011, the company delivered to its shareholders seven consecutive annual dividend hikes. During his streak the company enhanced its total annual dividend payout more than four-fold and managed to maintain and average growth rate 23.3% per year.

The share price reached its 52-week low of $64.40 very early in the trailing 12-month period. However, after bottoming out on November 29, 2017, the share price gave back nearly all its gains and closed on November 15, 2018, at $65.36. This closing price was still 6.4% above the 52-week high from one year earlier, as well as 63% higher than it was five years ago.

While continuing its streak of consecutive annual dividend hike and despite the share price pullback, the company still managed to deliver to its shareholders a total return of 5% over the past 12 months. The three-year total return was 28% and shareholders received an 80% total return on their investment over the past five years.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic