Massive Options Trading Is Manipulating the Market

By: Bryan Perry,

In a recent weekend edition of the Wall Street Journal, (Sept. 5-6), an article titled “SoftBank Trade Fueled Stock Rally” was front-page news, generating some buzz on trading desks but otherwise little press.

I found it to be quite startling to learn that a company like SoftBank will buy $4 billion in the top mega-tech stocks that comprise about 25% of the S&P 500 and then leverage that $4 billion in stock purchases with call options tied to another $50 billion of individual stocks, most of which are in the same mega-tech names. It seems after SoftBank CEO Masayoshi Soo reported a record $9 billion in losses in the latest fiscal year ending in March, he came up with a way to reboot his balance sheet with what can be considered mass, but seemingly legal, stock market manipulation.

Mr. Soo’s $100 billion Vision Fund was crushed by the demise of WeWork and the decline in the value of his $7.6 billion investment into Uber Technologies (UBER) among other less famous private startups. In early August SoftBank disclosed it was establishing an asset management arm to trade public securities and noted it could use derivatives (aka call and put options).

As the Wall Street Journal article points out so clearly, such a concentration in the most heavily weighted tech stocks with such mammoth capital backing that concentrated trade makes it a no brainer that those trades propelled the Nasdaq 1,000 points higher during the month of August. After it was revealed that SoftBank was the “Nasdaq whale” earlier this month, it begs the question of whether SoftBank still owns these positions following an 11% correction in the Nasdaq this past week.

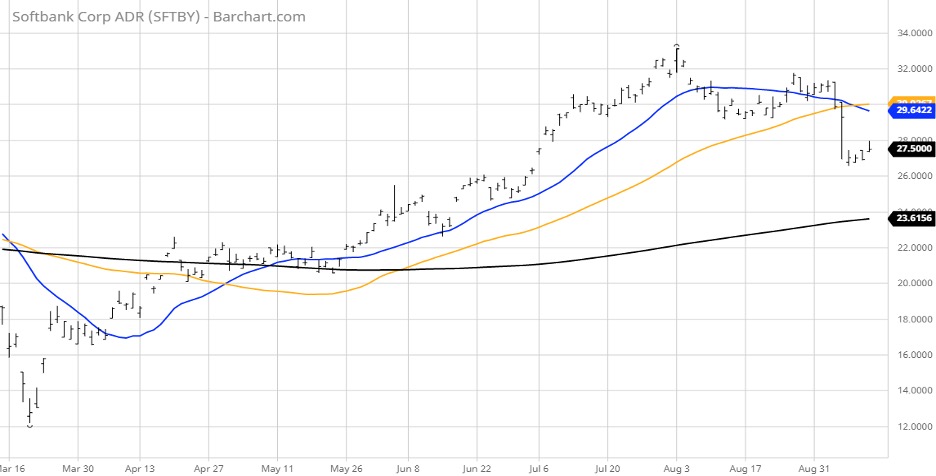

To date, SoftBank has declined to comment, but it is safe to say the company’s purchase of call options, in addition to buying technology stock shares, gave it access to a much higher number of shares on paper. Thus, SoftBank now is receiving criticism for exacerbating the U.S. stock market’s run-up and subsequent tech sell-off. Shares of SoftBank have shed 17% in value since early August as investors ponder why a company that had built its reputation as an incubator to Silicon Valley unicorns could become a giant trading firm and leverage the future on time-wasting assets.

It should be no wonder why the market has been rattled by this development, especially since SoftBank seems to have intentionally juiced equities higher with the tsunami of call option buying that amplified the market’s gains in August. It almost smack-off the old saying, “desperate men do desperate things.” Apparently, Son himself is personally leading the options trading with a small staff.

Who knows, SoftBank booked billions in gains, but not likely. Son would have been the first to tout realized monster gains rather than watch his own company’s stock tank.

“Son is a speculator — not this visionary everyone claims he is,” said Amir Anvarzadeh, a market strategist at Asymmetric Advisors in Singapore who has been covering SoftBank since it went public in 1994. “This is yet another proof of that, as he is never too far from the action when a bubble is formed.”

One can only imagine the staggering paper losses SoftBank is suffering from the recent sell-off, assuming it is still 100% long. More importantly, it raises the specter of what other multi-billion-dollar sovereign or private funds may do to juice their valuations through similar behavior.

Knowing that just nine stocks control 54.5% of the Nasdaq, and the direction of the broad market opens the way for other so-called legal bouts of market manipulation. It is a bit disturbing because it also contributes to the tech options frenzy on sites such as Robinhood Markets, where experienced traders are few, and platform outages are a frequent occurrence during the most volatile sessions.

Now, it’s being reported over this past weekend by the Financial Times that SoftBank is considering going private, where public disclosure of such trading activity would not be a requirement. As if investors did not have enough to deal with regarding high-frequency trading, proprietary shops (prop shops) account for roughly 70% of daily volume. In addition, computer-generated “fat finger trap door sell-offs” like the one that occurred in September 2017 go unexplained. Along with the rise of unlimited central bank stimulus spending that is perceived by investors as a protective “put” on the stock market, now we have vast pools of motivated derivative trading capital that can manipulate stocks.

As it stands now, “unusual options activity” has taken the top spot as the most important data point released during every day the stock market is open for business. This level of speculation usually results in large numbers of investors and traders ending up in the rinse cycle and coming out cleansed of their capital.

History has a very good track record of repeating itself when markets get too frothy, and the current selling in the Nasdaq is a testament to just how quickly things can turn when logic returns and replaces emotion. It is constructive for sustaining the integrity of the bull trend for sure, but it also can be quite painful for those who wear their trading accounts on their sleeves.

Connect with Bryan Perry

Connect with Bryan Perry