Maxim Integrated Products Advances Quarterly Dividend Payout 16% (MXIM)

By: Ned Piplovic,

Maxim Integrated Products, Inc. (NASDAQ:MXIM) continues to advance its annual dividends at double-digit percentage growth rates to keep up with its share price, which is rising even faster.

In addition to the significant dividend hike, the company has boosted its annual dividend every year since it started distributing dividends in 2002. Despite the double-digit percentage dividend hike, the current 3% yield is slightly lower than the 3.1% yield from the same period last year because Maxim Integrated Products’ share price increased more than 25% over the past 12 months.

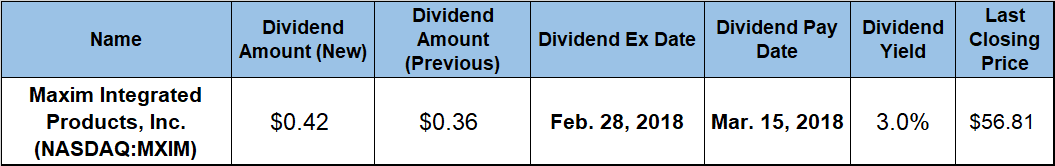

Maxim Integrated Products will pay the next dividend on March 15, 2018, to all its shareholders of record before the next ex-dividend date, which occurs approximately two weeks earlier, on February 28, 2018.

Maxim Integrated Products, Inc. (NASDAQ:MXIM)

Headquartered in San Jose, California and founded in 1983, Maxim Integrated Products, Inc. designs, manufactures and markets integrated circuits and high-frequency process technologies. The company serves automotive, communications, data center, computing, consumer and industrial markets. Maxim Integrated Products markets its products through direct-sales and through its own and other unaffiliated distribution channels.

The company boosted its quarterly dividend amount 16.7% from $0.36 in the previous quarter to the current $0.42 quarterly distribution. Additionally, the new quarterly payout is 27.3% higher than it was in the first quarter of 2017. The first-quarter dividend hike is a little uncharacteristic. Over the past decade, the company has been hiking its quarterly distribution in the third calendar quarter, which is equivalent to the first quarter on the company’s fiscal calendar. The current dividend hike leaves open the possibility of another dividend increase during calendar 2018.

The current quarterly payout converts to a $1.68 annualized dividend distribution and yields 3%. The current yield is 4.6% below the company’s own 3.1% average yield over the past five years. However, Maxim Integrated Products’ 3% yield is the highest yield in the Broad Line Semiconductor market segment. Additionally, the company’s current yield is 64% above the 1.8% average yield of all the companies in the segment, 26% higher than the average yield of only dividend-paying companies in the segment and 137% higher than the average yield of the entire Technology sector.

The company boosted its annual payout every year since it started distributing dividends 16 years ago. Over that period, the company enhanced its annual dividend amount 21-fold by growing the annual amount at an average rate of 21% per year. Even if we disregard the annualized dividend in the first year – which was only $0.08 – the average growth rate over the past 15 years is still 14.5% per year.

The share price had a relatively flat first half of the trailing 12-month period and dropped 3.2% from $45.14 on February 8, 2017, to reach its 52-week low of $43.69 by April 12, 2017. While the share price rose slightly over the following 60 days, it lost all those gains and was back down to only $0.03 above the 52-week low by August 21, 2017. After reaching near-bottom in late August, the share price rose more than 25% and closed above $55 by January 25, 2018.

Following speculations that a Japanese chip company Renesas Electronics Corp (TSE:6723) might acquire Maxim Integrated Products for up to $20 billion, Maxim Integrated Products’ share price jumped 20% over four days and reached the company’s 52-week high of $67.27 on January 29, 2018. However, Renesas Electronics dismissed acquisition reports as unfounded. On that news, Maxim Integrated Products’ share price fell back 14% in one week and closed on February 7, 2018 at $56.81, which was still 3.1% above the pre-spike price of $55.12 from January 25, 2018.

As of closing on February 7, 2018, the share price was almost 26% higher than it was one year earlier, 30% above the 52-week low from April 2017 and 76% above the price from five years ago. The current share price long-term uptrend goes back to December 2008. Since then, the share price rose more than 400%.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic