Medtronic Boosts Quarterly Dividend 8.7% (MDT)

By: Ned Piplovic,

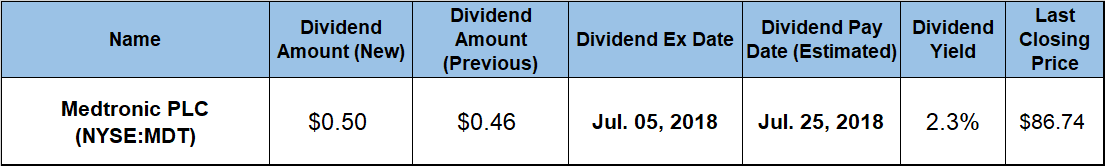

After four decades of consecutive annual dividend hikes, Medtronic PLC (NYSE:MDT) continued boosting its dividend income distributions with an 8.7% increase to its quarterly dividend payout.

The company’s current 2.3% dividend yield might seem low or average at best compared to other market sectors. However, Medtronic’s current yield exceeds the average yield of the Health Care sector, as well as the Medical Appliances & Equipment industry segment by more than 200%. Among more than 30 of its peers in the segment, Medtronic’s 2.3% yield is tied for the top spot.

The company’s share suffered a 14.3% share-price decline over the first nine months of the trailing 12-month period. However, after reversing the declining trend in March 2018, the share price has recovered most of those losses and pulled within 2.7% of its level from one year ago.

Additionally, the share price has experienced a similar level of volatility over the past five years. However, over those five years, the share price managed to rise more than 65%. The current closing price is still more than 9% below the analysts’ average target price and the technical indicators hint at a possible continuation of the uptrend.

Therefore, investors convinced that the share price might continue to rise should do their research and take a position prior to the company’s next ex-dividend date on July 5, 2018, to ensure eligibility for the next round of dividend distributions on the July 25 pay date.

Medtronic plc (NYSE:MDT)

Founded in 1949 and headquartered in Dublin, Ireland, Medtronic manufactures and sells device-based medical therapies worldwide. The company operates through four distinctive segments, the Cardiac and Vascular Group, the Minimally Invasive Therapies Group, the Restorative Therapies Group and the Diabetes Group. Through these four segments, Medtronic develops, manufactures and distributes pacemakers, defibrillators, cardiac resynchronization therapy devices, diagnostics devices, surgical instruments, sutures, electro-surgery products, bone graft substitutes, drug delivery systems, insulin pumps and consumables. It also provides continuous glucose monitoring systems, web-based therapy management software solutions and many other health care products. The company has more than 370 locations globally to support its operations in more than 160 countries.

Pulling back from its two-year peak just a few days earlier, the share price reached its 52-week high of $89.30 on June 28, 2017, which was just the third day of the trailing 12-month period. The share price continued its decline and lost nearly 14% by the beginning of October 2017. After spiking briefly to within 2.3% of the June 2017 peak price by mid-January 2018, the share price dropped again and reached its 52-week low of $76.55 on March 23, 2018.

However, the share price reversed direction once more, regained 80% of its losses since the 52-week high and closed on June 25 at $86.74, which was just 2.7% below the share price from one year earlier and 2.9% short of the 52-week high from June 2017. Additionally, the June 25, closing price was 13.3% above the 52-week low from three months earlier and 66% higher than it was five years ago.

Medtronic paid its first quarterly dividend in July 1977 and has enhanced its annual amount every year since then. Moreover, Medtronic had its highest quarterly dividend hike when most companies were cutting or suspending their dividends during the 2008 financial crisis. For its July 2008 distribution, Medtronic boosted its quarterly dividend 50%.

While not as impressive as the 2008 hike, the company’s upcoming $0.50 quarterly dividend amount will be 8.7% higher than the previous period’s $0.46 distribution amount. This new dividend amount corresponds to a $2.00 annualized payout and yields 2.3%, which is almost 10% higher than the company’s own 2.1% average yield over the past five years. In addition to outperforming its own five-year average yield, Medtronic’s current 2.3% yield is 255% above the 0.65% simple average yield of the entire Health Care sector and 220% higher than the average yield of its peers in the Medical Appliances & Equipment segment.

While lower than the 17.1% average dividend growth rate over the past 40 years, the company’s 13.1% five-year dividend growth rate is higher than the 12.3% rate over the past decade, which indicates that Medtronic accelerated its annual dividend increases over the past few years.

While the share price ended the trailing 12 months slightly below last year’s level, the dividend distributions made up the difference to prevent a combined loss over the past year. Should it continue, the current share price uptrend could bring shareholders’ total return back to levels similar to the 19.2% return over the past three years and more than 80% over the past five years.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic